BabySteps: Hit Financial Goals Software

Company Name: The Lampo Group Incorporated

About: A new concept for the beginning of the process of children learning 0-5 years.

Headquarters: , , .

Ba Overview

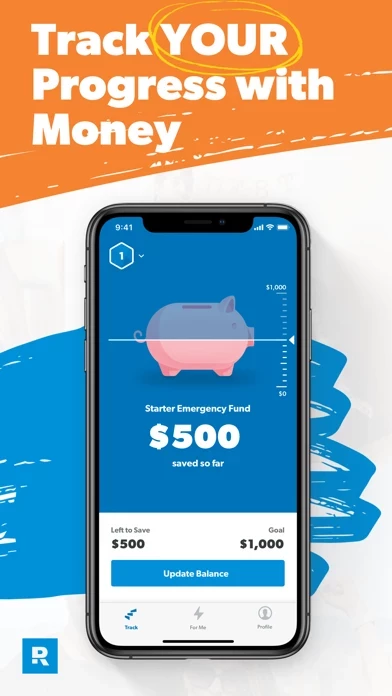

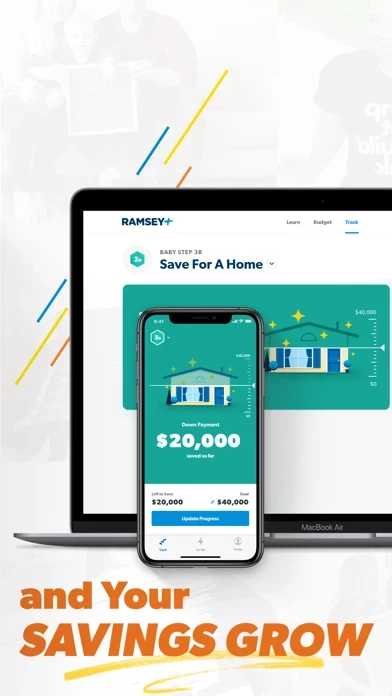

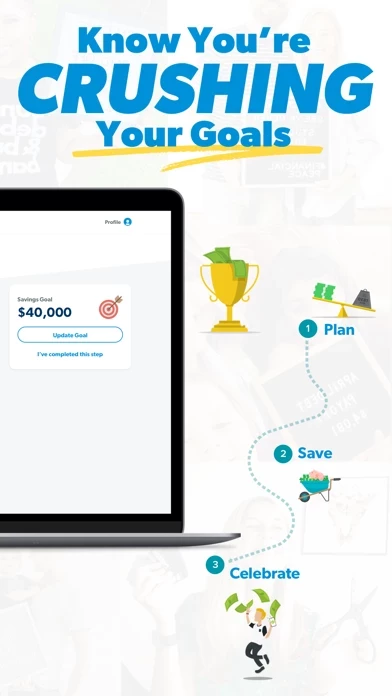

What is Ba? The BabySteps app is a financial management app that helps users pay off their debts, build an emergency fund, save for a down payment on a home, and invest for their future. The app follows Dave Ramsey's 7 Baby Steps, which is a step-by-step playbook that has helped millions of people achieve their financial goals. The app tracks all payments in one place and uses the powerful debt snowball method to take them out one by one. The app is available to Ramsey+ members, which also includes access to EveryDollar and FinancialPeace.

Features

- Follow Dave Ramsey's 7 Baby Steps

- Track which Baby Step you're on

- Work the Baby Steps to pay off debt, save for emergencies, and build wealth

- Track debt payments using the debt snowball method

- Discover the date you'll be debt-free

- Pay off one debt at a time, smallest to largest

- Find out how much faster you can be debt-free by adding extra money to your monthly payments

- Throw a digital snowball at your debt every time you make a payment

- Get tips on how to save money faster and establish an emergency fund

- Flip digital coins into your piggy bank

- Watch your savings account grow

- Watch in-app coaching from finance experts, including Dave Ramsey, Rachel Cruze, Chris Hogan, and Ken Coleman

- Track progress on both desktop and mobile

- Sync with EveryDollar budget to update debt snowball in real-time

- Privacy Policy and Terms of Use are available for users to review.

Official Screenshots

Product Details and Description of

Paying off debt doesn’t have to take as long as you think! It’s time to take your money back—and the this app app shows you the fastest way to do it. Got some credit cards? What about student loans or car payments? (Maybe you’ve got a little bit of everything.) Hey, that’s most people. But you don’t want to be “most people.” With the this app app, you’ll track all your payments in one place and take them out one by one using the powerful debt snowball. But once those debts are history, what’s next? Your money is finally freed up to do what YOU want it to. And the this app app helps you track your money for the long haul. You’ll work through Dave Ramsey’s 7 Baby Steps, the step-by-step playbook with money that’s helped millions go from “I can’t do this” to “I just did that!” Pay off debt. Build an emergency fund. Save for a down payment on a home. Invest for your future. Watch your confidence with money grow as you reach one goal after another. TRY RAMSEY+ TO GET THE APP So, first things first. To access this app, you’ll need to be a member of Ramsey+. (SmartDollar members—you’re already good to go!) Wait, why not just the this app app? Well, if you want to hit a big money goal (like paying off debt), tracking your progress is just one part. You’ve got to tackle your mindset AND your habits. That’s where Ramsey+ comes in. All three of our apps work together to help you make better choices with money every single day. All those small wins add up to BIG results in your bank account and better habits that get you to your goals faster. You also get access to: • EveryDollar – Take control of your spending so you can put more money toward your goals with our easy-to-use budgeting app. • FinancialPeace – Learn the practical know-how about saving, paying off debt, and building wealth you can start putting into practice TODAY. Not a member of Ramsey+ yet? No problem. Start your FREE TRIAL at ramseyplus.com. KEY APP FEATURES Follow our simple money plan: • Learn Dave Ramsey’s 7 Baby Steps. • Find out which Baby Step you’re on. • Work the Baby Steps to pay off debt, save for emergencies, and build wealth. Track your debt payments using the debt snowball method: • Discover the date you’ll be totally debt-free. • Pay off one debt at a time, smallest to largest. • Find out how much faster you can be debt-free by adding extra money to your monthly payments. • Throw a digital snowball at your debt every time you make a payment. Boom. It feels good to hit back. Track your savings: • Get tips on how to save money faster and establish an emergency fund. • Flip some digital coins into your piggy bank. Literally. • Watch your savings account grow—along with your motivation. Watch in-app coaching from finance experts: • Dave Ramsey lays out the facts about debt and saving. • Rachel Cruze gives budgeting tips to reach your goals faster. • Chris Hogan shows you why an emergency fund is a must-have. • Ken Coleman dishes out career advice that works at every Baby Step. Take the app anywhere: • Track your progress on both desktop and mobile. • Sync with your EveryDollar budget to update your debt snowball in real time. Privacy Policy: https://policies.ramseysolutions.net/privacy-policy Terms of Use: https://policies.ramseysolutions.net/terms-of-use

Top Reviews

By Bobby&People

Inspiring App that works!

Our family can’t live without this app as we go along with the baby step process! It’s fun, informative and inspires us every time we open it.

By Wolfforce1

Breath of Fresh Air

I was losing motivation and falling off track. This app helped to reenergize my financial journey & give me hope again!

By BVerrico83

Baby Steps - Making Strides

The Dave Ramsey Company, their tools and resources are a must have!!! This is a new app but I love the reasoning and purpose of it. . .