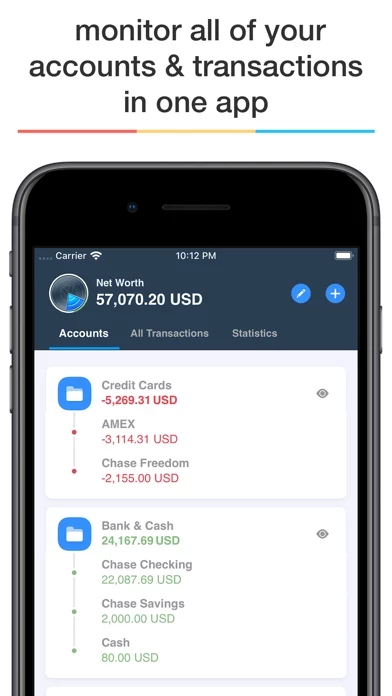

- Worldwide online banking support with automatic transaction categorization and access to over 18,000 banks in over 70 countries

- Crypto, forex, and stock trading investment accounts with automatic trades sync

- Cross-platform sync with native apps for your desktop and mobile

- Manual transaction entry & bank statement import for those who prefer to do manual bookkeeping

- Powerful budgets, transaction scheduling, financial forecasts, and reporting

- Translated into more than 20 languages, support for all world currencies, multi-level custom categories, and over 600 features

- Online banking feature that automatically downloads and categorizes transactions from your checking, credit card, savings, investment, forex, and crypto accounts

- Proprietary AI algorithms that learn from your changes to improve auto-categorization

- Ability to enter manual transactions with ease and import transactions in form of CSV, QIF, OFX, QFX, and MT940 files

- Cross-device sync with SYNCbits syncing service that allows for offline use and automatically detects internet connection to sync any changes made while offline

- Privacy-oriented approach with optional use of online services that are protected with the best safeguards and encryption methods available

- Local data can be locked down with a PIN code (supported by fingerprint or facial authentication)

- Dedicated support team that is frequently mentioned in positive reviews

- Two options for purchase: MoneyWiz Premium (subscription that enables everything on all devices) and MoneyWiz Standard (one-time payment that enables SYNCbits but not online banking)

- Automatic renewal of subscriptions each month or year (depending on plan) with the ability to turn off auto-renew at any time from your iTunes account settings.