PointCard™ Neon Software

Company Name: Point Up Inc.

About: Squire offers a barbershop management and POS/Booking mobile application that connects barbers and

clients nationwide.

Headquarters: New York, New York, United States.

PointCard Overview

What is PointCard?

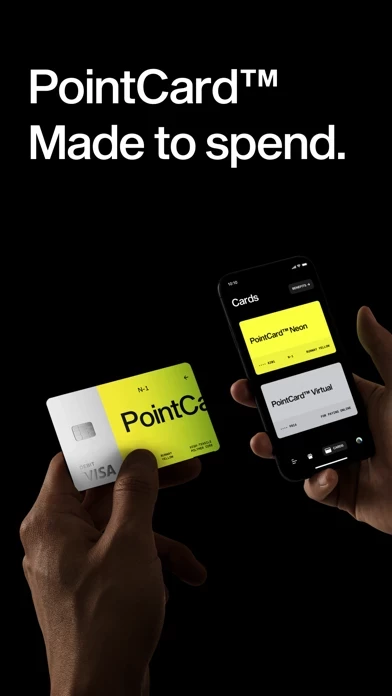

PointCard™ Neon is a mobile banking app that offers a debit card with unlimited cash-back and benefits. The app is designed to provide clarity and speed to enhance the user's everyday spending and mobile banking experience. The app is FDIC insured and does not require a credit check.

Features

- Debit card with unlimited cash-back, exclusive rewards, and comprehensive benefits

- App designed for clarity and speed

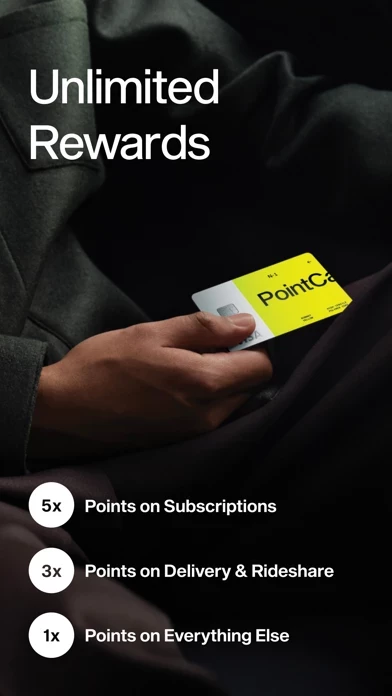

- 5x points on subscriptions like Netflix, Spotify, and more

- 3x points on food delivery and rideshare like DoorDash, Postmates, Uber, Lyft, and more

- 1x points on everything else

- Phone Insurance - reimburses up to $1,000 per year if your phone is lost or damaged when you pay your phone bill with your PointCard

- New Purchase Insurance - reimburses up to $1,000 if a new item bought with your PointCard is damaged or lost within 90 days of the purchase

- Trip Cancellation Insurance - covers up to $1,500 for any out-of-pocket expenses you incur if your trip is cancelled or delayed

- Car Rental Insurance - automatically covers for any physical damage or theft to your rental car when you pay with your PointCard

- Virtual Card - an all-digital card designed for online and in-store shopping

- Card Control - allows users to get notifications the instant their card is charged, change their PIN, and lock their card anywhere, anytime

- No international travel fees

- Member support available via email or text.

Official Screenshots

PointCard Pricing Plans

| Duration | Amount (USD) |

|---|---|

| Billed Once | $50.00 |

**Pricing data is based on average subscription prices reported by Justuseapp.com users..

Product Details and Description of

this app™ Neon is the premier debit card and mobile banking experience, with unlimited cash-back and benefits. FDIC insured.* No credit check required. Learn more at: www.point.app WHAT YOU GET • Card — A debit card designed for unlimited cash-back, exclusive rewards, and comprehensive benefits. • App — Engineered for clarity and speed, to take your everyday spending and mobile banking experience to the next level. • 5x points on subscriptions like Netflix, Spotify, and more.¹ • 3x points on food delivery and rideshare like DoorDash, Postmates, Uber, Lyft, and more.² • 1x points on everything else.³ • Phone Insurance — Get reimbursed up to $1,000 per year if your phone is lost or damaged when you pay your phone bill with your this app.⁴ • New Purchase Insurance — We’ll reimburse you up to a $1,000 if a new item bought with your this app is damaged or lost within 90 days of the purchase.⁵ • Trip Cancellation Insurance — this app covers up to $1,500 for any out-of-pocket expenses you incur if your trip is cancelled or delayed.⁶ • Car Rental Insurance — When you pay with your this app, you're automatically covered for any physical damage or theft to your rental car.⁷ • Virtual Card —An all-digital card designed for online and in-store shopping, virtual card enables you to start spending and earning instantly. • Card Control — With Point, you’re in complete control. Get notifications the instant your card is charged, change your PIN, and lock your card — anywhere, anytime. • No international travel fees.⁹ • And much more. For member support, please email [email protected] or text (650) 539-2701. 1. 5x points on subscriptions is applicable on the following services: Netflix, Hulu, HBO Max, YouTube Premium, Spotify, Pandora, Feather, and Headspace. 2. 3x points on food delivery and rideshare services is applicable on the following services: DoorDash, Uber Eats, Postmates, Caviar, GrubHub, Seamless, Instacart, Good Eggs, Uber, Lyft, and Lime. 3. Purchasing goods and services with your Point card, in most cases, will earn points, excluding balance transfers, cash-like transactions, digital currency purchases, certain gift card purchases and all other forms of manufactured spending. 4. Provides coverage when you charge your monthly phone bill to your Point card and in the event your phone is stolen or damaged (inc. cracked screens), up to $600 per incident, $50 deductible per loss. A maximum of $1,000 per 12 months. 5. Provides coverage for most new items purchased with your Point card that are damaged or stolen within 90 days of purchase, up to $1,000 per loss. A maximum of $25,000 per 12 months. 6. Protects you against forfeited, non-refundable, unused payments if a trip is cancelled or interrupted for covered reasons, up to $1,500 per incident. Coverage applies to common carrier airfare. 7. Pays for physical damage and theft to most rental vehicles when you pay for the entire rental transaction with your Point card and decline the Collision Damage/Loss Damage Waiver coverage offered by the car rental company. 8. Incoming bank transfers typically arrive within 1-3 business days (M-F excluding public holidays) when initiated inside Point app. 9. Covers foreign merchant transaction fees at Visa locations outside the United States. *Banking services are provided by Column N.A., member FDIC. “Column” is a registered trademark of Column National Association. Point Up Inc. © 2022 All Rights Reserved. Benefits are subject to terms, conditions and limitations, including limitations on the amount of coverage. Please refer to terms for additional details.

Top Reviews

By thekaylamoore

Banking Done Right

Just started using Point Bank a few weeks ago & I am amazed! Everything about the app & website is so beautifully designed & straight forward. Their reward system is legit & one of the best I’ve ever seen with mobile banking. In addition, you can’t beat the APY %. Communication is outstanding & current with the generation we’re in. I had one issue in creating my account, the app gave me the number to text to seek help & in no time, issue was resolved. If they keep this up, they can count on me being a customer of their’s for life. The only criticism I have is making “mobile check deposit” an option for adding money to the account & add more partners to receive discounts on.

By Ryan & Sarah (NYC->SF)

Wow, finally a 21st century banking and payment experience

So happy to have Point as my bank and primary payment card. They’ve built a great debit experience WITH POINTS. It’s nice to finally have a bank that’s working with me instead of supporting the big corporate greed monsters like chase, wells, Citi, etc. Great customer service on the rare occasion I need something too. And holy cow it’s an incredible UI and design. 10 stars if I could and I can’t wait to see what else they build. Ps - virtual cards are awesome. Thanks for building what consumers (like myself) long wanted in a banking and payment app.

By Harrison Wieland

Great start!

The core message and value of this app is right on! I would just love a bit more polish in a few areas. 1. Starting with the splash screen, instead of flashing bright white, keep with the dark theme. 2. Have pending/cancelled transactions disappear/drop off from transaction history to help keep the history clean and efficient. 3. Chat functionality built into the app, even if it’s not instant. 4. Apple Pay! Also, I’m not sure if it’s a bug, but I haven’t been getting push notifications for transactions. Keep up the great work :)