U.S. Bank Mobile Banking Software

Company Name: U.S. Bancorp

About: Cadence Bancorp provides banking services.

Headquarters: Houston, Texas, United States.

U S Bank Overview

What is U S Bank? The U.S. Bank Mobile App is a top-rated app that provides easy banking and investing services. It offers security features, personalized insights, easy money movement, and access to a range of products. The app also provides help and support when needed.

Features

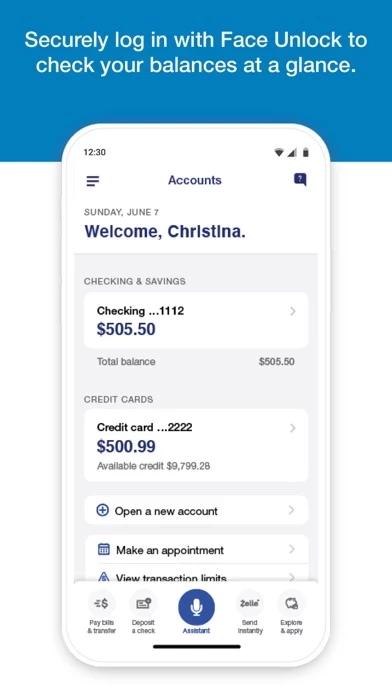

- Secure login with credentials for digital services at usbank.com

- Alerts for duplicate charges, suspicious activity, and low balances

- View accounts and balances in one spot, including checking, savings, credit cards, loans, and more

- Secure access to credit scores

- Set travel notifications, lock and unlock cards, and add cards to mobile wallet

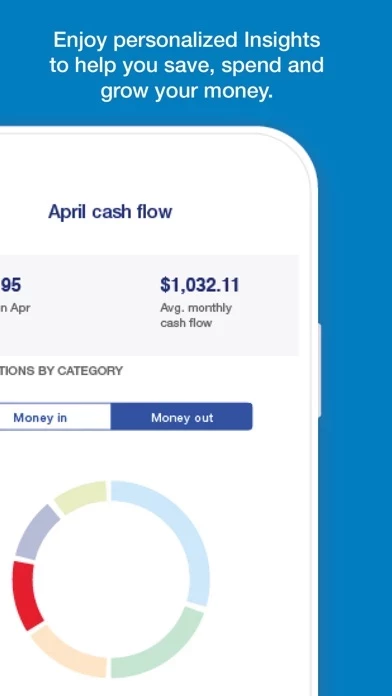

- Personalized insights on monthly spending and recommendations on how to save and grow money

- U.S. Bank Smart Assistant for managing accounts and moving money through voice commands

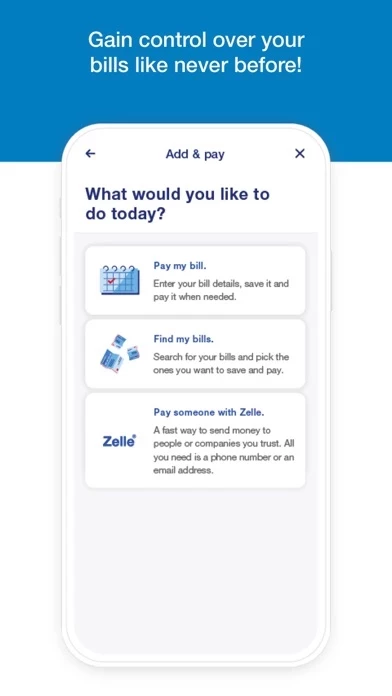

- Easy money movement through Zelle for sending and requesting money with friends and family

- Quick deposit of checks with increased limits

- Pay and manage bills in one spot and make transfers between U.S. Bank accounts

- Explore and apply for new accounts, credit cards, loans, and small business accounts

- Help center for answers to commonly asked questions and banking demos on Digital Explorer

- Schedule an appointment with a banker or get real-time support with Cobrowse

- Locate branches and ATMs near you

- View U.S. Bancorp Investments accounts and balances and make transfers between U.S. Bank accounts and U.S. Bancorp Investment accounts.

Official Screenshots

Product Details and Description of

Easy banking and investing with the top-rated1 U.S. Bank Mobile App. Security at your fingertips • Log in with your credentials for digital services at this app.com. Don’t have online access? Enroll with the app. • Be alerted to duplicate charges, suspicious activity, and low balances. Manage accounts and cards • View accounts & balances in one spot: checking, savings, credit cards, loans, and more. • Securely access credit scores. • Set travel notifications, lock & unlock cards, and more. • Add cards to mobile wallet. • Select your language preference – English or Spanish. Personalized Insights • Review monthly spending in key categories, like Food & Dining. • Get recommendations on how to save and grow your money based on your spending history. U.S. Bank Smart AssistantTM • Manage accounts by asking "What’s the routing number for my checking account?" • Move money by saying “Transfer $50 from checking to savings." Easy money movement • Send & request money with friends and family using Zelle®3. • Quickly deposit checks, now with increased limits. • Pay & manage bills in one spot. • Make transfers between U.S. Bank accounts. Explore products • Find new accounts, credit cards, loans, small business accounts, & more. • Apply from the app and often get a decision within minutes. Help when you need it • Explore the Help Center for answers to commonly asked questions. • View banking demos on Digital Explorer. • Schedule an appointment with a banker or get real-time support with Cobrowse. • Locate branches & ATMs near you. U.S. Bancorp Investments, an affiliate of U.S. Bank • View U.S. Bancorp Investments accounts & balances. • Make transfers between U.S. Bank accounts & U.S. Bancorp Investment accounts. 1. Industry benchmarking firm Keynova Group ranked U.S. Bank #1 for mobile app in its Q3 2021 Mobile Banker Scorecard. 2. Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under license. U.S. checking or savings account required to use Zelle®. Requests for money with Zelle® sent to a U.S. mobile number require that the mobile number first be enrolled with Zelle®. U.S. Bank and U.S. Bancorp Investments is committed to protecting your privacy and security. Learn more by visiting U.S. Bank Consumer Privacy Pledge, the U.S. Bancorp Investments Privacy Pledge, and the Online Privacy and Security Policy. The Digital Security Guarantee | Mobile and online security | U.S. Bank (this app.com) protects customers from fraud loss. For more information about U.S. Bank Mobile Banking, please visit this app.com/mobile or call us toll-free at 800-685-5035. Investment and insurance products and services including annuities are: Not a Deposit ● Not FDIC Insured ● May Lose Value ● Not Bank Guaranteed ● Not Insured by any Federal Government Agency For U.S. Bank: Equal Housing Lender. Credit products offered by U.S. Bank National Association and subject to normal credit approval. Deposit products are offered by U.S. Bank National Association. Member FDIC. U.S. Bank is not responsible for and does not guarantee the products, services, or performance of U.S. Bancorp Investments. For U.S. Bancorp Investments: Investment and insurance products and services including annuities are available through U.S. Bancorp Investments, the marketing name for U.S. Bancorp Investments, Inc., member FINRA and SIPC, an investment adviser and a brokerage subsidiary of U.S. Bancorp and affiliate of U.S. Bank.

Top Reviews

By MelodyMaker67

Could Use Sensitivity training

I was depositing a large check from the university I was attending. The branch manager came out to assist the teller. She began asked nag me questions in this Kindergarten teacher voice. She asked me if I knew that the check was from a school in Arizona. I told her that I was taking classes online. She said, “Oh, you’re getting your Associate degree?” I looked at her and told her no and that I’m getting my Masters degree. She was shocked. My inference from her behavior was clear that because I am a black woman, she assumed that the check could have been stolen and then that I did not already have a college degree. I’ve gone through a divorce and it left me struggling financially. My account has been overdrawn a few times. However, the automatic assumption should never be that someone is criminal because they are depositing a large check. That money was for a laptop. She had no clue as to how insulting she was. That tells me that that is her propensity towards people of color. I was insulted and hurt upon leaving the bank and I am thinking about taking my funds and leaving your bank. Her behavior was reprehensible and appalling.

By CLBajek

Love this bank - HATE THE APP: UPDATE

UPDATE: They heard us, guys! They fixed the app and now life is SO. MUCH. EASIER! Thank you, U.S. BANK for appeasing your customers!! :) :) This has nothing to do with the bank. My gripe is the new, updated app. They took an easy, user friendly banking app and completely screwed the pooch. What was once face recognized to open app, now has you log in with your user name, hit password, then face recognition pops up. After that you’re still required to hit log in, are taken to another page to hit the banks app, and then you can finally sign in. I’ve been playing with this since the “upgrade” and there is no simple way to log in. It used to be one step and done. Now it’s a process. For the love of God, change this back to the way it was. Even transferring money between accounts is ridiculous. I would give the new app ZERO stars if it were an option. It’s so bad I’m ready to go back to the old fashioned way of calling an operator for my banking needs. I want the old app back!

By Lynn4thewin

Potential

It took me a while to be able to deposit a check on my phone. I even put it behind a dark background and signed the back. However took me 4 times because it kept saying error. Maybe there is a bug there cause i should have been easy to do. I even had tellers use my phone and the app to take a pic of the check to show me how to do it. It took them a couple tries as well. So maybe there is something to take a look at that in the app. Also maybe more insight with the credit cards where it tells someone how much in and out money is circulating through the accounts. Maybe more fixing bugs on where the money is going to like groceries, shopping, utilities, and etc. when i scroll through the app i can see the pie chart but when i scroll down to the transaction i cant scroll up again to see the pie chart and chose a different category. If i have to choose a different one i have to go out and than click on the bar chart to see it again.