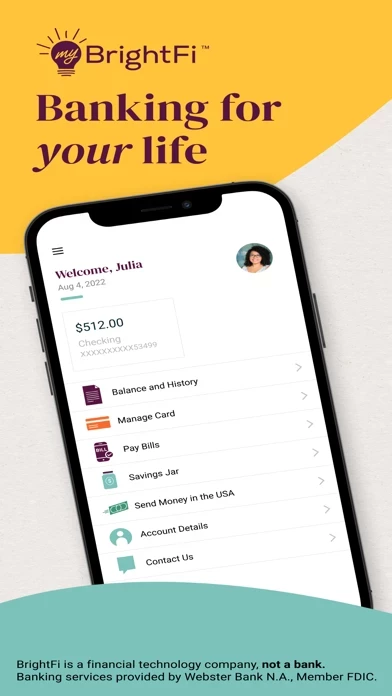

MyBrightFi Overview

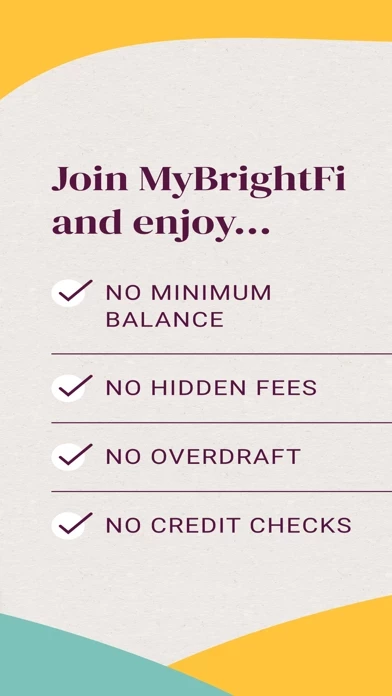

What is MyBrightFi? MyBrightFi is a financial technology company that provides banking services through Webster Bank, N.A. The app is designed to help users save money by avoiding hidden fees, overdrafts, and ATM fees. It offers features such as mobile check deposit, savings jars, bill pay, and the ability to transfer money to friends and family. MyBrightFi does not require credit checks, minimum balances, or minimum funding amounts to open an account.

Features

- Account for everyday spending with deposits held by Webster Bank, N.A. and FDIC-insured up to $250,000

- Mastercard Debit Card

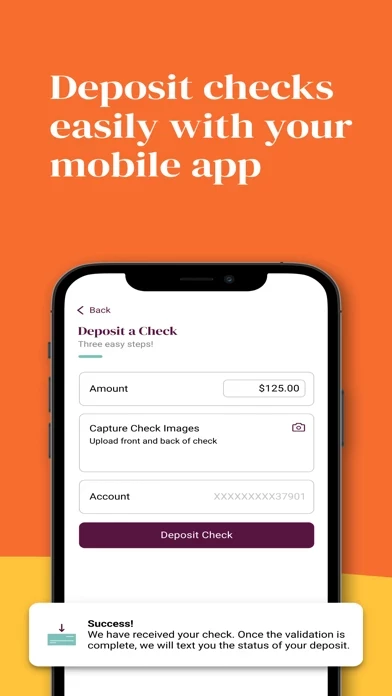

- Mobile check deposit to avoid check cashers

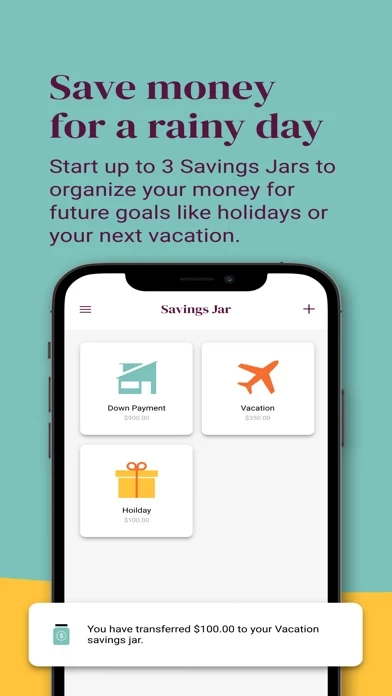

- Savings jars to put money aside for future expenses and goals

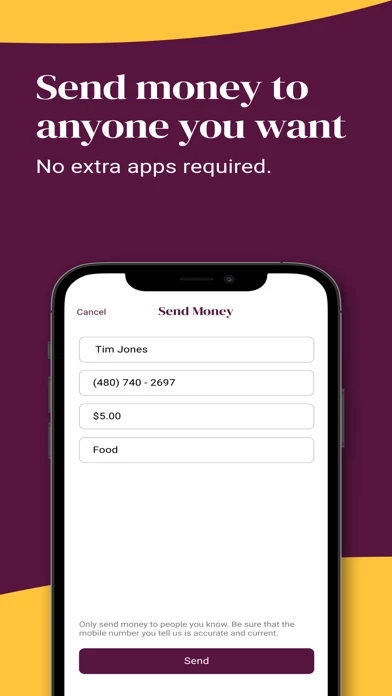

- Transfer money to friends and family at no extra cost

- BillPay features

- No overdraft fees

- Live customer service from Customer Support Specialists in English and Spanish

- Monthly subscription of $4.95

- No credit checks, minimum balances, or minimum funding amounts required to open an account

- Out-of-network ATM withdrawal fees apply, but ATM withdrawals within the Moneypass ATM network are included at no extra cost. Other fees such as third-party fees may apply.

Official Screenshots

Product Details and Description of

this app is the banking app designed to help you keep more of your hard-earned money. BrightFi is a financial technology company, not a bank. Banking services are provided by Webster Bank, N.A.; Member FDIC. In 2020, banks made $12.4 Billion in overdraft fees. Every day, people have to pay check cashers and money transmitters for access to their own money. With no hidden fees, no overdrafts and no ATM fees*, our customers can save hundreds of dollars each year in fees. Keep control of your money with technology and security features, immediate access to direct deposited funds, ways to save for your goals and the ability to send money to friends and family, all from the palm of your hand. WHAT YOU PAY A monthly subscription of $4.95 WHAT YOU GET • Account for everyday spending - Deposits held by Webster Bank, N.A., and FDIC-insured up to $250,000 • Mastercard Debit Card • Avoid check cashers mobile check deposit • Savings Jars to put money aside for future expenses and goals • Transfer money to friends and family at no extra cost • BillPay features • No overdraft fees • Live customer service from our Customer Support Specialists in English and Spanish BANKING FOR EVERYONE this app does not require: • Credit checks • Minimum balances • Minimum funding amounts to open an account Here’s how the application process works: 1. Download the this app app 2. Grab your SSN or ITIN and government issued photo ID (you’ll need it to verify your identity) 3. Open the app and sign up in under 4 minutes 4. Fund your account by depositing a check with your smartphone or filling out a direct deposit form in the app and sending it to your employer 5. Activate your card when it arrives (usually 7-10 business days) 6. Check out www.this app.com/customer-support to learn more about how this app can work for you Questions about signing up or want to learn more? Please visit www.this app.com or call our Customer Support Specialists at 1-888-627-5407. Your privacy and security are important to us. Please check out our privacy policy at https://this app.com/policies ------ Banking services provided by Webster Bank, N.A., Member FDIC. The this app Mastercard Debit Card is issued by Webster Bank, N.A., pursuant to a license from Mastercard. *Out-of-network ATM withdrawal fees apply. ATM withdrawals within the Moneypass ATM network are included at no extra cost. Other fees such as third-party fees may apply.

Top Reviews

By olatyler

🤔

Why can’t I sign up for new account. What’s going on. Fix this as soon as possible

By WTFMAN123abc

HACKERS

This app is being used to scam people.

By shewanda millee

Not happy

Why is my acc not approved yet it been 3 days now they aren’t approved it