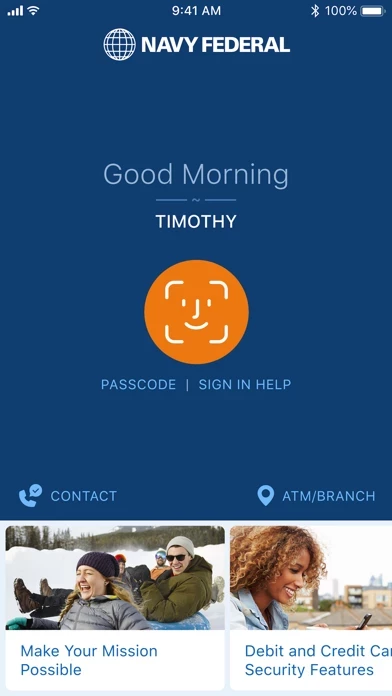

- Safe and secure access to your accounts 24/7

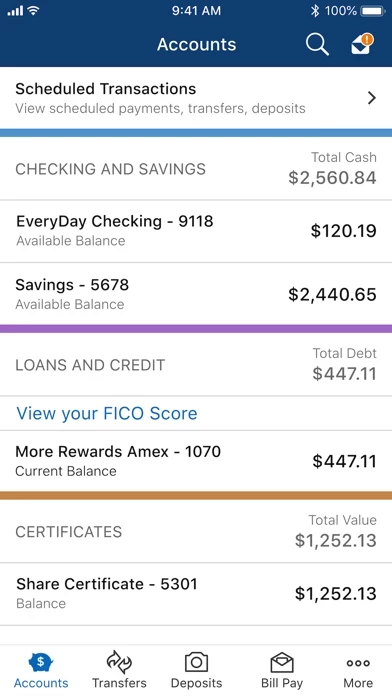

- View balances without signing in using the widget

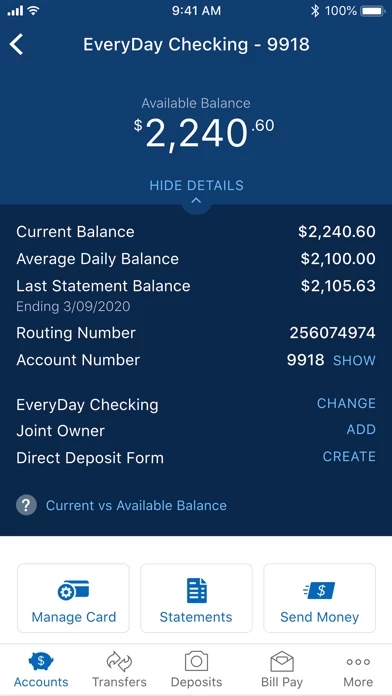

- Pay people using Zelle® or member to member transfers

- Move money between your accounts

- Deposit checks without visiting a branch or ATM

- View scheduled transactions, including pending deposits, upcoming transfers, and bill payments

- Make payments to Navy Federal consumer loans, mortgages, and credit cards, or to other companies via Bill Pay

- Apply for new credit cards, auto loans, or personal loans, or become a Navy Federal member

- View and manage statements

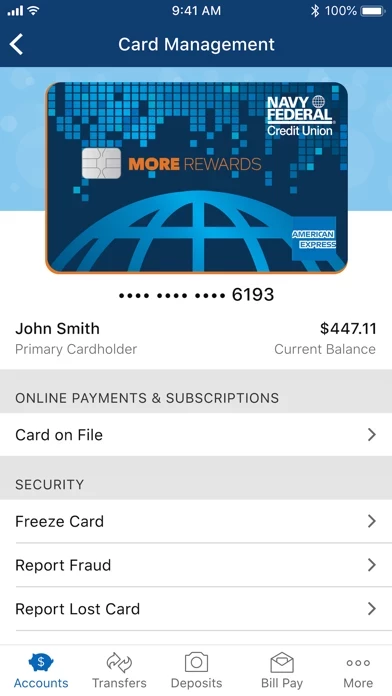

- Manage your credit or debit cards, including activating cards, signing up for purchase notifications, or freezing misplaced cards

- Security tips and management of your username and password

- Find the nearest branch or ATM

- View rates and info on loans and savings products, or estimate a payment with a calculator

- Read timely articles to help educate and plan your financial life.