Peak Money - Savings Goals Software

Company Name: Peak Financial, LLC

About: PEAK (peakaccount.com) is one of the leading online accounting solution provider in Thailand.

Headquarters: Bangkok, Krung Thep, Thailand.

Peak Money Overview

What is Peak Money?

The Peak Savings Account is a free app that helps users save money and become more confident with their finances. It offers a 0.25% annual return, which is over 4x the national average. Users can set up savings goals, track their progress, and celebrate their achievements. The app also offers a premium version with additional features for a fee.

Features

- Free savings account with a 0.25% annual return

- Set up savings goals with a digital peak for each one

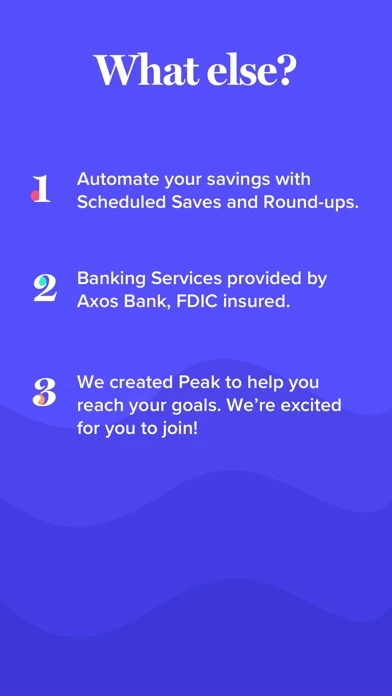

- Choose an automated savings plan (Scheduled Saves or Round-Ups) for each peak

- Monitor progress and make necessary adjustments

- Premium version with personalized insights and advanced, custom actions

- Premium version costs $5 per month or $50 per year

- Real bank account with FDIC insurance up to $250,000

- Can save for any goal, such as emergency funds, a new car, down payment on a house, or travel/vacations.

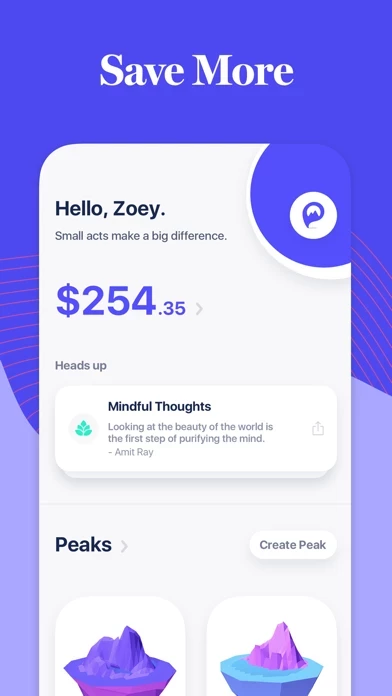

Official Screenshots

Product Details and Description of

Save more and become more confident with your money, with a Peak Savings Account. It’s FREE and includes a 0.25% annual return— over 4x the national average! [1] -- USING PEAK -- 1. Choose your peaks: Set up your savings goals—name, amount, and due-date—with a digital peak for each one. 2. Plan your climb: Choose an automated Savings Plan (Scheduled Saves or Round-Ups) for each peak. 3. Track your progress: Monitor your results and make necessary adjustments. 4. Celebrate & Repeat: Reach your destination, celebrate, and repeat with confidence. -- ALL NEW: PEAK PREMIUM -- The core Peak experience is still 100% free: set as many goals as you want, and make progress toward your goals automatically, with Scheduled Saves and Round-ups. Want to take your savings to the next level? We now offer Peak Premium, which includes all of these features, plus: + Understand your spending with personalized Insights: See all of your transactions in one place and get a clear picture of where you’re spending. + Get more ways to save with advanced, custom Actions: Connect automatic saves to your everyday transactions—like getting paid or buying coffee at your favorite shop. Premium is $5 per month or $50 per year, and you can cancel at any time. So what are you waiting for? Whether you’re saving for a sunny beach trip or a rainy day fund, download Peak and start the path to reaching your goals today. -- FAQs -- Does Peak move my money? — Yes! Peak is a real bank account, so you’re actually putting money aside toward your goals. Is my money safe and secure with Peak? — Absolutely. This is our top priority. Everything you save with Peak is not only protected by bank-level security, but is insured by the FDIC up to $250,000. How much does Peak cost? — It’s free! Peak Premium is a completely optional buy-up, which costs $5 per month, or $50 per year. What kind of goals can I use Peak to save for? — Anything you want! The most common goals on Peak are: Emergency Funds, New Car, Down Payment on a House, and Travel / Trips / Vacations. If you have any questions, please shoot us a message at hello@this app.com! [1] National Average Interest Rate for Savings Accounts, as of March 2021, via the FDIC: https://www.fdic.gov/regulations/resources/rates/

Top Reviews

By Ryguyglover

Mindful Saving Meets Beautiful Design

Can’t say enough positive things about Peak. What I maybe like most is the intentionality it places around saving. “Saving” is a pretty loaded buzzword. People tell you that you should be saving your money, etc, but, to me, it’s always felt like a fairly vague term. Saving for what exactly?? When you’re saving just to say you’re saving, that’s when it gets easy to justify the 4 dollar coffee or the 7 dollar beer. Because you’re not saving for anything tangible or specific, so it doesn’t feel real. With Peak, it’s the exact opposite. You set specific savings goals for yourself (a vacation, an item you’ve always wanted, an engagement ring, whatever) and you can very clearly track your progress in reaching those goals. Not to mention, it’s probably the most beautifully designed money saving app on the market. Period. All in all, very happy with Peak and would highly recommend.

By tcstaffordd

You can feel the human behind the app

This app will help you save money. It’s a simple, but refreshingly well-made app that brings compelling visuals to your savings goals. I downloaded Peak on a whim, but I’m so happy I did. I check Peak everyday, even just to glance at my mountains for a moment. You can customize each peak for a savings goal in mind; and then you decide whether you want to save automatically (weekly, monthly, etc.) or deposit funds at your own pace. You can have meticulous control over how you save - or you can let Peak do the savings for you. The best part is you can customize how much and how often you want saved for each peak. I’ve already decided I’ll use Peak to help save each year for Christmas. Y’all this app is great in every way. It greets you with an inspiring message every time you open it. Peak also has a breathing exercise, so you can save and find your center all at the same time. The people behind this app are amazing and they really care about their users. They were in the fitness world and have made Peak their passion project. In other words, they care about you and are serious about helping you save. I’ve looked for money saving apps in the past, and have tried many. Peak is leaps and bounds ahead of them all.

By rowdy104

Great app for personal savings goals

This is such a great app. What it’s really good for is micro savings goals. At first I didn’t know exactly how it could be helpful for my wife and I because we have a joint checking account that we pay everything out of and we didn’t want to siphon off money all the time to these other accounts, and we also don’t have all the same savings goals. Then we decided to set up our own personal checking accounts and give ourself an “allowance” every month in those accounts. Now we both have peak connected to our own accounts and it’s really helping us control our individual discretionary spending. I am saving for a golf trip next year and have realized I better stop buying a cup of coffee every morning and things like that. Really super helpful accountability. Five stars.