GO2bank Reviews

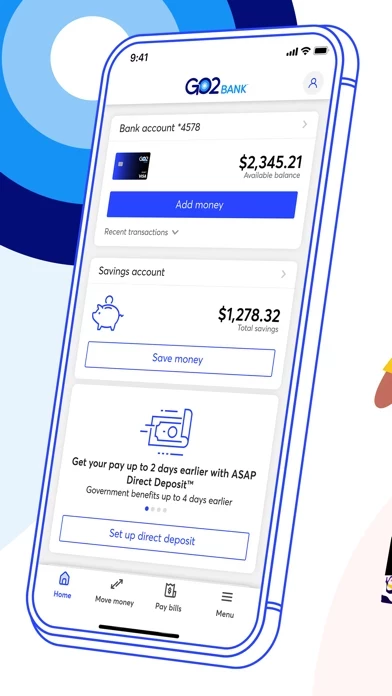

Published by Green Dot Corporation on 2025-02-25🏷️ About: GO2bank is a mobile banking app and debit card that offers a range of features to help users manage their money and build their credit. The app is designed to provide value and convenience to users, with no monthly fees for eligible direct deposit, free nationwide ATM network, overdraft protection, and early direct deposit. Users can also earn high interest rates on their savings and cashback on eGift cards purchased through the app. GO2bank also offers a secured credit card to help users build or repair their credit over time.