- Kids and teens can track balances in Save, Earn, Invest, Spend, and Give accounts

- Parents can invest for college or any other goals with an easy, flexible platform

- Kids can receive money from friends and family

- Parents can send money instantly and receive real-time alerts of kids' spending activity

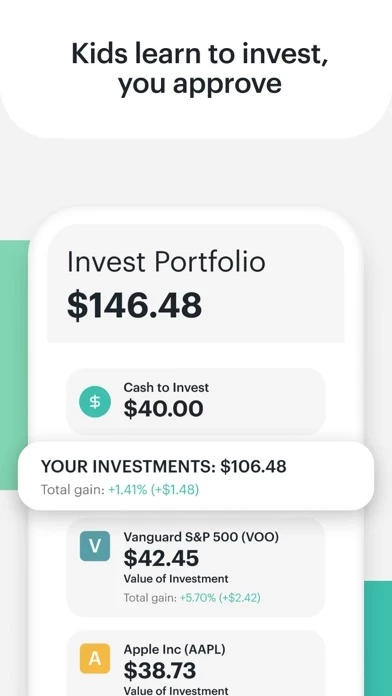

- Kids can learn to invest in stocks of their choice and research their favorite companies

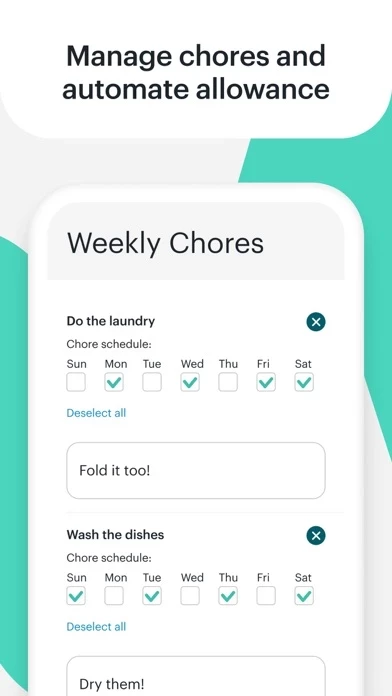

- Parents can manage chores, approve kids' investments, automate allowances, put limits on spending, and set parent-paid interest rates

- Kids can set savings goals and set up direct deposit for their paychecks

- The app supports Apple Pay, Google Pay, and Samsung Pay

- The app comes with an EMV chip and parent-controlled PIN for safety

- The app has automated blocked categories for unsafe spending

- The app uses several security features to help protect accounts from unauthorized access

- Funds available through the Save, Earn, Give, and Spend functionality are FDIC-insured through the partner Community Federal Savings Bank

- Funds available through the Invest functionality are not FDIC-insured but may be SIPC-insured through the partner DriveWealth, LLC

- The support team is available 24/7

- The app is not a bank but facilitates banking services through Community Federal Savings Bank, Member FDIC

- Investment Advisors, LLC, an SEC Registered Investment Advisor, provides investment advisory services to its clients.