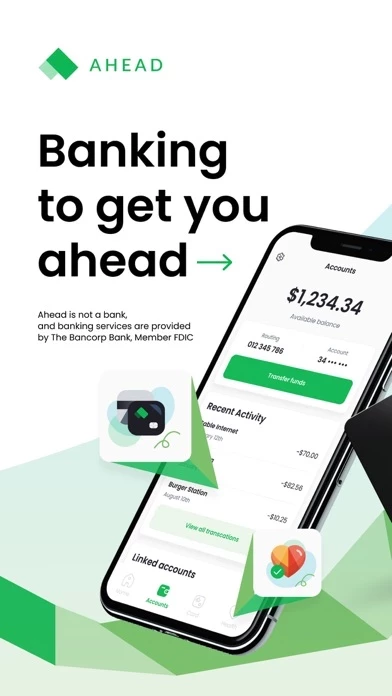

Ahead Money Overview

What is Ahead Money? Ahead is a financial app that offers personalized financial health services to its users. It is not a bank, but it provides banking services through The Bancorp Bank, Member FDIC. The app offers features such as early paycheck access, fee-free overdraft protection, no monthly or hidden fees, and access to over 55,000 ATMs worldwide.

Features

- Empowerment: Users can access their paychecks up to 2 days early through direct deposit.

- Resilience: Eligible members can overdraft up to $100 on qualified debit card purchases with no fees through Ahead Overdraft.

- Transparency: Ahead Accounts have no monthly fees, no minimum balance fees, and no overdraft fees.

- No fees at 55,000+ ATMs: Users can withdraw money at no cost from any of the 55,000+ AllPoint® ATMs locations worldwide.

- Safe and secure: The app stores user information securely, and users can easily lock their Ahead debit card if they misplace it.

- Legal stuff: The Ahead Visa® Debit Card is issued by The Bancorp Bank pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted.

- Eligibility: Ahead Overdraft is available after qualifying direct deposits of $1,000 or more into the Ahead Account over 35 consecutive calendar days.

- Early paycheck access: Early access to direct deposit funds depends on the timing of the submission of the payment file from the payer.

- Direct deposit: The routing and account number can be used for setting up Direct Deposit or to pay bills online with the direct deposit feature.

Official Screenshots

Product Details and Description of

Ahead personalizes your financial health through: EMPOWERMENT - Paycheck up to 2 days early‡ RESILIENCE - Fee-Free‣ Overdraft up to $100 TRANSPARENCY - No monthly or hidden fees^ Ahead is not a bank. Banking services are provided by The Bancorp Bank, Member FDIC. The Banking Features You Deserve FEE-FREE OVERDRAFT‣ Go over your account balance? Don't worry, Ahead has got you covered with up to $100 in overdraft protection at no cost. Using Ahead Overdraft, eligible members overdraft up to $100‣ on qualified debit card purchases with no fees. EARLY PAYCHECK ACCESS‡ Get your money when you need it. Use direct deposit to receive your paycheck up to 2 days earlier than some traditional banks‡. Set up direct deposit with paychecks, tax returns, unemployment benefits in your Ahead Account. NO MONTHLY OR HIDDEN FEES^ Ahead Accounts have no monthly fees, no minimum balance fees and no overdraft fees‣. NO FEES AT 55,000+ ATMS^ You can withdraw money at no cost from any of the 55,000+ AllPoint® ATMs locations worldwide. SAFE AND SECURE Reliability is our top priority. Your information is stored securely and you can easily lock your Ahead debit card if you misplace it. LEGAL STUFF Ahead is not a bank. Banking services provided by The Bancorp Bank, Member FDIC. The Ahead Visa® Debit Card is issued by The Bancorp Bank pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted. ^There is no fee to withdraw money from any Allpoint® ATM. There is a $2.50 ATM cash-withdrawal fee assessed by Ahead for all non-Allpoint® ATM transactions (out of network transactions). The ATM operator may charge an additional fee. ‣Ahead Overdraft is available after qualifying direct deposits of $1,000 or more into the Ahead Account over 35 consecutive calendar days. For eligible members who are enrolled in Ahead Overdraft, Bank will approve purchases that result in a negative balance on the Ahead Account up to $100. Not all purchases are eligible. See this app.com/overdraft for full terms and conditions. ‡Early access to direct deposit funds depends on the timing of the submission of the payment file from the payer. We generally make these funds available on the day the payment file is received, which may be up to 2 days earlier than the scheduled payment date. The recipient’s name on any deposits received must match the name of the Ahead customer. Any deposits received in a name other than the name registered to the Ahead Account will be returned to the originator. The routing and account number can be used for setting up Direct Deposit or to pay bills online with the direct deposit feature. Be sure only to provide your routing account number information to your payer, benefits provider or trusted billers.

Top Reviews

By snorkeldork

great message for a great app!

finally off the waitlist & what an awesome launch!!!

By TimmyFadedWake

ROLLING DOINKS

This is a launch pad for the astronauts To the best artist, excelsior!

By leti89tx

They don’t pay

I was told I’d get $10 for signing up and trying them. Even support said I’d get paid yet nothing! I’m still owed 14 referrals 🤨 Update: Still no signup paid, only been paid for 3 referrals Customer service is a joke