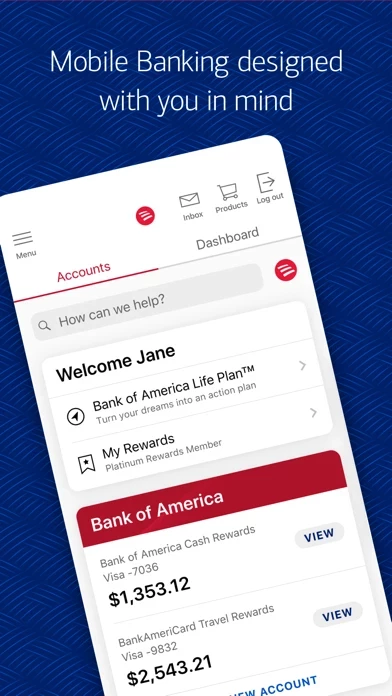

- View account balances and review activity

- Activate or replace credit/debit cards

- Set alerts for important account info

- Securely send and receive money with Zelle using a U.S. mobile number or email address

- Transfer funds between your Bank of America and linked Merrill accounts

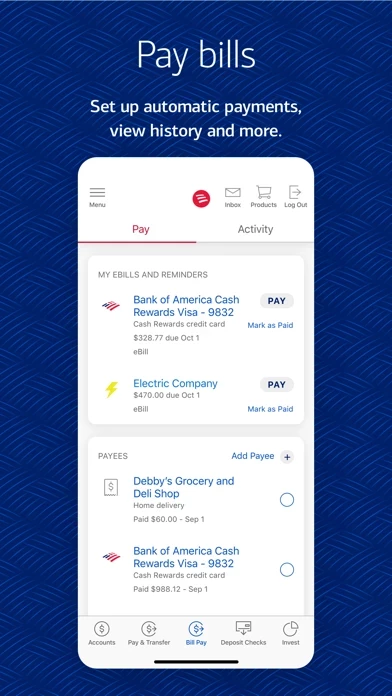

- Pay bills

- Deposit checks by taking photos of them

- Get immediate confirmation that your check is processing

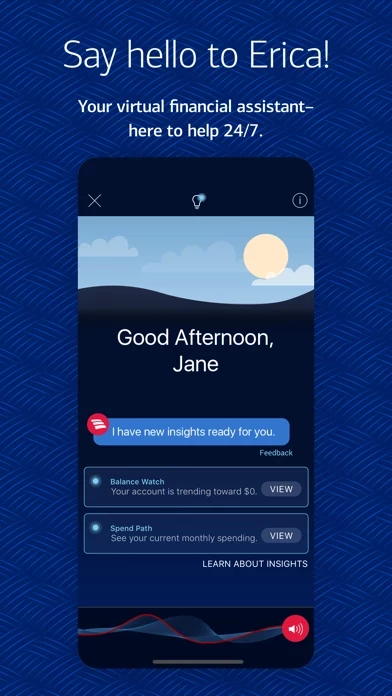

- Use Erica, your virtual financial assistant, to find transactions, pay bills, and more

- Get valuable alerts and helpful insights from Erica

- Set up Touch ID/Face ID for added security

- Receive notifications if fraudulent activity is suspected on your card

- Manage investments with Merrill, including trading stocks, ETFs, and mutual funds

- View up-to-date market data, news, and quotes

- Send messages and documents securely to your advisor

- Mobile Banking Security Guarantee protects you from fraudulent transactions when reported promptly

- Zelle transfers require enrollment and must be made from a Bank of America consumer checking or savings account to a domestic bank account or debit card

- Erica is only available in English

- All features may not be available in iPad and may only be available for certain account types.