Starship - Health Savings Software

Company Name: Brighter Financial, Inc.

About: Brighter Investment Invest in the brightest students in developing countries. Students earn a degree

and investors an attractive return.

Headquarters: Vancouver, British Columbia, Canada.

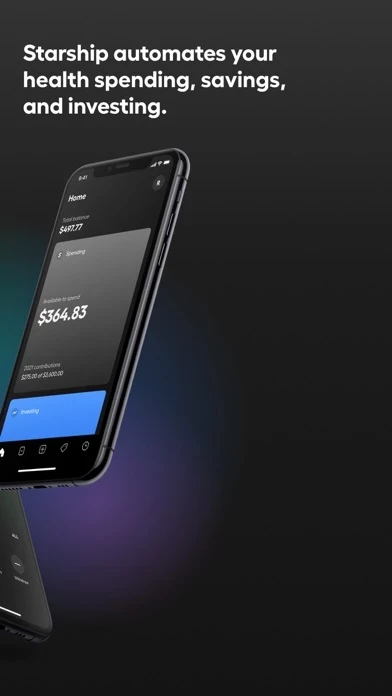

Starship Overview

What is Starship? Starship is a financial technology company that offers a modern approach to health savings. It provides a triple tax break, no hidden fees, and automatic investing to help individuals and families plan for their future health. Starship is not a bank, but it offers banking services provided by nbkc bank, Member FDIC.

Features

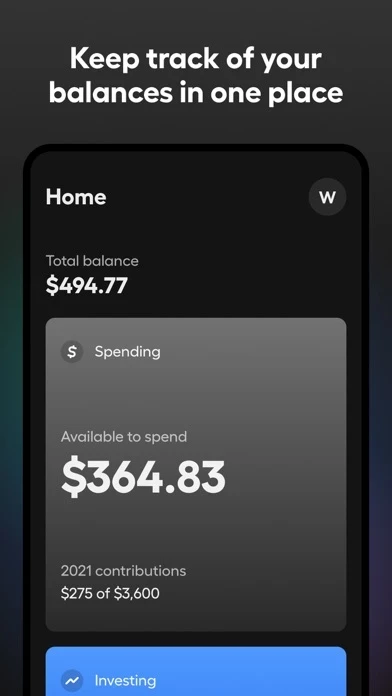

- Save: Users can save for everyday health expenses like dental, vision, health emergencies, and more while avoiding hidden banking fees. They can save for themselves or their entire family.

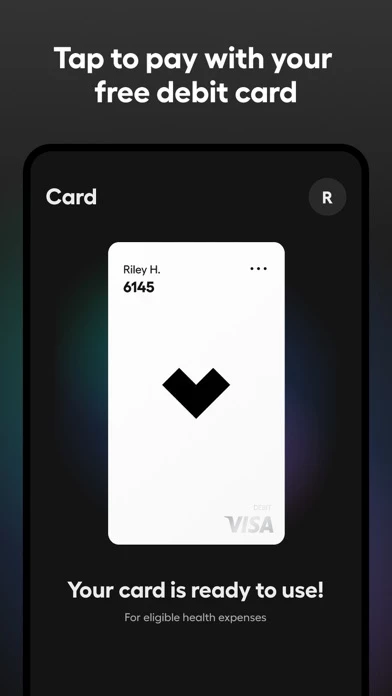

- Spend: Users can order a free Starship Visa® Debit Card from the app and use it to make eligible health purchases in-store and online. They can also add their card to Apple Pay.

- Invest: Users can auto-invest in their future health by building a portfolio of diverse ETFs based on their risk level. This can help fast-track retirement with more financial security.

- Health savings simplified: Starship offers modern tools and services to help new users navigate health savings.

- Triple tax break: Users can get tax breaks on contributions, investment growth, and health-related purchases.

- No hidden fees: Starship has no overdraft fees, withdrawal fees, or minimum balance fees.

- Safe and secure: Starship prioritizes user security and sends transaction alerts when users turn on notifications.

- Pay yourself back: Users can easily withdraw funds for money spent on out-of-pocket health purchases.

- Support: Users can reach out to [email protected] or chat with the team in the app for personalized guidance and knowledge on how to make the most of their health savings.

Official Screenshots

Product Details and Description of

With a triple tax break, no hidden fees, and automatic investing, this app is empowering 100,000+ individuals and families to plan for their future health. this app is a financial technology company, not a bank. Banking services provided by nbkc bank, Member FDIC. How it works: • Save - Save for everyday health expenses like dental, vision, health emergencies, and much more while avoiding hidden banking fees – for yourself or your entire family. • Spend - Order your free this app Visa® Debit Card directly from the this app app. Swipe, dip, or tap your card to make eligible health purchases in-store and online. Add your card to Apple Pay. • Invest - Auto-invest in your future health. Build a portfolio of diverse ETFs based on your risk level. Better than a 401(k), fast-track retirement with more financial security. Here’s why thousands are saving with this app: HEALTH SAVINGS SIMPLIFIED New to health savings? We have the modern tools and services to help. TRIPLE TAX BREAK Get tax breaks on contributions, investment growth, & health-related purchases. NO HIDDEN FEES Ever. You shouldn’t have to spend money to save it. this app has no overdraft fees, no withdrawal fees, and no minimum balance fees. SAFE & SECURE Your security is our top priority. this app sends you transaction alerts when you turn on notifications, so you know what’s happening with your money. PAY YOURSELF BACK Easily withdraw funds for money spent on out-of-pocket health purchases. SUPPORT Reach out to [email protected] or chat with us in the app. Our team provides personalized guidance and knowledge on how to make the most of your health savings. – this app is a financial technology company, not a bank. Spending Accounts and the this app Visa® Debit Card provided by and issued by nbkc bank, Member FDIC. Balances in your this app Spending Account (“Spending”) earn .01% Annual Percentage Yield (“APY”) on deposit balances $0.01 – $1,999.99 and .04% APY on deposit balances $2,000 and above. We use the Spending Account’s end of day balance to calculate the interest earned that day. The rates are effective as of October 1, 2021, are variable and subject to change after the account is opened. Accounts subject to approval. Any balances you hold with nbkc bank, including but not limited to those balances held in this app accounts are added together and are insured up to $250,000 per depositor through nbkc bank, Member FDIC. nbkc bank utilizes a deposit network service, which means that at any given time, all, none, or a portion of the funds in your this app accounts may be placed into and held beneficially in your name at other depository institutions which are insured by the Federal Deposit Insurance Corporation (FDIC). For a complete list of other depository institutions where funds may be placed, please visit https://www.cambr.com/bank-list. Balances moved to network banks are eligible for FDIC insurance once the funds arrive at a network bank. To learn more about pass-through deposit insurance applicable to your account, please see the Account Documentation. Additional information on FDIC insurance can be found at https://www.fdic.gov/resources/deposit-insurance/. Investing Accounts and investment advisory services offered through this app Securities, LLC, a registered investment adviser. this app Securities, LLC is a wholly-owned subsidiary of Brighter Financial, Inc dba ‘this app’. Brokerage services by DriveWealth LLC, member SIPC. Investing involves risk; investments are not FDIC insured and may lose value. Content presented is not intended as legal, tax, financial or medical advice. It is the member’s responsibility to ensure eligibility requirements for contributions and qualified medical expenses. Always consult a professional tax advisor before making financial decisions with tax implications. For this app terms & conditions, please visit: https://www.starshiphsa.com/terms-conditions/

Top Reviews

By Marc Stud

Super simple to use

I got a new health insurance with higher deductibles and was advised to open up an HSA account as a complementary benefit. this app is so simple to enroll with and love the debit card you get which connects to your spending account. Makes your tax returns much easier to deal with. Looks like I’ll be able to invest my contributions as well. Can’t wait.

By philly_foodie

🙂 The number one HSA!

Signing up for this app only took 4 minutes and it was completely seamless. Once I signed up, I was blown away by the app. The app offers a ton of handy features like overflow investing, auto contribution, receipt capture, and so on. I shopped around and saw that this app offered the highest APY around. Plus the app is completely fee free!

By nicknameus

1000% better than any other benefits program

Just started using this with my employer and LOVE it! Fantastic interface to track my $$ and super easy to spend. Everyone with a high deductible health plan should be using this product.