Quicken—Budget & Money Planner Reviews

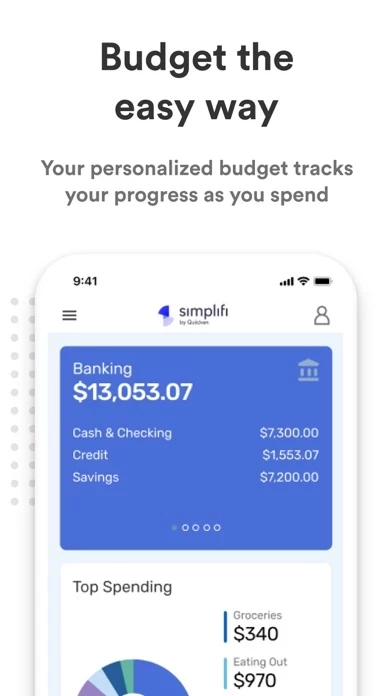

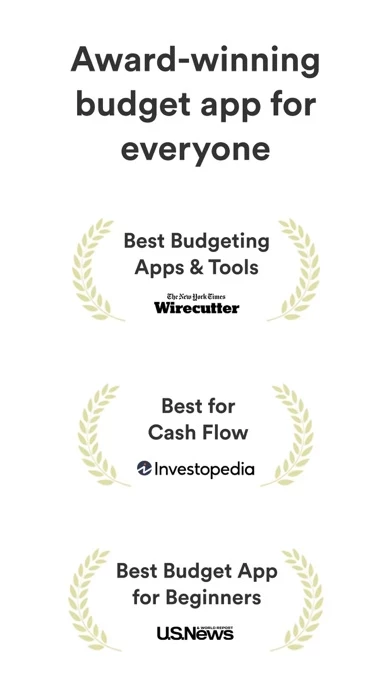

Published by Quicken Inc. on 2024-01-08 About: Effortlessly manage your finances and track your spending all in one place with

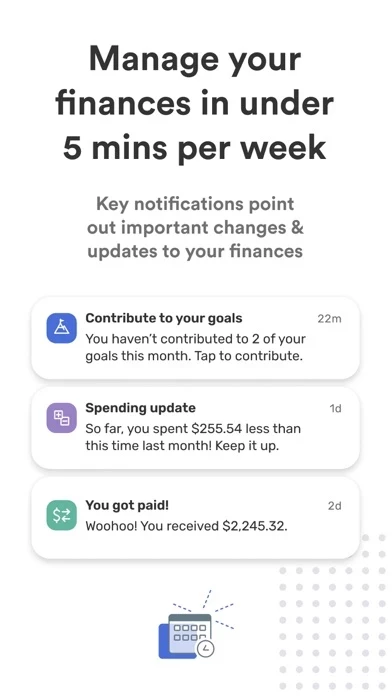

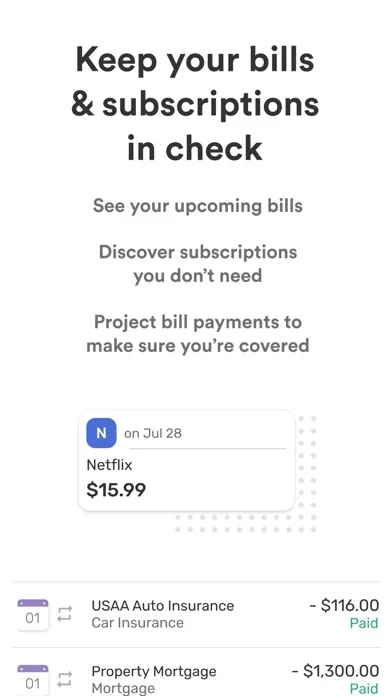

Simplifi by Quicken, a convenient and easy-to-use budgeting app. Tracking

expenses, managing budgets, and keeping tabs on your finances can be a challenge.