- Fast and secure sign-in with Face ID and Touch ID

- Quick View to see a snapshot of your account without signing in

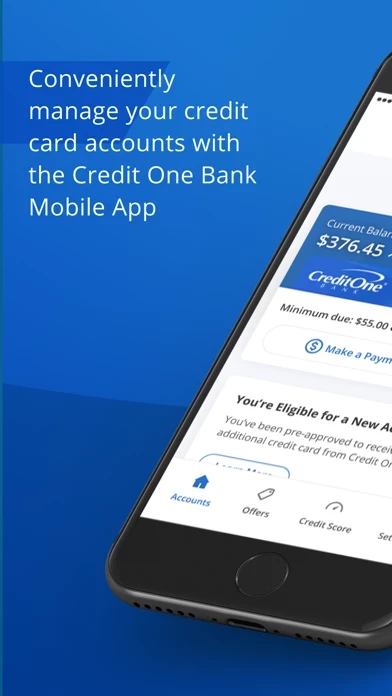

- Schedule, edit, or cancel one-time payments

- Change your payment due date

- Check your balance and available credit, and view recent transactions or monthly statements

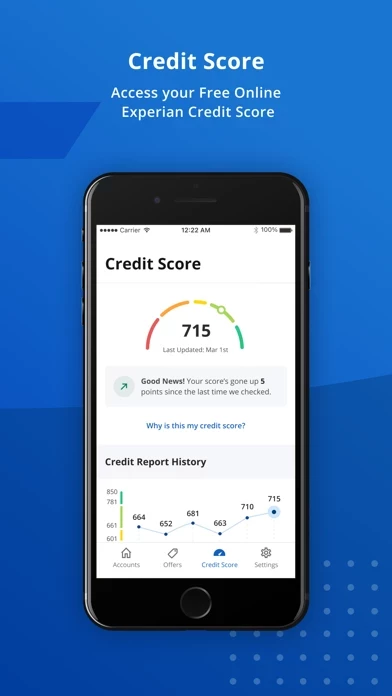

- Access your Free Online Experian Credit Score

- Manage your profile and account settings

- Enroll in paperless documents and statements

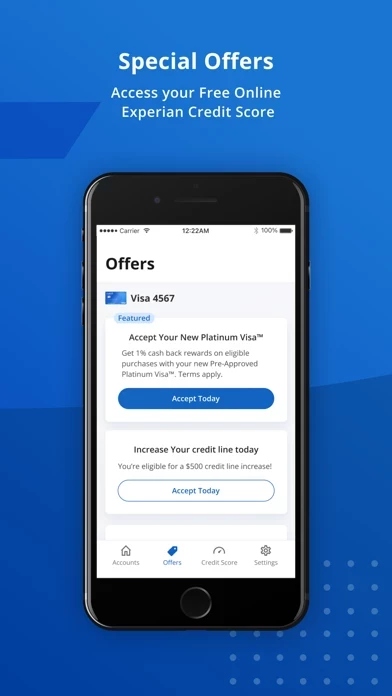

- View the latest offers and More Cash Back Rewards on purchases at participating merchants

- View exclusive credit card offers

- Easy access to Help & Support contact information

- Chat feature for instant answers to your questions

- Full list of frequently asked questions and answers

- Choose how you get alerts, including mobile notifications, email, and text

- Set up notifications for important account activity, payment reminders, and special offers

- Get notified when rewards and exclusive credit card offers are available

- Receive alerts if fraudulent activity is suspected on your account.