Checking features for the Cash Account are subject to identity verification by Green Dot Bank.

Neither Wealthfront Brokerage nor any of its affiliates are a bank, and Cash Account is not a checking or savings account.

Links provided to other server sites are offered as a matter of convenience and are not intended to imply that Wealthfront Advisers or its affiliates endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Deposits under any of these trade names are deposits with Green Dot Bank and are aggregated for deposit insurance coverage.

We’ve partnered with Green Dot Bank, Member FDIC, to bring you checking features.

Green Dot Bank operates under the following registered trade names: GO2bank, GoBank, Green Dot Bank and Bonneville Bank.

Wealthfront products and services are not provided by Green Dot Bank.

All of these registered trade names are used by, and refer to, a single FDIC-insured bank, Green Dot Bank.

Cash Account is offered by Wealthfront Brokerage LLC (“Wealthfront Brokerage”), a member of FINRA/SIPC.

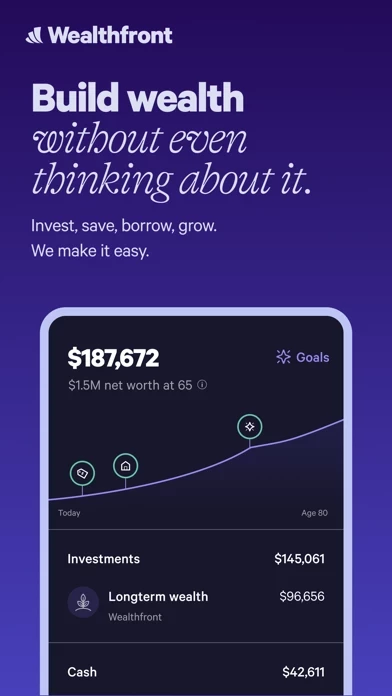

Investment management and advisory services are provided by Wealthfront Advisers LLC (“Wealthfront Advisers”), an SEC registered investment adviser.

For out-of-network ATMs and bank tellers a $2.50 fee will apply, plus any additional fee that the owner or bank may charge.

Wealthfront Advisers and Wealthfront Brokerage are wholly owned subsidiaries of Wealthfront Corporation.

Take care of everyday cash needs with mobile checks, bill-pay, and thousands of free ATMs nationwide.

Green Dot is a registered trademark of Green Dot Corporation.