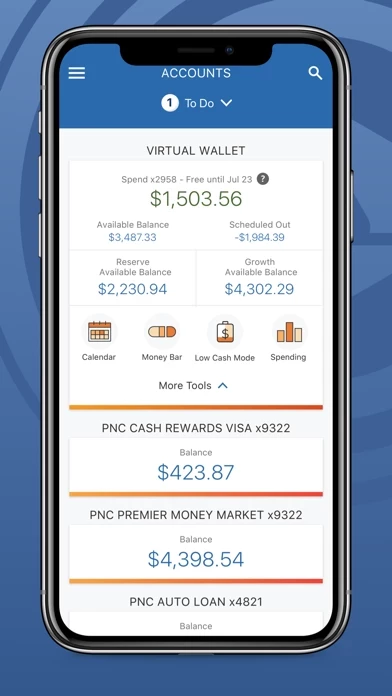

- Check balances and recent transactions for checking, savings, credit card, and loan accounts

- Set up Touch ID or Face ID for secure sign-on

- Reset password quickly and conveniently

- Send money with Zelle to people you know and trust using mobile number or email address

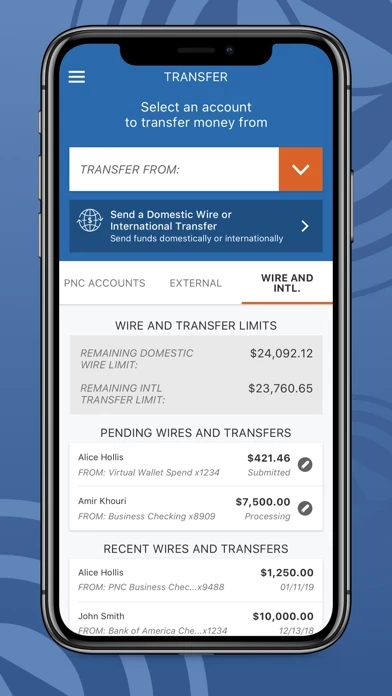

- Transfer funds between eligible PNC accounts and external bank accounts

- Deposit checks quickly and easily with iOS device

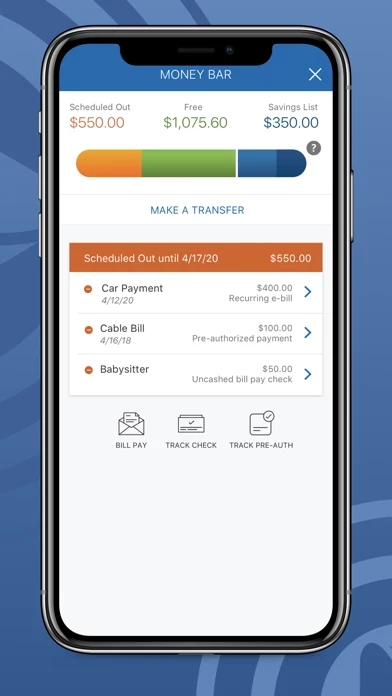

- Add bills and make one-time or recurring bill payments

- View and manage PNC credit, debit, and SmartAccess cards

- Make in-store payments with Apple Pay

- Lock or unlock PNC debit or credit card if misplaced

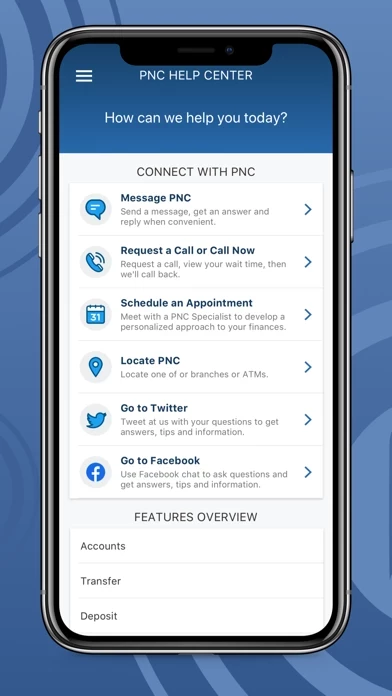

- Locate nearest PNC ATM or branch using location services or search by zip code and street address

- For Virtual Wallet users:

- See what's free to spend with Scheduled Out and Free Balance

- Visualize money with Money Bar

- Use Calendar to see upcoming paydays and payments and view transaction history

- Track spending and set budgets with categories

- Create savings goals and set up automatic rules to transfer money to savings

- PNC's Security and Privacy protects personal and financial information

- Zelle should only be used to send or receive money with people you know and trust

- Limits to the number of transactions from savings or money market account per month

- Mobile Deposit feature requires supported camera-equipped device and PNC mobile banking app

- Certain restrictions apply, see mobile banking terms and conditions in PNC Online Banking Service Agreement.