- Custom dashboard: Users can securely connect their accounts, assets, and liabilities to get an easy overview of their finances. The dashboard displays up-to-date balances and transactions in a simple, clean format. Users can also customize widgets to make financial tracking easier.

- Investment tracking: Monarch's portfolio tracker consolidates all investment holdings in one place. Users can analyze historical performance, chart their allocation, and compare their portfolio performance to key benchmarks.

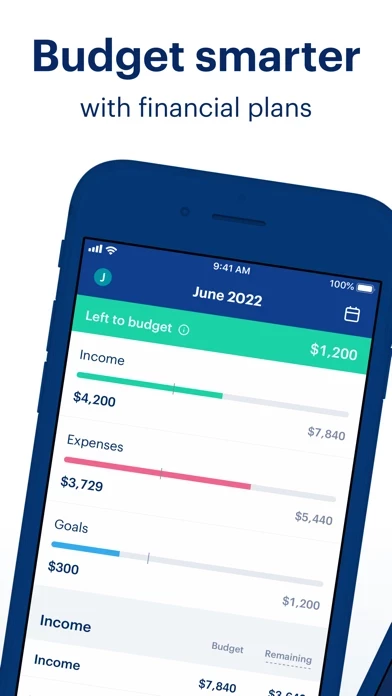

- Budgeting tools: Monarch offers an easy budgeting view that tracks monthly progress. Users can track spending, income, assets, and net worth to get a complete picture of their finances. If users get off track, Monarch helps them adjust their personal budget without feeling bad.

- Expense tracking: Monarch's automatic categorization helps users track expenses and manage their personal budget. Users can set up rules to recategorize future transactions and view monthly expense and income summaries. They can also view their top merchants with expense breakdowns to see where they are spending their money.

- Financial planning: Monarch's financial planner helps users create long-term financial plans and goals to stay on track. Users can track expenses, receive motivation, and apply leftover savings toward their goals at the end of each month. They can also watch their monthly income, spending, and savings behaviors compound over time.

- Membership: Monarch is a membership-based service that offers financial literacy and personal finance tools. Users get access to a roadmap portal where they can suggest and vote on features that will help them the most. Monarch is private, secure, and ad-free.

- Private and secure: Monarch uses bank-level security and never stores any financial credentials. The platform is read-only, so there is no way to move money around. Monarch highly values user privacy and never sells personal or financial information to third parties.