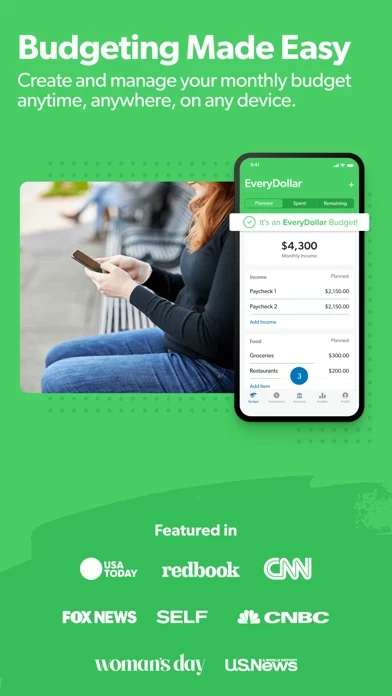

EveryDollar Overview

What is EveryDollar? EveryDollar is a budgeting app that helps users plan and manage their finances stress-free. It is built on zero-based budgeting, where every dollar is given a job to do before the month begins. The app offers a free version and a premium version with additional features.

Features

- Create unlimited budgets on the mobile app or desktop

- Adjust or reset budget throughout the month

- Split expenses across multiple budget lines

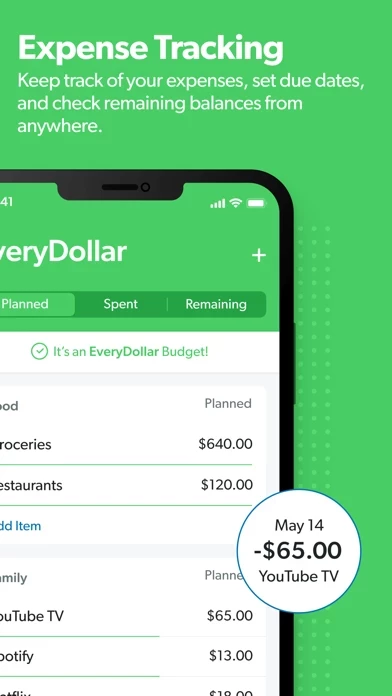

- Stay on top of spending and see how much cash is remaining each month

- Manually track transactions

- Check budget from anywhere

- Connect to bank account to automatically stream in transactions (premium version)

- Get one-click transaction tracking suggestions (desktop only, premium version)

- See custom reporting on income and spending habits (premium version)

- View all connected account balances in the app (premium version)

- Export transactions and download as CSV (desktop only, premium version)

- Fast-track debt payoff with automatic balance updates (premium version)

- Get priority callback support from customer success team (premium version)

- Set due date reminders three days before a bill is due (mobile app only, premium version)

Official Screenshots

Product Details and Description of

Budgeting doesn’t have to be boring and tedious. Seriously. You just need a budgeting app made with you in mind. That’s this app. this app has helped millions of people learn to love budgeting by taking the stress out of planning and managing money. Create your first budget in about 10 minutes. Then customize categories, track expenses, set up savings goals, and more! You can also pay off debt faster, build lasting wealth, and plan for your future. Tell Your Money Where to Go this app is built on zero-based budgeting. You give every dollar a job to do (see where we got the name?) before the month begins—so your income minus your expenses always equals zero. No complicated percentage-based or “month ahead” planning required—just simple budgeting that puts you in control of your finances. Find and Save More Money When you start to tell your money where to go instead of wondering where it went, you’ll feel like you got a raise. In fact, budgeters find an average of $332 in their first month using this app. You can start budgeting with the free version of this app or unlock the premium version with a free trial. What’s included with the free version of this app? - Create unlimited budgets on the mobile app or on desktop. - Adjust or reset your budget throughout the month. - Split expenses across multiple budget lines. - Stay on top of spending and see how much cash is remaining each month. - Manually track transactions. - Check your budget from anywhere. What’s included with the premium version of this app? - Everything in the free version, plus: - Connect to your bank so transactions automatically stream in straight from your bank account. - Get one-click transaction tracking suggestions (desktop only). - See custom reporting on income and spending habits. - View all your connected account balances in the app. - Export transactions and download as CSV (desktop only). - Fast-track your debt payoff with automatic balance updates. - Get priority callback support from our customer success team. - Set due date reminders three days before a bill is due (mobile app only). Download this app and start budgeting today. Privacy Policy: https://www.this app.com/privacy/plain Terms of Use: https://policies.ramseysolutions.net/terms-of-use/this app

Top Reviews

By DC_Dave

This app is by far the best budgeting tool out there.

This app and corresponding desktop interface is by far the best out there. It’s very customizable. I’ve never been good at budgeting because I get paid bi-weekly and I have a variable income. I also travel unexpectedly for my job which throws off my budget by adding reimbursable expenses throughout the month. Through the help and suggestions of the this app support staff, I know now how to work this app as an effective tool with all those budgeting variables. You work your current month budget with the paychecks from the previous month. Then I keep a “hill and vallley” account with just enough to cover any short months where my checks may not cover expenses. So far I haven’t had to use that account. For the travel expenses, I created an expense and income category of reimbursable expenses. I know how much I get per day for meals while traveling and I simply add that to the reimbursable lines as the month/travel has gone on. This has been a huge money saver for me. I’m controlling every aspect of my finances by budgeting. It’s the foundation for everything I’m doing with my money. And I highly recommend spending the $120 for financial peace university which as of now includes this app plus for a year. Worth. Every. Penny. (And no I don’t work for Dave Ramsey but it’s a great program for getting out of debt)

By leongwhyte

A Must Have!!

If you’re serious about keeping tabs on your budget, this app is a must-have! The free version is nice. However, for $100 per year, you can link your bank and or credit card accounts to track your spending. The app reminds you to create a budget for an upcoming month two or three days before the new month starts! It automatically copies the previous month’s info which makes it easy to tweak budget items and amounts. The app is intuitive because you can create a fund (like a Christmas gift shopping fund, or a vacation fund) and tuck money away each month knowing that when it’s time to pay for that cruise, you can easily transfer the funds and pay without worry. The app also allows you to enter long-term payment accounts; car loan information for example, can be entered and you can more or less keep track of what is owed, on the app. This has made life so much easier for my family! I love Excel, but for $100 per year, I don’t have to spend hours each month tracking where the money went!! Thank you Mr. Ramsey!!

By kingxicano

Changed Our Lives!

I thought I wanted to stick to Dave Ramsey‘s paper budget printout. It seemed too much of a bother to get on the computer to do my budgeting but boy was I wrong! This app does all the adding, subtracting, re-adding, re-subtracting automatically for you! If I need to make a small adjustment to my budget I was having to re-calculate the whole month! What a hassle. Now I can make any adjustments so easily and this really keeps me on track. I prefer to do it on the large computer screen but it’s also so very handy to have the budgeting app on my phone for when I’m out I need to add in a transaction. Another thing I like to do is look at my bank screen on the computer, and use my phone for this app so I can add in the transactions. There are no advertisements or gimmicks. Since beginning Dave’s program in mid February we have paid off a total of $14,000 in debt and saved another $14,000 towards our emergency fund. This app was pivotal in helping me to organize our household budget. The best part is that my husband has been really impressed!