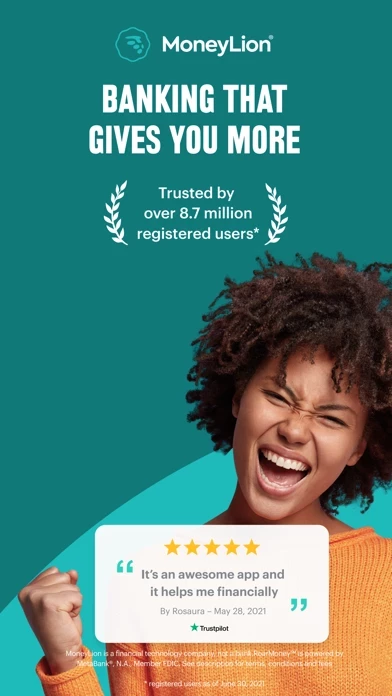

MoneyLion: Go-to Money App Software

Company Name: MoneyLion

About: MoneyLion is a mobile banking platform for borrowing, saving, and investing.

Headquarters: New York, New York, United States.

MoneyLion Overview

What is MoneyLion?

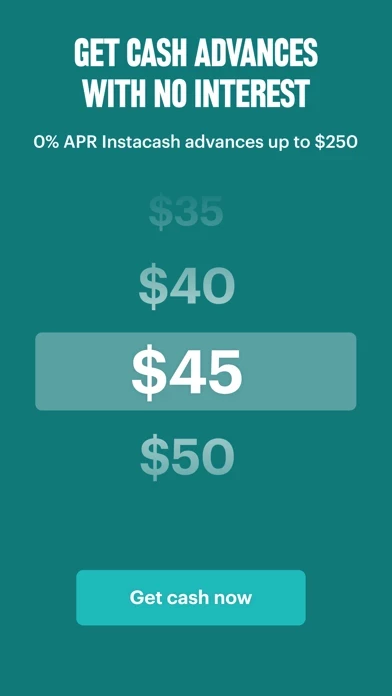

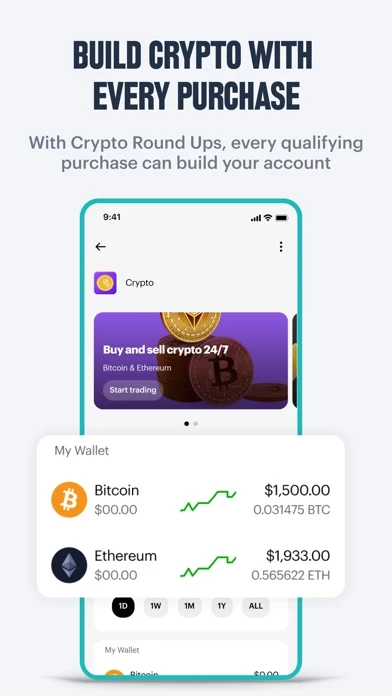

MoneyLion is a financial technology company that offers a range of financial tools and services to help users manage their money. The app provides mobile banking, credit-building, financial tracking, cash advances, and investing features. Users can sign up for RoarMoney to get paid up to 2 days early, earn cash back on everyday spending, and unlock up to $1,000 in 0% APR cash advances with qualifying recurring direct deposits. The app also offers Instacash, which allows users to get up to $250 in 0% APR cash advances with no credit checks or interest. Round Ups is another feature that helps users invest or buy cryptocurrency while they spend. MoneyLion also offers Credit Builder Plus, which provides access to a Credit Builder loan up to $1,000 and personalized discounts with PerkSpot.

Features

- Mobile banking

- Credit-building

- Financial tracking

- Cash advances

- Investing features

- RoarMoney: get paid up to 2 days early, earn cash back on everyday spending, and unlock up to $1,000 in 0% APR cash advances with qualifying recurring direct deposits

- Instacash: get up to $250 in 0% APR cash advances with no credit checks or interest

- Round Ups: invest or buy cryptocurrency while you spend

- Credit Builder Plus: access to a Credit Builder loan up to $1,000 and personalized discounts with PerkSpot

- MoneyLion Debit Mastercard with Price Protection and Zero Liability

- No minimum balance fees and no ATM fees at over 55,000 ATMs nationwide

- FDIC-insured funds

- Cryptocurrency services powered by Zero Hash and subject to separate terms and conditions.

Official Screenshots

MoneyLion Pricing Plans

| Duration | Amount (USD) |

|---|---|

| Billed Once | $4.00 |

| Monthly Subscription | $35.00 |

**Pricing data is based on average subscription prices reported by Justuseapp.com users..

Product Details and Description of

this app is a financial technology company, not a bank. With this app, you get the tools you need to live your best money life. From mobile banking to credit-building, financial tracking, cash advances, and investing features, we simplify all aspects of personal finance so you can maximize the power of your wallet from anywhere. Ready to make awesome decisions with your money? We made access to Credit Builder loans and cash advances simple to help you achieve your life goals. If you want banking that gives you more, sign up for RoarMoney℠ to get paid up to 2 days early,1 earn cash back on everyday spending, and unlock up to $1,000 in 0% APR cash advances with qualifying recurring direct deposits.2 Plus, you can get a contactless this app Debit Mastercard® with Price Protection3 and Zero Liability4 and a RoarMoney virtual card automatically when you fund your account. Our this app Debit Mastercard has no minimum balance fees and no ATM fees at over 55,000 ATMs nationwide!5 If you need help covering life’s fun and not-so-fun surprises, you can get up to $250 with Instacash℠. No credit checks and no interest – fast cash with no tricks or gimmicks? It’s really that simple. Round Ups work simply to take the complication out of investing or buying cryptocurrency. For every qualifying purchase you make, the amount you pay gets rounded up to the nearest dollar and then put in your this app Crypto or Investment account. Now you can use your spare change to buy Bitcoin and investments without the hassle. Get your hard-earned money to work for you with cash advances and financial tools made to fit your needs perfectly. Join this app to take control over your finances today. RoarMoney - banking that gives you more - Get your paycheck up to 2 days early with direct deposit.1 - Earn up to $500 every day just by shaking your phone with Shake 'N' Bank. - Get up to a $250 refund if you find a lower price for an item within 90 days with Price Protection.3 - No minimum balance requirement and no fee at over 55,000 Allpoint ATMs.5 Instacash - get extra cash when you need it - Nab up to $250 in 0% APR cash advances — no credit check, monthly fee, or interest. - Access up to $1,000 with qualifying recurring direct deposits into a RoarMoney account.2 - Unlock up to $300 when you become a Credit Builder Plus member. - Worry less about running low on money. Round Ups - invest or buy crypto while you spend - Put your spare change to work with an easy way to start investing or buying crypto. - Automatically build a this app Crypto or Investment account with any eligible credit or debit card purchases. - Start small and build with confidence. - Get on a path to your financial goals without having to think about it. Credit Builder Plus – save while you build credit - Credit Builder Plus members get access to a Credit Builder loan up to $1,000. - Monitor credit on a weekly basis. - Earn up to $19.99 per month with Lion’s Share. - Get personalized discounts with PerkSpot. this app is a financial technology company, not a bank. RoarMoney℠ demand deposit account provided by, and this app Debit Mastercard® issued by, Pathward, National Association, Member FDIC. RoarMoney is a service mark of this app. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated. Funds are FDIC insured, subject to applicable limitations and restrictions, when we receive the funds deposited to your account. Cryptocurrency services are powered by Zero Hash and are subject to separate terms and conditions. Cryptocurrency assets custodied by Zero Hash are not subject to FDIC or SIPC insurance. https://mldocs.this app.com/GTB_Price_Protection_MoneyLion05052020.pdf https://www.this app.com/terms-and-conditions https://this app.nyc3.cdn.digitaloceanspaces.com/wp-content/uploads/2022/02/02181744/this app-Round-Ups-Terms-and-Conditions-1.27.22.pdf https://get.this app.com/lionsshareterms/

Top Reviews

By Nadezhada

Super excited thus far...

I downloaded the app and although there are issues like DL not scanning and the #growyourstack option doesn’t pan a flat surface, I was able to get everything else going. I was super skeptical, ESPECIALLY after reading all the reviews about high interests, unexpected “surprises”, and scams but if you, as a consumer, do you part and actually read a document, you will see exactly what are signing up for. I was approved for the loan at the 5.99%; they don’t even check your credit for it and their requirements for approval are clearly stipulated. I opened up the contract to make sure and I was happy to see that I was set up for payments according to my pay period and at a 5.99% APR. Had I seen something different, I wouldn’t have accepted the loan. I would recommend that you open docs and read them before agreeing to anything. I am looking forward to having the issues worked out so I can take 100% advantage of all this app’s functionality. Financial stability is very important to me. It is clear to me that this app knows that there is an enormous gap between basic financial knowledge and healthy finances and they are invested in bridging that gap to help those of us that haven’t made the best “financial” decisions. I will come back and update my review as time passes. I’m hoping to bump it to 5 stars and 2 big thumbs up!!

By Rosslynn N.

Great investment

So I’ve been a member for a full 30 days now. I was very skeptical at first, I wanted to cancel after my first payment because I read some negative reviews. But, thinking about the situation a little longer I realized all the negative reviews have one thing in common, and that’s because these people didn’t read the documents or what they were signing up for. So I left it at that! Now if you don’t have the money monthly to pay both the membership fees and the loan. Then I wouldn’t suggest this app, cause you need to spend money to make money, if you have no money then you can’t make any. Anyways, you pay a membership fee of $33 and some change every two weeks. $50 of that goes into your investment account. That is STILL your money! It’s just in a savings account for you basically. ML couldn’t verify my bank account so I was in something called the LOANLocked group. I had to make sure to pay my membership ON TIME, auto-drafted from my bank account. 30 days later with no questions asked I was approved without running my credit for the $500 loan. I don’t have this app just for the loan. I have it to build my credit, and the ongoing investment. I would recommend this app to my close family and friends because I trust it. AGAIN READ what you’re signing up for. ☺️☺️☺️☺️

By BeeBoi

It’s really a 5 Star

I would have given this app a 5 star rating if it wasn’t for the verification system they have in place. But I can also blame them for the glitches because customer service seems to know what’s going on but doesn’t come right out to tell you, and that makes the verification go on for weeks. If some would have taken the time to explain I would have given 5 stars. After answering about 4 questions about myself which I answered CORRECTLY the computer told me I was wrong and I would get another try, the second time the same thing my answer were ALL CORRECT but there was no third try it told me I had to wait a week then reapply for the checking account which gives you a lot more options when it comes to borrowing money. Which in a sense is ur own money. But what gets me is why not just tell me I’m not eligible for the checking but I’m ok for the investment part which I really like and think it’s an Awesome way to save & invest at the same time. I wish I could get the checking account that would complete my portfolio! I still recommend investing it’s worth it, now and for the future!!! BeeMan