OXYGEN: Mobile Banking Software

Company Name: Oxygen Finances

About: Oxygen Finance brings innovation to early payment solutions, generating a new source of income for

companies

Headquarters: Birmingham, Birmingham, United Kingdom.

OXYGEN Overview

What is OXYGEN?

Oxygen is a digital banking platform that offers modern financial services to free thinkers, rebels, and entrepreneurs. It is a financial technology company that provides banking services through The Bancorp Bank, Member FDIC. The app offers cashback rewards, savings management, retail and travel benefits, and easy and secure banking services. It also offers personal tiers, including Earth, Water, Air, and Fire, with varying cashback rewards, savings APYs, savings goals, virtual cards, and annual fees. Additionally, Oxygen offers a business account with customizable invoices, virtual cards with spending controls, a business savings account with a 1.00% APY, and LLC formation services.

Features

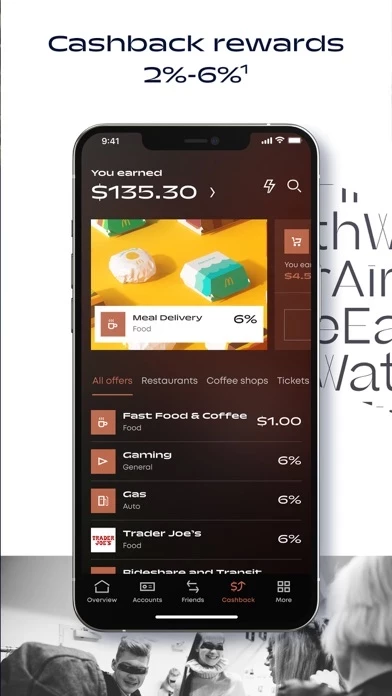

- Cashback rewards on TraderJoes, gas, food delivery, and more, with $1 back at your favorite coffee shop

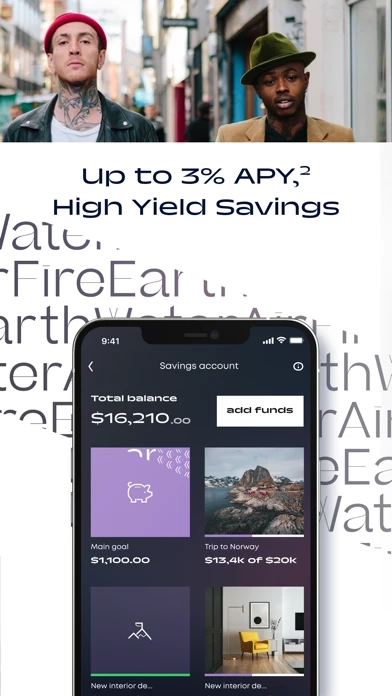

- Savings management with rounding up the change and Annual Percentage Yields (APYs) up to 20x the average national rate

- Retail and travel benefits, including cell phone insurance, extended warranty, delayed and lost luggage, hotel theft, and car rental damage waiver protection

- Easy and secure banking services, including fee-free bank transfers, bill payments, and access to over 40,000 fee-free domestic ATMs

- Personal tiers, including Earth, Water, Air, and Fire, with varying cashback rewards, savings APYs, savings goals, virtual cards, and annual fees

- Business account with cashback on ride share, gas, selected couriers, customizable invoices, virtual cards with spending controls, a business savings account with a 1.00% APY, and LLC formation services

- Card controls, card freezing, and virtual cards to keep your money safe

- Banking services provided by The Bancorp Bank, Member FDIC

- Oxygen Visa® Debit Card and Oxygen Visa® Business Debit Card issued by The Bancorp Bank pursuant to a license from Visa U.S.A. Inc. and can be used everywhere Visa debit cards are accepted.

Official Screenshots

OXYGEN Pricing Plans

| Duration | Amount (USD) |

|---|---|

| Billed Once | $0.00 |

**Pricing data is based on average subscription prices reported by Justuseapp.com users..

Product Details and Description of

this app is a modern digital banking platform for the 21st century economy – the free thinkers, rebels, and entrepreneurs. this app is a financial technology company, not a bank. Banking Services provided by The Bancorp Bank, Member FDIC CASHBACK REWARDS¹ TraderJoes, Gas, Food delivery, and more. Plus $1 back at your favorite coffee shop! GROW & MANAGE SAVINGS Boost your savings by rounding up the change; grow it with Annual Percentage Yields (APYs)³, up to 20x the average national rate.⁴ RETAIL & TRAVEL BENEFITS Standard Retail benefits like cell phone insurance and extended warranty, travel perks like delayed and lost luggage, hotel theft, and car rental damage waiver protection. See below for premium benefits on SELECT ELEMENTS. EASY & SECURE Pay friends through the app, fee free bank transfers, pay bills, and access over 40,000 fee-free domestic ATMs⁵. Keep your money safe with card controls, card freezing, and virtual cards. PERSONAL TIERS EARTH No qualifications or fees. No monthly fees or minimum balance All standard benefits, plus: 2% Cashback / 0.50% Savings APY³ / 3 Savings Goals / 3 Virtual Cards WATER Qualification: 30 consecutive days qualified deposit ($1,500), spend ($500) plus a $19.99 Annual fee.⁶ All standard benefits, plus: 4% Cashback / 1.00% Savings APY³ / 10 Savings Goals / 15 Virtual Cards / 2 mo. Netflix reimbursement AIR Qualification: 30 consecutive days qualified deposit ($3,000), spend ($1,000) plus a $49.99 Annual fee.⁶ All standard benefits, plus: 5% Cashback / 2.00% Savings APY³/ Unlimited Savings Goals & Virtual Cards / 2 mo. Netflix & Peloton digital reimbursement/ PriorityPass™ Membership plus 5 Annual Visits FIRE Qualification: 30 consecutive days qualified deposit ($6,000), spend ($2,000) plus a $199.99 Annual fee.⁶ All standard benefits, plus: 6% Cashback / 3.00% Savings APY³ / Unlimited Savings Goals & Virtual Cards / 2 mo. Netflix & Peloton reimbursement/ PriorityPass™ Membership plus 10 Annual Visits / Global Entry Reimbursement. BUSINESS ACCOUNT Cashback on Ride Share, Gas, Selected couriers and more! Customizable invoices Virtual cards with spending controls Business Savings Account with a 1.00% APY⁷ Form an LLC from within the app⁸ Banking Services provided by The Bancorp Bank, Member FDIC. The this app Visa® Debit Card and the this app Visa® Business Debit Card is issued by The Bancorp Bank pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted. ¹ Cashback percentage varies by element. Variable annual fee, deposit and spend requirements may apply. Please refer to Cashback Terms & Conditions for full details. ² 3.00% annual percentage yield (APY) applies to Fire Element only on balances of $20,000 or less. For balances over $20,000, APY ranges from 3.00% to 0.50%. APY current as of 08/4/22. Annual fee applies, fees may reduce earnings. No minimum balance to open the account, however, monthly spend and deposit requirements apply. See this app.us/apy for details. ³ Savings APY varies by Element. Variable annual fees, deposit and spend requirements may apply. Annual fee applies, fees may reduce earnings. No interest paid on balances over $20,000. Please refer to this app.us/apy for details. ⁴ Based on the average Savings APY at Bankrate.com ⁵ Out-of-Network and International fees apply. Third party fees may apply. ⁶ Annual fee assessed only once if you continue to meet the deposit and spend qualifications ⁷ Refer to the Business Savings Account Agreement for full details ⁸ LLC formation is powered by CorpNet, Inc. Fees for LLC creation differ by state and services selected

Top Reviews

By Midsommar42

A bank that “gets” me

Work is changing, so banking needs to change too. this app gets that, and puts the customer first, with no fees, good discounts, and virtual cards. Highly recommended for the cost conscious, and those juggling personal and business expenses.

By awarren5678

Great app, easy to use, better than a regular bank

Recently downloaded and started using the debit card. Awesome way to avoid fees from regular big banks. Seems legit... I am a happy customer so far.

By Thomas Zimmerman

Excellent bank and extraordinary customer service!!!

They are always there to help, they went above and beyond answering my questions and walking me through the solutions!