MoneyLion Reviews

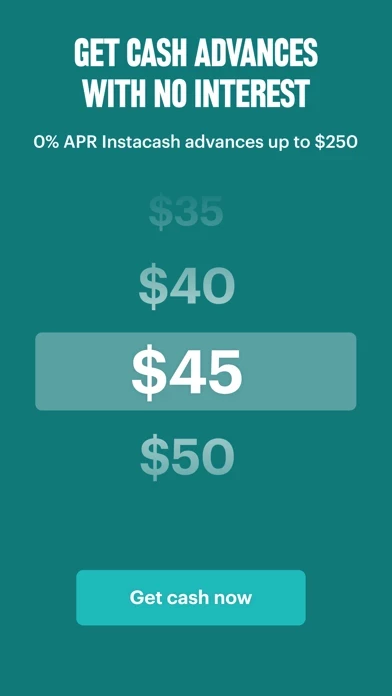

Published by MoneyLion on 2025-02-10🏷️ About: MoneyLion is a financial technology company that offers a range of financial tools and services to help users manage their money. The app provides mobile banking, credit-building, financial tracking, cash advances, and investing features. Users can sign up for RoarMoney to get paid up to 2 days early, earn cash back on everyday spending, and unlock up to $1,000 in 0% APR cash advances with qualifying recurring direct deposits. The app also offers Instacash, which allows users to get up to $250 in 0% APR cash advances with no credit checks or interest. Round Ups is another feature that helps users invest or buy cryptocurrency while they spend. MoneyLion also offers Credit Builder Plus, which provides access to a Credit Builder loan up to $1,000 and personalized discounts with PerkSpot.