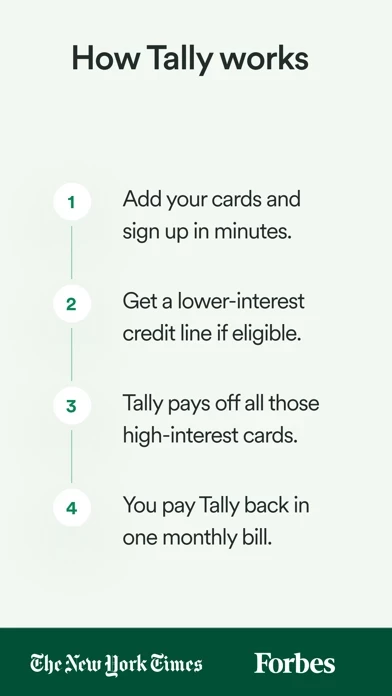

Tally sounds good and all, especially with its high reviews, but now I’m actually wondering whose writing these reviews for them. It starts off by making it simple, easy to use, and immediate debt relief. Unfortunately, it’s not that simple and it takes about a week to get through the process, and FYI if you don’t have a minimum 660 FICO don’t even bother downloading Tally , because they won’t help you at all. My score is around 650, no major derogatory marks, no late payments, solid credit history, my only current problem is high credit utilization because I was laid off work a few months ago, and with the holidays and all it’s been a tough quarter for me. I currently have a job, and everything is being paid on time, I just wanted a lower interests rate and to make it simpler a single payment to this app. After downloading Tally , I added on my credit cards and after all my personal information was added Tally said “we payed 3 of your cards for a total of $8,000, your total this app debt is $8k” my bills are being paid, cool right? NOT! 2-3 days later they send me an email stating nothing is actually being paid, I need to now provide work history, pay stubs, bank statements, 2 forms of ID etc....after providing all of this, it took another 3 days for the verification team to get back to me to deny me of any credit at all, so I guess it’s back to my regularly scheduled payments on my own, deleting my account and app...see ya this app!