How to Cancel Green Dot

Published by Green Dot Corporation on 2024-02-20We have made it super easy to cancel Green Dot - Mobile Banking subscription

at the root to avoid any and all mediums "Green Dot Corporation" (the developer) uses to bill you.

Complete Guide to Canceling Green Dot - Mobile Banking

A few things to note and do before cancelling:

- The developer of Green Dot is Green Dot Corporation and all inquiries must go to them.

- Check the Terms of Services and/or Privacy policy of Green Dot Corporation to know if they support self-serve subscription cancellation:

- Cancelling a subscription during a free trial may result in losing a free trial account.

- You must always cancel a subscription at least 24 hours before the trial period ends.

How easy is it to cancel or delete Green Dot?

It is Very Easy to Cancel a Green Dot subscription. (**Crowdsourced from Green Dot and Justuseapp users)

If you haven't rated Green Dot cancellation policy yet, Rate it here →.

Potential Savings

**Pricing data is based on average subscription prices reported by Justuseapp.com users..

| Duration | Amount (USD) |

|---|---|

| Monthly Subscription | $15.35 |

How to Cancel Green Dot - Mobile Banking Subscription on iPhone or iPad:

- Open Settings » ~Your name~ » and click "Subscriptions".

- Click the Green Dot (subscription) you want to review.

- Click Cancel.

How to Cancel Green Dot - Mobile Banking Subscription on Android Device:

- Open your Google Play Store app.

- Click on Menu » "Subscriptions".

- Tap on Green Dot - Mobile Banking (subscription you wish to cancel)

- Click "Cancel Subscription".

How do I remove my Card from Green Dot?

Removing card details from Green Dot if you subscribed directly is very tricky. Very few websites allow you to remove your card details. So you will have to make do with some few tricks before and after subscribing on websites in the future.

Before Signing up or Subscribing:

- Create an account on Justuseapp. signup here →

- Create upto 4 Virtual Debit Cards - this will act as a VPN for you bank account and prevent apps like Green Dot from billing you to eternity.

- Fund your Justuseapp Cards using your real card.

- Signup on Green Dot - Mobile Banking or any other website using your Justuseapp card.

- Cancel the Green Dot subscription directly from your Justuseapp dashboard.

- To learn more how this all works, Visit here →.

How to Cancel Green Dot - Mobile Banking Subscription on a Mac computer:

- Goto your Mac AppStore, Click ~Your name~ (bottom sidebar).

- Click "View Information" and sign in if asked to.

- Scroll down on the next page shown to you until you see the "Subscriptions" tab then click on "Manage".

- Click "Edit" beside the Green Dot - Mobile Banking app and then click on "Cancel Subscription".

What to do if you Subscribed directly on Green Dot's Website:

- Reach out to Green Dot Corporation here »»

- Visit Green Dot website: Click to visit .

- Login to your account.

- In the menu section, look for any of the following: "Billing", "Subscription", "Payment", "Manage account", "Settings".

- Click the link, then follow the prompts to cancel your subscription.

How to Cancel Green Dot - Mobile Banking Subscription on Paypal:

To cancel your Green Dot subscription on PayPal, do the following:

- Login to www.paypal.com .

- Click "Settings" » "Payments".

- Next, click on "Manage Automatic Payments" in the Automatic Payments dashboard.

- You'll see a list of merchants you've subscribed to. Click on "Green Dot - Mobile Banking" or "Green Dot Corporation" to cancel.

How to delete Green Dot account:

- Reach out directly to Green Dot via Justuseapp. Get all Contact details →

- Send an email to [email protected] Click to email requesting that they delete your account.

Delete Green Dot - Mobile Banking from iPhone:

- On your homescreen, Tap and hold Green Dot - Mobile Banking until it starts shaking.

- Once it starts to shake, you'll see an X Mark at the top of the app icon.

- Click on that X to delete the Green Dot - Mobile Banking app.

Delete Green Dot - Mobile Banking from Android:

- Open your GooglePlay app and goto the menu.

- Click "My Apps and Games" » then "Installed".

- Choose Green Dot - Mobile Banking, » then click "Uninstall".

Have a Problem with Green Dot - Mobile Banking? Report Issue

Leave a comment:

Reviews & Common Issues: 2 Comments

By kyler cole

3 years agoHello, kindly contact them via their fast response service at : Greendotbank @ representative . com

By David DeRocker

3 years agoI want to uninstall the Green Dot banking app.

What is Green Dot - Mobile Banking?

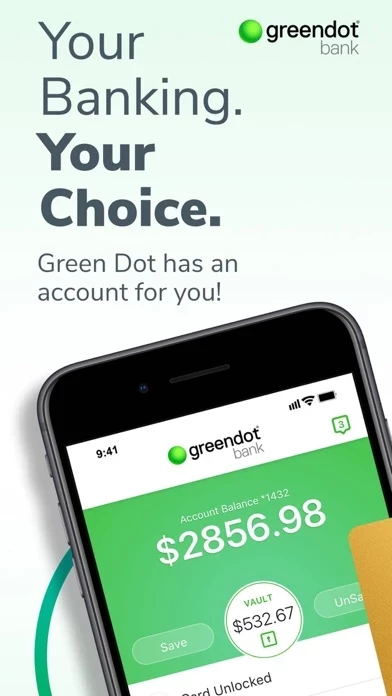

Enjoy a range of features across our collection of Green Dot cards including: • Get your pay up to 2 days early and government benefits up to 4 days early with early direct deposit¹ • Send money & pay bills™² • Deposit cash using the app³ • Enjoy no minimum balance requirement Additional features available across select Green Dot cards: • Access a free ATM network. Limits apply.⁷ • Overdraft protection up to $200 with opt-in & eligible direct deposit⁴ • Earn 2% cash back on online and mobile purchases⁵ • Save up money in the Green Dot High-Yield Savings Account and earn 2% annual interest (APY) on money in savings – 20X higher than the national average, up to a $10,000 balance!⁶ Easily manage any Green Dot Bank account at any time. This app allows you to… • Register/activate a new card • View balance and transaction history and see other account information • Lock/Unlock feature • Deposit checks from your mobile phone • Works with mobile payment options including Apple Pay • Set up account alerts • Access chat customer support Want to know more? Visit this app.com today. Not a gift card. Must be 18 or older to purchase. Activation requires online access, mobile number and identity verification (including SSN) to open an account and access all features. Activated, personalized card required to access some features. ¹ Direct Deposit early availability depends on timing of payor’s payment instructions and fraud prevention restrictions may apply. As such, the...