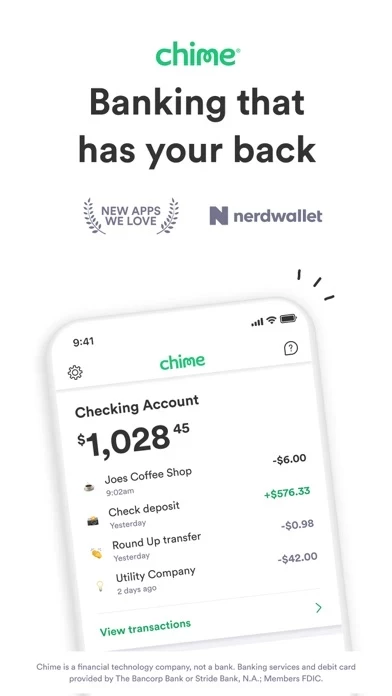

- Security features to keep your money safe

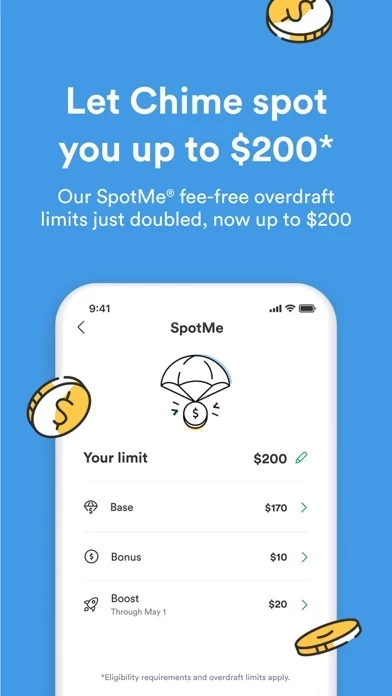

- Overdraft up to $200 fee-free on debit card purchases and ATM withdrawals

- No monthly maintenance fees, minimum balance fees, or foreign transaction fees

- Access to 60k+ fee-free ATMs at locations like Walgreens, 7-Eleven, CVS, and more

- Get paid up to two days early with direct deposit

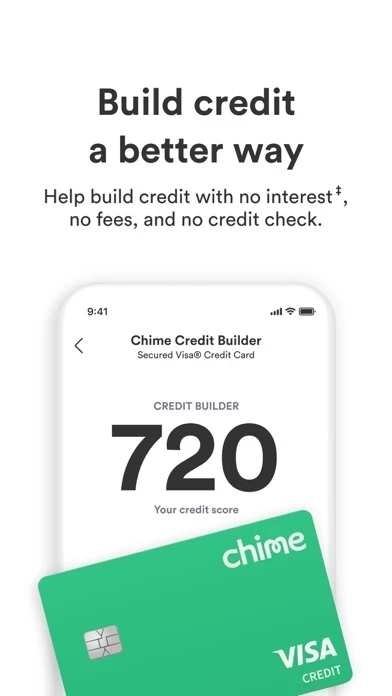

- Credit Builder to increase your FICO® Score by an average of 30 points with regular on-time payments

- Pay anyone with no transfer fees

- Two-factor authentication and the ability to block your card in a single tap

- Chime Visa® Debit Card and Chime Visa® Credit Builder Card issued by The Bancorp Bank or Stride Bank pursuant to a license from Visa U.S.A. Inc.

- Chime SpotMe, an optional, no fee service that allows eligible members to overdraw their account up to $20 on debit card purchases and cash withdrawals initially, but may be later eligible for a higher limit of up to $200 or more based on member's Chime Account history, direct deposit frequency and amount, spending activity and other risk-based factors.

- Early access to direct deposit funds depends on the timing of the submission of the payment file from the payer.

- Out-of-network ATM withdrawal fees may apply except at MoneyPass ATMs in a 7-Eleven, or any Allpoint or Visa Plus Alliance ATM.