- Automated and intuitive platform for building and managing wealth

- Smart Transfers for automating finances and long-term investing

- Investing in cryptocurrencies, including BTC and ETH

- Individual, joint, trust, or custodial account options

- Traditional, SEP, or Roth IRA or rollover a 401(k) options

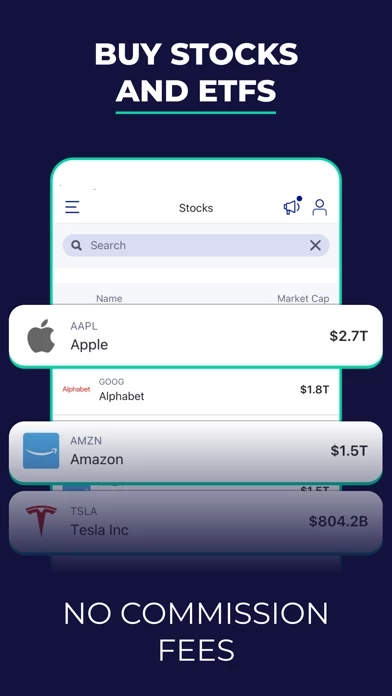

- Intuitive Pies interface for choosing stocks and ETFs

- Pre-built Expert Pies for investing according to values, risk tolerance, retirement plans, and more

- Fractional shares for investing as little as one dollar

- One-click rebalancing for ensuring investments match goals

- M1 Plus membership for exclusive features and perks

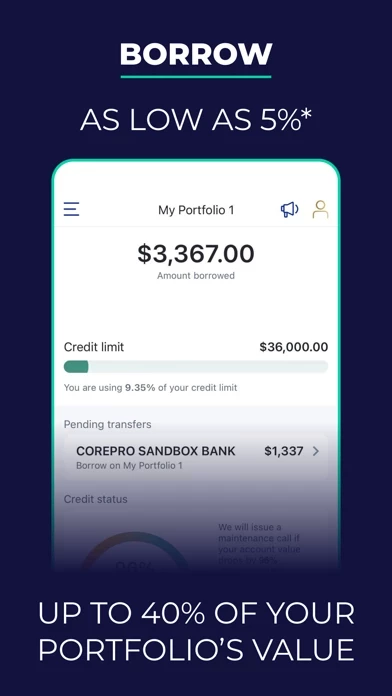

- Borrow against investments with rates from 5%-6.5%

- M1 Spend checking accounts with 2.50% APY and 1% cash back for M1 Plus members

- Owner's Rewards Card for earning cash back on eligible M1 Invest portfolio purchases and everywhere else

- Account protection with SIPC and FDIC insurance

- Must be 18+ and US resident to open an account

- Brokerage products and services are not FDIC insured, not bank guaranteed, and may lose value

- Investing in cryptocurrency comes with significant risk. Cryptocurrencies are not FDIC or SIPC insured.