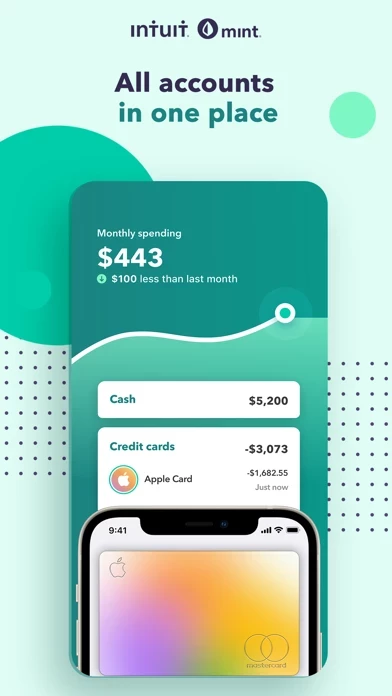

- All your money in one app: Mint brings together all your financial accounts, including cash, credit cards, loans, investments, and more, to give you a complete picture of your financial health.

- Monitor your cash flow: Mint helps track your transactions, budgets, expenses, and subscriptions, and alerts you when you're close to going over budget or overdrafting from an account.

- Billshark bill negotiation: A new feature that helps users save on their monthly bills.

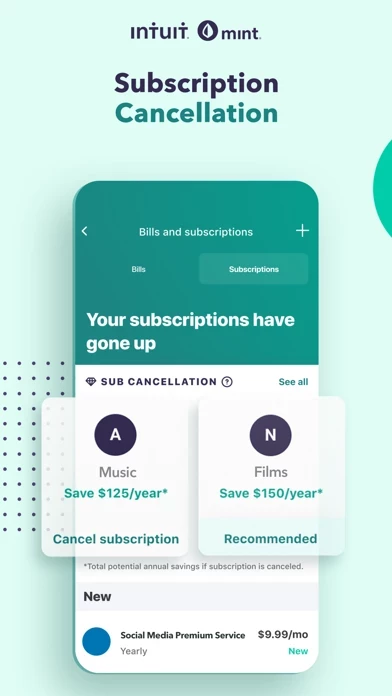

- Subscription cancellation: Mint can now cancel subscriptions directly from the app and notify users when subscription prices go up or uncover old ones they don't use.

- Mintsights: A feature that takes a deep dive into your accounts and uncovers new ways to make every dollar count.

- Better budgeting and expense monitoring: Mint offers a smart budget based on your spending on day 1 and a budget tracker to keep tabs on your balances.

- Bill tracker: Mint's bill tracker makes it easy to manage your expenses and track bills right alongside your account balances, helping you keep tabs on your debt and avoid late fees.

- IRS tax refund: Users can file and track their taxes directly in Mint with TurboTax and get notified when their refund arrives in their account.

- Financial goals: Set custom financial goals in Mint's budgeting app and get actionable tips tailored to you.

- Free credit score and credit report: See your free credit score and credit report whenever you sign in, and get fraud and identity alerts and updates to your score in one money management app.

- Security: Mint takes data protection seriously and is constantly improving its security measures to keep users' accounts safe.