Before using Zelle to send money, you should confirm the recipient's email address or U.S. mobile phone number.

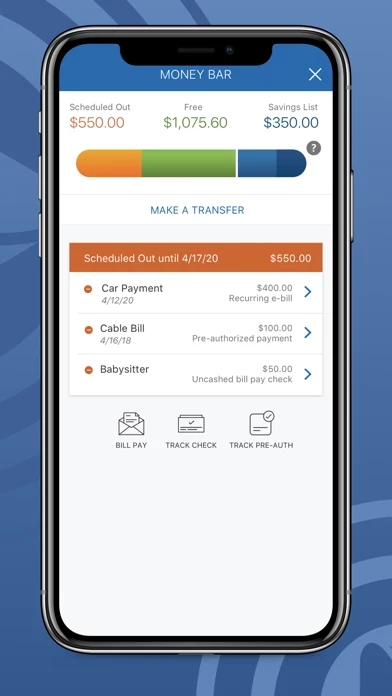

Visualize your money – Use Money Bar® to see how much is available to spend with your Free Balance, what you’ve scheduled for bills and how much you’ve set aside for goals.

See what’s free to spend – Your Scheduled Out subtracts known bills and expenses from your available checking account balance to show you what’s free to spend, which we call your Free Balance.

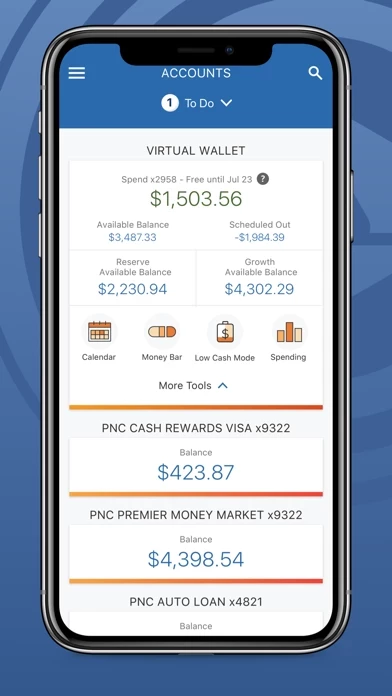

Check balances & recent transactions – See current account activity for your checking, savings, credit card and loan accounts.

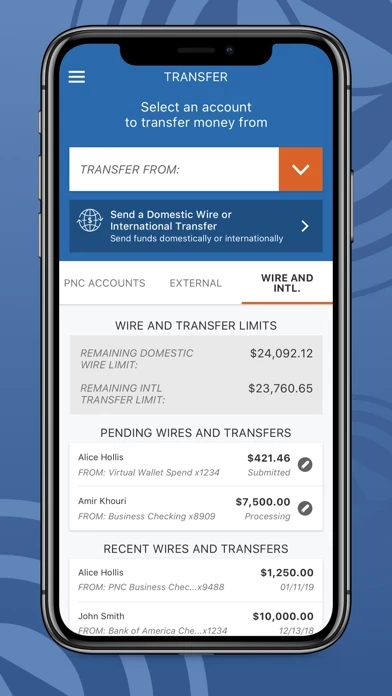

(ii) There are limits to the number of transactions you can make from a savings or money market account per month.