Ahead Money Status

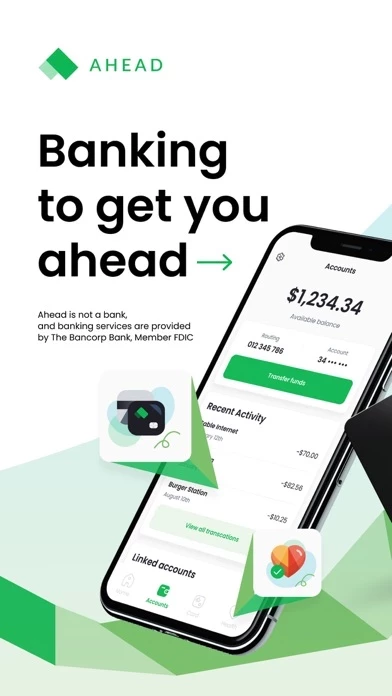

Published by Ahead Financials, LLC Ahead personalizes your financial health through:

EMPOWERMENT - Paycheck up to 2

days early‡

RESILIENCE - Fee-Free‣ Overdraft up to $100

TRANSPARENCY - No

monthly or hidden fees^

Ahead is not a bank. Banking services are provided by

The Bancorp Bank, Member FDIC.

Are you having issues? Select the issue you are having below and provide feedback to Ahead Money.

problems reported in the last 24 hours

Reported Issues: 1 Comments

By Sally McCauley 1 year ago

I am getting debit card offers to a person who no longer lives at the address. Please remove the following: CGALR21120648PRI0001/00000357/00000357 Timothy Maynard 5246 West Lake Road Mayville, NY 14757 Please let me know if you need more information. Thank you.

Common dislikes about Ahead Money app

- Does not sync with or recognize phone

- Authentication error when credentials are correct

- Direct deposit issues in the past

Have a Problem with Ahead Money? Report Issue

Leave a comment:

Common Ahead Money Problems & Solutions. Troubleshooting Guide

Complete guide to troubleshoot Ahead Money app on iOS and Android devices. Solve all Ahead Money app problems, errors, connection issues, installation problems and crashes.

Table of Contents:

Some issues cannot be easily resolved through online tutorials or self help. So we made it easy to get in contact with the support team at Ahead Financials, LLC, developers of Ahead Money.

100% Contact Match

Developer: Ahead Financials, LLC

E-Mail: [email protected]

Website: Visit Ahead Money Website

Any deposits received in a name other than the name registered to the Ahead Account will be returned to the originator. account number can be used for setting up Direct Deposit or to pay bills online with the direct deposit feature. For eligible members who are enrolled in Ahead Overdraft, Bank will approve purchases that result in a negative balance on the Ahead Account up to $100. Not all purchases are eligible. See this app. com/overdraft for full terms and conditions. ‡Early access to direct deposit funds depends on the timing of the submission of the payment file from the payer. The ATM operator may charge an additional fee. ‣Ahead Overdraft is available after qualifying direct deposits of $1,000 or more into the Ahead Account over 35 consecutive calendar days. Using Ahead Overdraft, eligible members overdraft up to $100‣ on qualified debit card purchases with no fees. The Ahead Visa® Debit Card is issued by The Bancorp Bank pursuant to a license from Visa U. S. A. Inc. and may be used everywhere Visa debit cards are accepted. Set up direct deposit with paychecks, tax returns, unemployment benefits in your Ahead Account. Be sure only to provide your routing account number information to your payer, benefits provider or trusted billers. Your information is stored securely and you can easily lock your Ahead debit card if you misplace it. Ahead is not a bank. Use direct deposit to receive your paycheck up to 2 days earlier than some traditional banks‡. Banking services are provided by The Bancorp Bank, Member FDIC. Banking services provided by The Bancorp Bank, Member FDIC. We generally make these funds available on the day the payment file is received, which may be up to 2 days earlier than the scheduled payment date. Ahead Accounts have no monthly fees, no minimum balance fees and no overdraft fees‣. There is no fee to withdraw money from any Allpoint® ATM. There is a $2. 50 ATM cash-withdrawal fee assessed by Ahead for all non-Allpoint® ATM transactions (out of network transactions). The recipient’s name on any deposits received must match the name of the Ahead customer.