Porte: Mobile Banking Software

Company Name: Populus Financial Group, Inc

About: Populus Financial Group offers a range of financial products and services delivered through retail

and digital channels.

Headquarters: Irving, Texas, United States.

Porte Overview

What is Porte?

Porte is a mobile finance app that offers a range of features to help you manage your money and secure your financial freedom. With Porte, you can enjoy no monthly account fees, a contactless debit card, virtual cards, charitable giving, and Direct Deposit that pays you up to 2 days faster. You can also open an optional savings account, add money at over 130,000 reload locations, and use Apple Pay. Porte is not a bank, but banking services are provided by MetaBank, N.A., Member FDIC.

Features

- No monthly account fee

- Premium matte black Porte VisaⓇ debit card

- Faster Pay - Get paid up to 2 days faster with Direct Deposit

- Add money at over 130,000 convenient reload locations

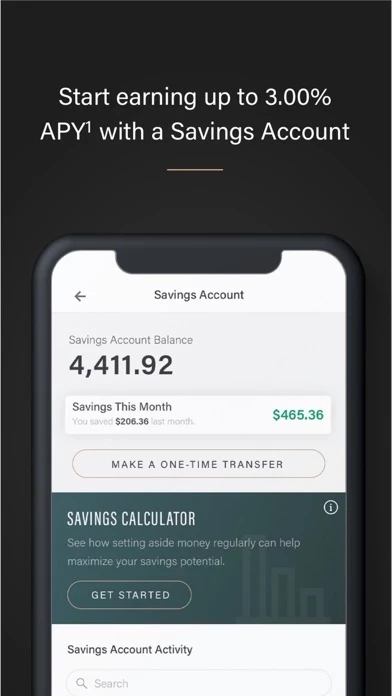

- Open an Optional Savings Account

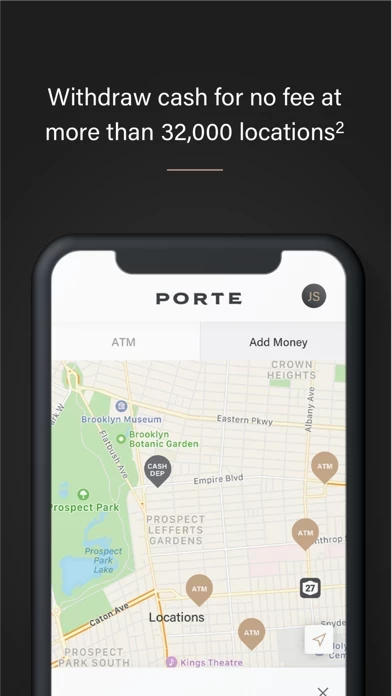

- No ATM fees at over 32,000 MoneyPass® ATMs

- Lock/unlock your card within the app

- Up to 6 virtual cards to secure your online purchases

- Apple Pay®

- Real-time balance notifications

- Support a charity through Porte’s #DoorToChange program

- No charge for this service, but your wireless carrier may charge for messages or data.

Official Screenshots

Product Details and Description of

this app is the mobile finance app built for you. Enjoy no monthly account fees,⁴contactless debit card, virtual cards, charitable giving,⁵ and Direct Deposit that pays you up to 2 days faster.³ Own your money and your future with this app. Some of the many reasons why this app should be your first choice: • No monthly account fee⁴ • Premium matte black this app VisaⓇ debit card • Faster Pay - Get paid up to 2 days faster with Direct Deposit³ • Got cash? Add money at over 130,000 convenient reload locations⁶ • Open an Optional Savings Account¹ • No ATM fees at over 32,000 MoneyPass® ATMs² • Lock/unlock your card within the app • Up to 6 virtual cards to secure your online purchases • Apple Pay® • Real-time balance notifications⁷ • Support a charity through this app’s #DoorToChange⁵ program Download today and get ready to secure your financial freedom. For California residents, go to https://www.portebanking.com/privacy/ca/ to learn what personal information we collect and how it is used. ¹ Qualifications for the this app Savings Account are changing. Go to https://content.portebanking.com/uploads/disclaimers/savings-disclosure.pdf for more information about the changes taking effect on 1/1/2022. No minimum balance to open an optional Savings Account. To open a Savings Account, consent to receive communications from us in electronic form is required. Savings Account funds are withdrawn through your this app Account (maximum 6 such transfers per calendar month). The Savings Account linked with your this app Account is made available to Accountholders through Metabank, N.A., Member FDIC. Funds on deposit are FDIC insured through MetaBank, N.A. For purposes of FDIC coverage, all funds held on deposit by you at MetaBank, N.A., will be aggregated up to the coverage limit, currently $250,000.00. ² No ATM owner surcharge or ATM Cash Withdrawal Fees for domestic ATM withdrawals at MoneyPass® ATMs (“in-network ATMs”). Visit the this app Mobile App for a list of in-network ATMs. All other ATMs may apply an owner’s surcharge fee in addition to the ATM Cash Withdrawal Fee disclosed in your Deposit Account Agreement. Balance Inquiry Fees apply. ³ Based on comparison of our ACH processing policy vs. posting funds at settlement. ⁴ Other fees may apply. See your Deposit Account Agreement for details. ⁵ After selecting a charity through your Mobile App, Populus will donate an amount equal to 0.05% of every debit card purchase transaction, subject to certain terms and conditions, made with your this app Debit Card to a charity selected by you through the Mobile App. Netspend, MetaBank, N.A., and Visa are not affiliated in any way with this offer and do not endorse or sponsor this offer. ⁶ Fee may be assessed by reload location and may vary from location to location. ⁷ No charge for this service, but your wireless carrier may charge for messages or data. this app is a mobile finance app, not a bank. Banking services provided by MetaBank,® N.A., Member FDIC. this app is a deposit account established by MetaBank®, National Association, Member FDIC. Certain products and services may be licensed under U.S. Patent Nos. 6,000,608 and 6,189,787.

Top Reviews

By Picky Emily

Best mobile banking start

Downloading and setting up the account was super easy. The interface seems very user friendly with many features you don’t see in other products. Transferring savings balances over to my new this app account with these rates- you can’t beat them. Look forward to exploring more of the product as it becomes my primary source for spending in all retail and online spaces.

By AlltheLiveMusic

🖤🖤🖤

I saw the 3% savings in an ad on my feed. I was skeptical at first but I read up on it and I love the look of the app, so I am giving it a shot. I also like that they donate to charities on my behalf, that’s a great perk. They just launched it recently and are taking feedback, so I gave them some and look forward to future enhancements. Also love the card, very chic and safe since you can tap to pay!

By KateGracie

My New Bank!

I’ve tried other mobile banks like Chime and Varo but they were a bit gimmicky. this app is something special. It’s got a super sleek interface, a savings account with the highest interest rate I’ve seen, and every time I make a purchase, I know I’m supporting a good cause! Also, through the this app Perks program, I can get cash back at stores I already shop at. Highly recommended!