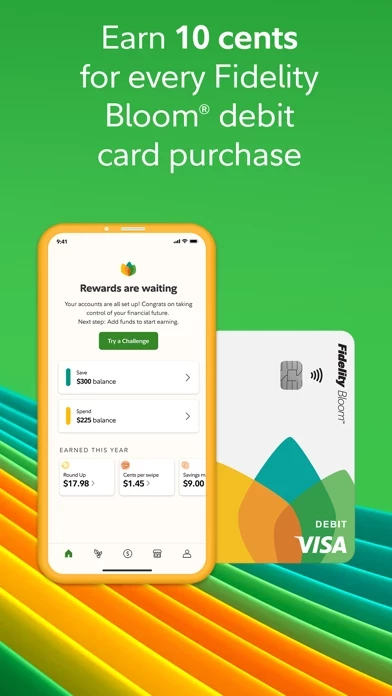

• Earn 10 cents from Fidelity with every purchase—we’ll automatically deposit 10 cents into your Fidelity Bloom Save account every time you use the Fidelity Bloom debit card.

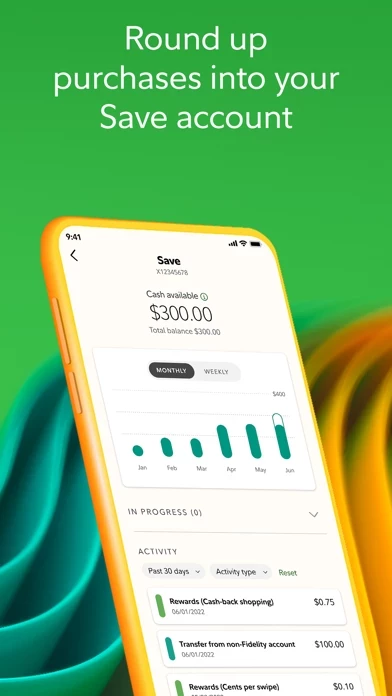

• Plus, automatically have all your Fidelity Bloom debit card purchases rounded up§—with the change going directly into your Fidelity Bloom Save account.

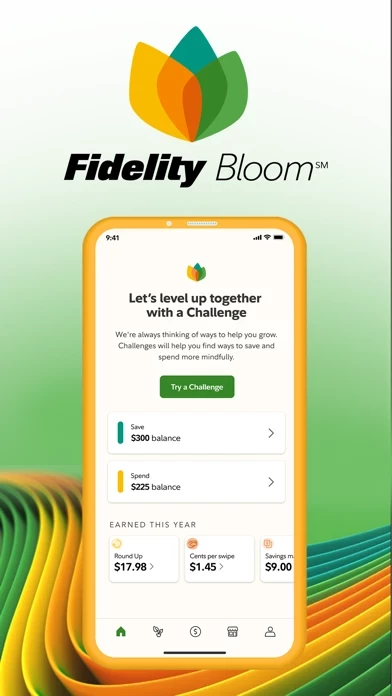

Fidelity Bloom is a free financial app and debit card with built-in cash rewards.

• Receive up to 25%‡ cash back—deposited into your Fidelity Bloom Save account when you shop through the app with 1,000+ participating retailers.

Saving is easy—and automatic—when you use the Fidelity Bloom debit card.

• Use Fidelity Bloom Spend as your go-to spending account for everyday expenses.

It’s easy to open your Fidelity Bloom Spend and Save accounts right from the app.

Fidelity Bloom accounts are brokerage accounts covered by SIPC insurance.

• Annual savings match—Get a 10% match† from Fidelity on your first $300 of deposits into Fidelity Bloom Save.

• Track the rewards you earn in Fidelity Bloom Save.

For a limited time, Fidelity is offering a cash reward for funding your accounts.

You’ll get timely, personalized prompts that help you spot opportunities to save more, spend less, and improve your relationship with money and finances.

Keeping your spending money separate from where you’re saving can be an essential step toward healthy saving habits.

They are not bank accounts and therefore are not covered by FDIC insurance.