You must file an amended return with another paid tax preparation company and/or online provider by April 15, 2021 and submit your claim no later than October 15, 2021 with proof that the IRS accepted the positions taken on the amended return.

If you are entitled to a larger refund, we’ll refund the tax preparation fees paid to us for that filed return (other product and service fees excluded) and give you an additional $100.

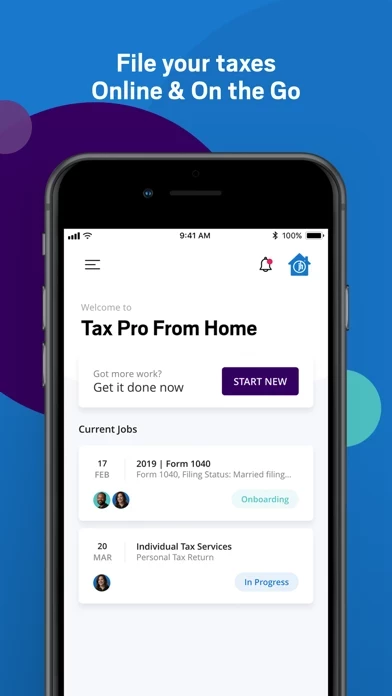

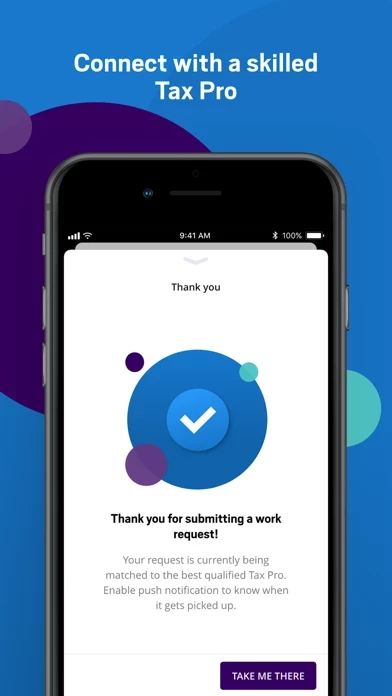

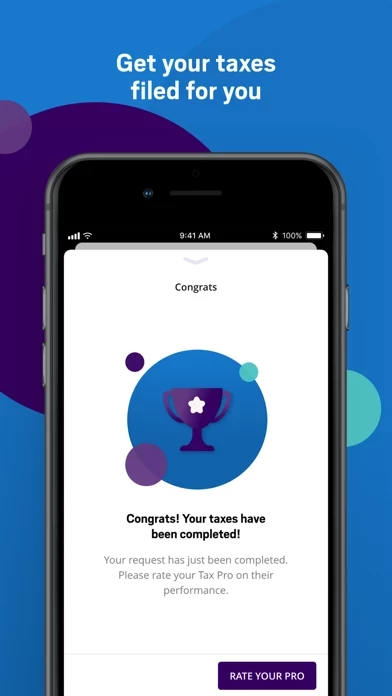

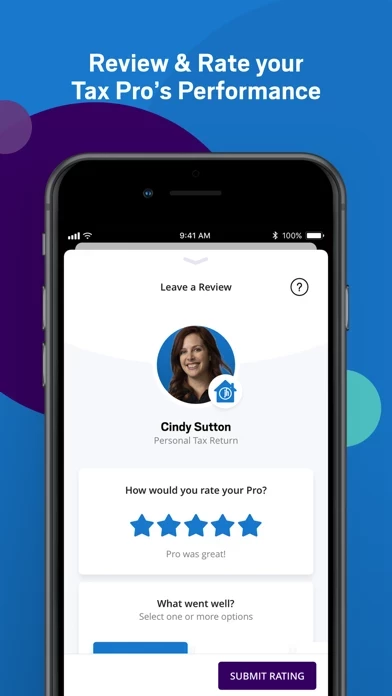

And after a year of changes, why take chances? With Jackson Hewitt®’s Tax Pro From Home, you can rely on our skilled Tax Pros to take care of your return for you, all from the comfort and convenience of your own home.

Once you create an account and answer a few questions, you’ll get a transparent upfront price quote based on your tax situation.

And if you want instant notifications of the status of your return, you can download our free Jackson Hewitt Tax From Home app from your mobile device’s app store.