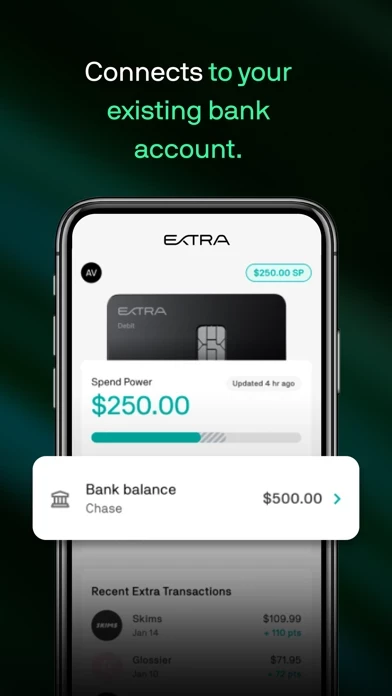

EXTRA: Build Credit with Debit Reviews

Published by Thingy Thing Inc on 2023-12-16 About: Today, there are over 100 million Americans who don't want, or can't get a

credit card. Yet there are very few alternatives for establishing your credit

other than with a risky Credit Card.