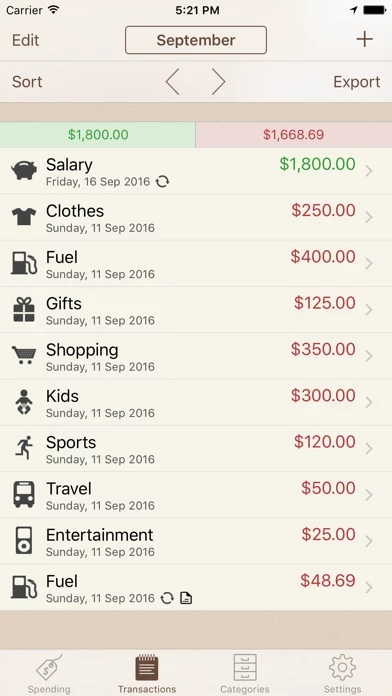

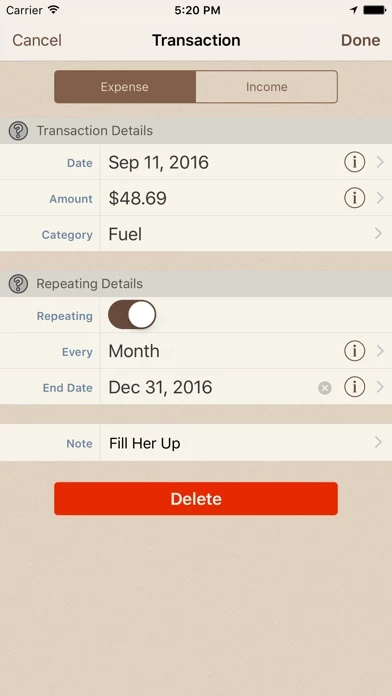

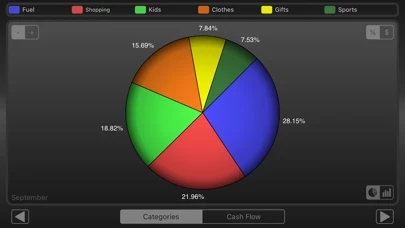

I’ve downloaded and tried more than a dozen expense tracking apps and most didn’t work for me. At first this one seemed too simple as I wanted to view transactions by category. Then I discovered that when you pull down on the screen you see the categories box and you can choose to view transactions by the categories you create. I upgraded to Pro then exported expenses and discovered you can export by category, a range of dates, by the month or year or whatever. At this point I saw what a game changer it was for me. When I did an email export all I had to do was click on the file from my desktop and I had a spreadsheet with all the transactions in order. If you had a mind to you could make categories that match your Schedule C for taxes which is what I did. So I have expense categories: Post Office, Shop Supplies, Office, Utilities, eBay fees, etc. I have income categories: Web Sales, eBay Sales, Shop Sale, Investment Sold, etc. Whenever I want to see any or all the transactions I can see any part of them by Daily, Weekly, Monthly or Yearly. Note that it syncs through DropBox so I can see it on my iPad or iPhone. No subscription. You can set up multiple accounts and set reminders, set a passcode, set auto-backup and other tweaks. Highly recommend especially if you’re trying to track receipts, payments and income. Charles