- Direct Access service that connects to over 14,000 banks worldwide and automatically delivers the latest transaction data to your Mac

- Set-up assistant that imports old data and downloads current transactions from bank accounts online

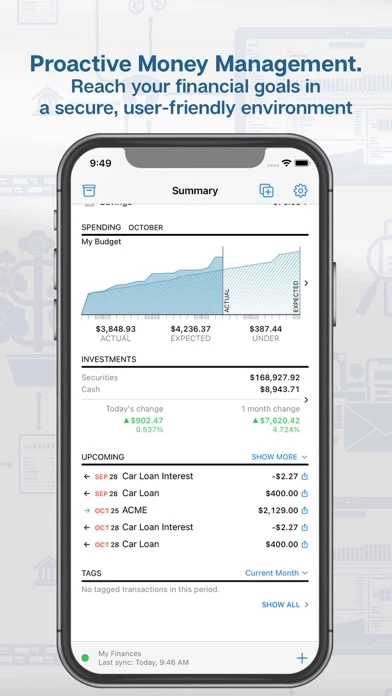

- Holistic view of finances, including checking accounts, savings, credit cards, real estate, mortgages, investments, and budgets

- Tools for tracking, categorizing, tagging, reconciling, and managing every transaction, including online bill pay

- Transaction templates that simplify the process of updating accounts

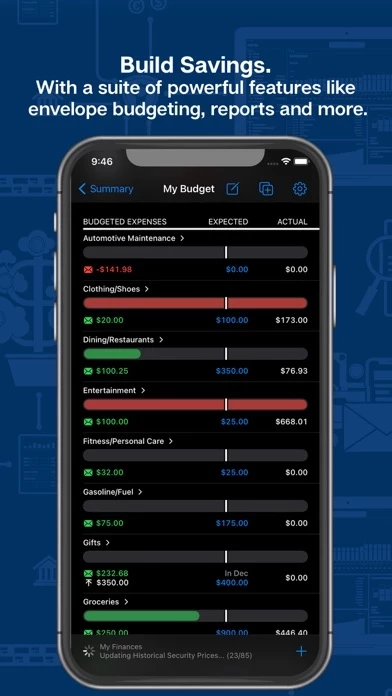

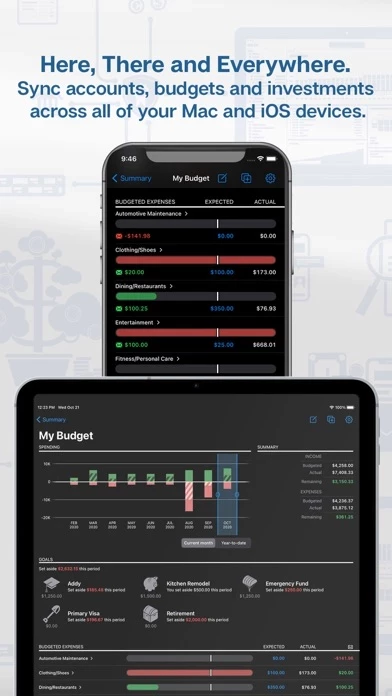

- Budgeting tools that help set saving and proactive spending goals, including Envelope Budgeting that assigns money to different categories

- Automatic budgeting of scheduled transactions like paychecks and bills

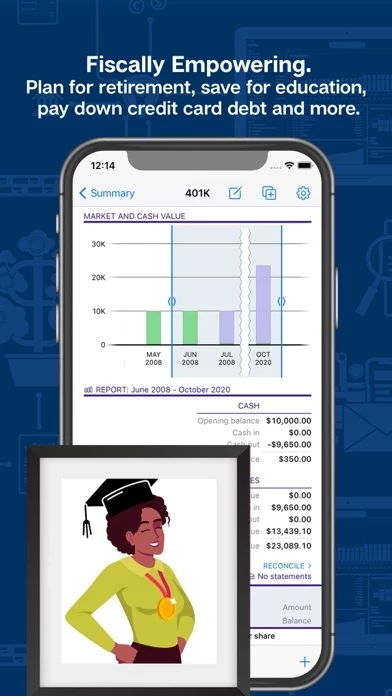

- Investment features that manage stocks, bonds, mutual funds, IRAs, 401Ks, CDs, and other assets, including tracking buys, sells, splits, dividends, options, and more

- Built-in report templates that dynamically analyze finances, including Income & Expense, Net Worth, Payee Summary, Tax reports, Portfolio, and Investment Summary reports

- Mobile app for entering transactions on the go and syncing accounts, budgets, and investments

- Unlimited email support, live chat, built-in Help files, a searchable Knowledge Base, and video tutorials.