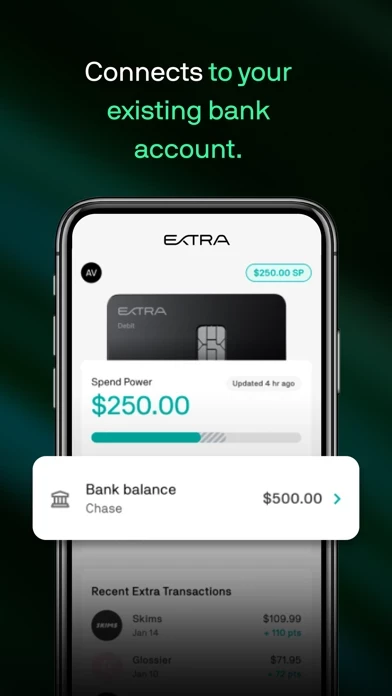

From the moment I read their business model, I knew this card would work. And it didn't take long for me to realize that I was right. I've been using my this app Card for only 3 weeks (app only, card is in mail), the first transaction report has already been filed and my credit has shot up 51 points! I understand the reasons to be skeptical, I considered them all before allowing this app access to my bank account. But this is the real deal, guys. everything has been great so far. Extra is easy to navigate, you'll like the interface, everything is in big lettering, easy to understand and operate. SO SIMPLE. It sends little reminders for things like balance alerts, spend power increases, and, if you're like me, accidentally leaving your card on FREEZE (another cool feature of the this app Card is an on/off "freeze card" option found in Extra ), the support staff are very friendly and helpful, there is a messaging service in Extra , it connects you to them pretty quickly and they work FAST to resolve any issue that may come up. If your goal is to build credit, give this a try. For me, I pretty much had nothing to lose, which means everything to gain! Thank you, this app Card, you guys are great!