- Early direct deposit of pay up to 2 days early and government benefits up to 4 days early

- Sending money and paying bills

- Depositing cash using the app

- No minimum balance requirement

- Access to a free ATM network (limits apply)

- Overdraft protection up to $200 with opt-in and eligible direct deposit

- Earn 2% cashback on online and mobile purchases

- Save money in the Green Dot High-Yield Savings Account and earn 2% annual interest (APY) on money in savings, up to a $10,000 balance

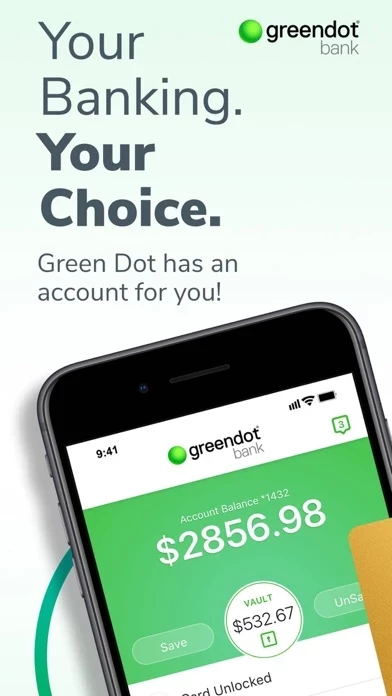

- Easily manage any Green Dot Bank account at any time, including registering/activating a new card, viewing balance and transaction history, locking/unlocking feature, depositing checks from your mobile phone, working with mobile payment options including Apple Pay, setting up account alerts, and accessing chat customer support.

- Must be 18 or older to purchase. Activation requires online access, mobile number, and identity verification (including SSN) to open an account and access all features. Activated, personalized card required to access some features.

- Direct Deposit early availability depends on timing of payor’s payment instructions and fraud prevention restrictions may apply.

- Limits apply for sending money and paying bills, depositing cash, and free ATM network.

- Opt-in required for overdraft protection.

- Cashback is earned on qualifying online and mobile purchases.

- Interest is paid annually on the average daily balance savings of the prior 365 days, up to a maximum average daily balance of $10,000 and if the account is in good standing.

- See app for free ATM locations. 4 free withdrawals per calendar month, $3.00 per withdrawal thereafter. $3 for out-of-network withdrawals and $.50 for balance inquiries, plus whatever the ATM owner may charge.

- Cards issued by Green Dot Bank, Member FDIC, pursuant to a license from Visa U.S.A., Inc.

- Technology Privacy Statement and Terms of Use can be found on the Green Dot website.