I was a Quicken user for over 20 years, When they went to a subscription service, and their mobile capabilities weren’t great, I started looking for an alternative for my tracking my personal finances, all in one place. I didn’t use the Quicken bill pay option, so all I really was looking for was something to keep track of my bank accounts, mortgage, credit cards, 401(k) and other investments. I researched online and found Personal Capital to be highly rated.

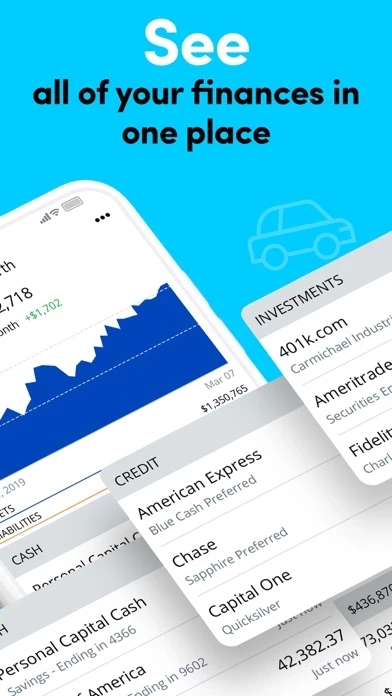

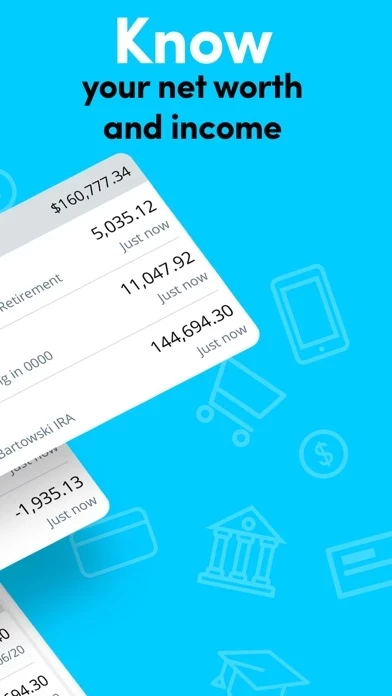

For me, Personal Capital is exactly what I need. It brings in all of my bank accounts, investments, and even gives a Zestimate on my house and calculates the equity to build into my Net Worth. Took me a while to figure out how to get my Fidelity 401(k) to link, but through some Google searches, figured out that my company uses Fidelity Net Benefits site, so there you go.

You can easily download files into csv, which is a nice feature. It has the ability to add expense and income categories, but you can’t make additions or changes to the register. That being said, I didn’t really make additions to the register in Quicken anyway as it pulled data from my banks and financial institutions.

Mobile apps are great also. It works best on my iPad Pro, but still get info on my iPhone and regular iPad as well.

Super easy to set up, great visualization and data. Great solution.