OnePay Reviews

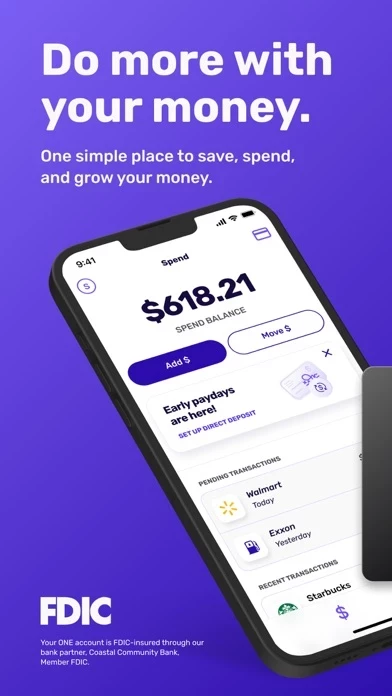

Published by One Finance, Inc. on 2025-05-27🏷️ About: The ONE app is a financial technology app that offers banking services and a debit card provided by Coastal Community Bank, Member FDIC, under license by Mastercard® International. The app allows users to earn 2% cash back on purchases at Walmart, gas stations, and drugstores for the first 12 months, as well as 1.00% APY interest on savings balances, including card round-ups. Users can also get paid up to 2 days early, have overdraft protection up to $200, and earn 1.00% APY on savings balances up to $25,000. The app offers enhanced security and convenience features, such as adding the card to a digital wallet for secure, touch-free payments, and instantly locking the card to prevent purchases.