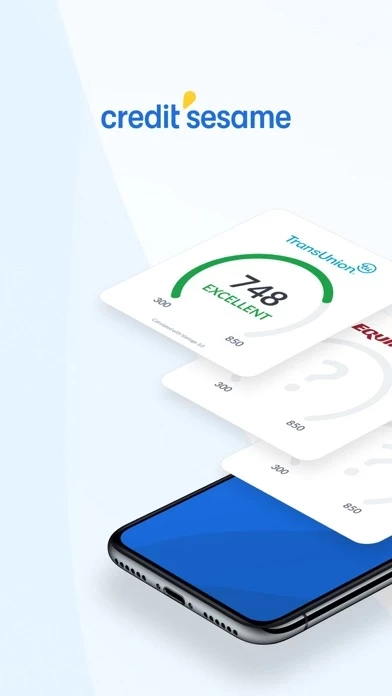

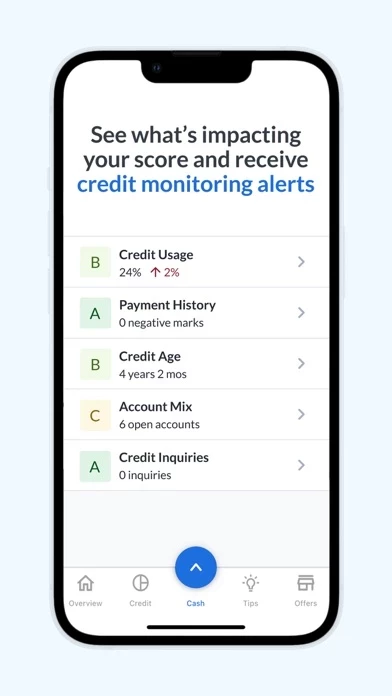

- Free credit score access

- Daily credit score refreshes

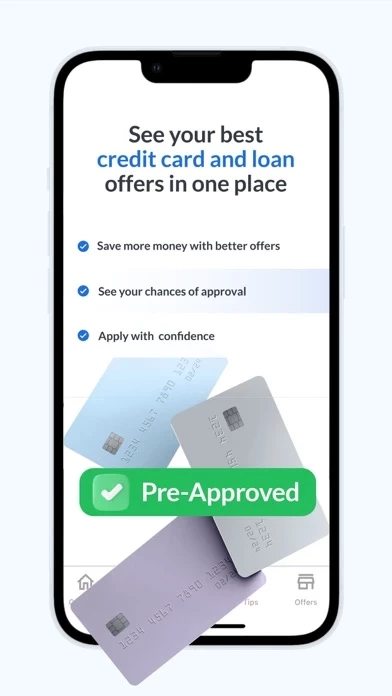

- Personalized recommendations for credit cards, insurance, and other important services

- Cash back offers from favorite brands

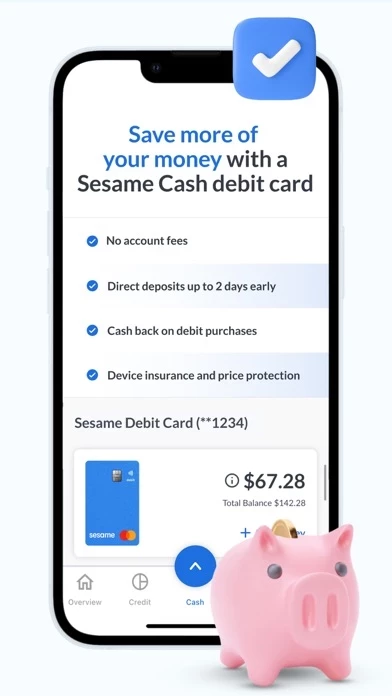

- 2-day early pay day

- Sesame Cash account with debit card and cash back offers

- Credit Builder to build credit with debit

- Credit Sesame Premium with additional tools and $1M identity theft protection policy

- Detailed 3 bureau reports

- 24/7 support for discrepancies

- Rent reporting to establish credit score with on-time rent payments

- Testimonials from satisfied users

- Legal documentation for terms of use and privacy policy

- International and out-of-network cash withdrawal fees apply

- Third-party and cash deposit fees may apply

- Sesame Cash requires opening a virtual secured credit card with CFSB to build credit

- Cash back offers powered by Empyr, Inc. and Button, Inc.

- Direct deposit and earlier availability of funds subject to payer's support and timing of funding.