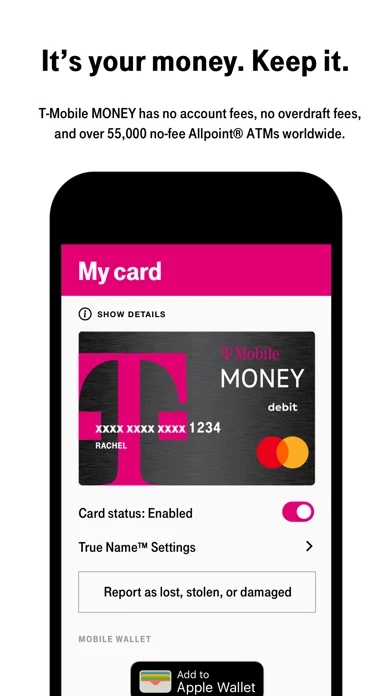

- No account fees, no overdraft fees, and no minimum balances

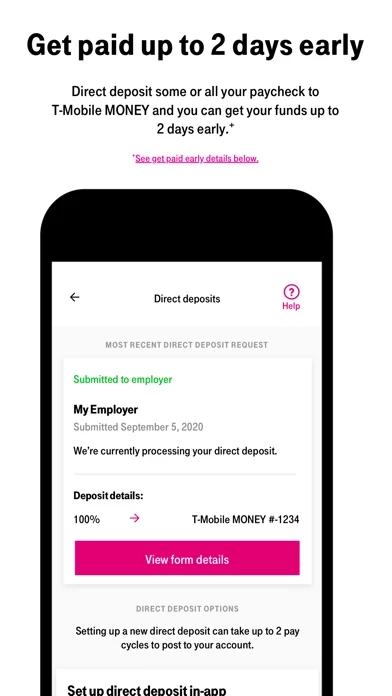

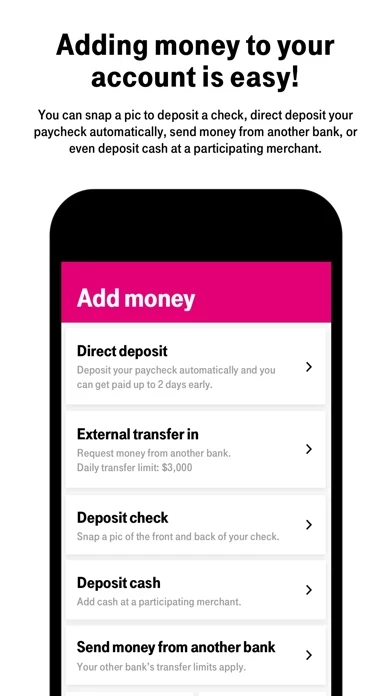

- Direct deposit to receive your paycheck up to 2 days sooner

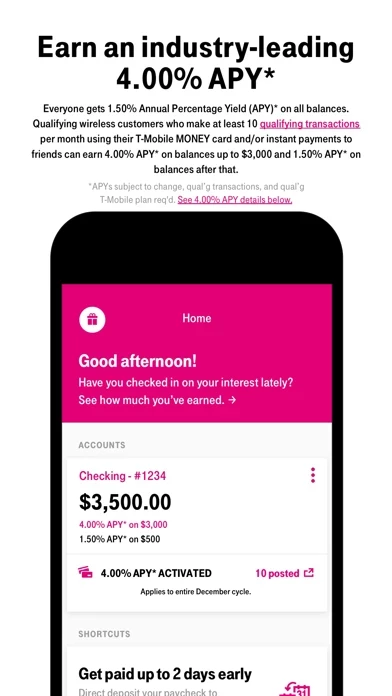

- Earn 1.50% Annual Percentage Yield (APY) on all checking and savings account balances

- Send instant payments to other MONEY customers without fees

- Withdraw cash at 55k no-fee AllPoint® ATMs

- Make purchases with a personalized debit card or enable Apple Pay for mobile payments

- Deposit checks on your phone or add cash at select merchants (third-party fees may apply)

- Pay bills: pay by check or set up recurring transfers

- Talk to T-Mobile MONEY specialists every day of the year, with help available in Spanish

- Anyone can apply, not just T-Mobile wireless customers

- Stay connected to your money with transaction and balance notifications

- Easily transfer money to and from your external accounts

- Temporarily disable your debit card from your phone or browser if lost or stolen

- Prevent unauthorized account access with multi-factor authentication and biometric login

- Accounts are FDIC-insured up to $250,000

- Zero Liability Protection from Mastercard® for protection against fraud.