How to Cancel Mint

Published by Mint.com on 2023-12-20We have made it super easy to cancel Mint: Budget & Expense Manager subscription

at the root to avoid any and all mediums "Mint.com" (the developer) uses to bill you.

Complete Guide to Canceling Mint: Budget & Expense Manager

A few things to note and do before cancelling:

- The developer of Mint is Mint.com and all inquiries must go to them.

- Check the Terms of Services and/or Privacy policy of Mint.com to know if they support self-serve subscription cancellation:

- Cancelling a subscription during a free trial may result in losing a free trial account.

- You must always cancel a subscription at least 24 hours before the trial period ends.

Pricing Plans

**Gotten from publicly available data and the appstores.

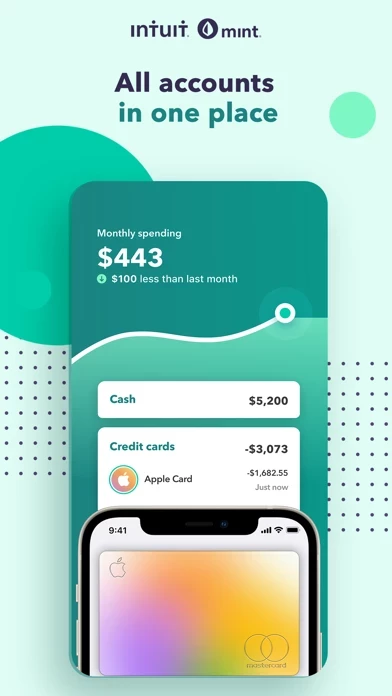

Mint offers a free subscription that includes personalized insights, custom budgets, spend tracking, and subscription monitoring. Mint also offers a premium feature enabling subscription cancellation and a new feature called Billshark bill negotiation that could help you save on your monthly bills. Mint is part of a suite of financial tools that include TurboTax, QuickBooks, QuickBooks Self-Employed, and ProConnect. Mint currently connects to US and Canadian financial institutions only.

How to Cancel Mint: Budget & Expense Manager Subscription on iPhone or iPad:

- Open Settings » ~Your name~ » and click "Subscriptions".

- Click the Mint (subscription) you want to review.

- Click Cancel.

How to Cancel Mint: Budget & Expense Manager Subscription on Android Device:

- Open your Google Play Store app.

- Click on Menu » "Subscriptions".

- Tap on Mint: Budget & Expense Manager (subscription you wish to cancel)

- Click "Cancel Subscription".

How do I remove my Card from Mint?

Removing card details from Mint if you subscribed directly is very tricky. Very few websites allow you to remove your card details. So you will have to make do with some few tricks before and after subscribing on websites in the future.

Before Signing up or Subscribing:

- Create an account on Justuseapp. signup here →

- Create upto 4 Virtual Debit Cards - this will act as a VPN for you bank account and prevent apps like Mint from billing you to eternity.

- Fund your Justuseapp Cards using your real card.

- Signup on Mint: Budget & Expense Manager or any other website using your Justuseapp card.

- Cancel the Mint subscription directly from your Justuseapp dashboard.

- To learn more how this all works, Visit here →.

How to Cancel Mint: Budget & Expense Manager Subscription on a Mac computer:

- Goto your Mac AppStore, Click ~Your name~ (bottom sidebar).

- Click "View Information" and sign in if asked to.

- Scroll down on the next page shown to you until you see the "Subscriptions" tab then click on "Manage".

- Click "Edit" beside the Mint: Budget & Expense Manager app and then click on "Cancel Subscription".

What to do if you Subscribed directly on Mint's Website:

- Reach out to Mint.com here »»

- Visit Mint website: Click to visit .

- Login to your account.

- In the menu section, look for any of the following: "Billing", "Subscription", "Payment", "Manage account", "Settings".

- Click the link, then follow the prompts to cancel your subscription.

How to Cancel Mint: Budget & Expense Manager Subscription on Paypal:

To cancel your Mint subscription on PayPal, do the following:

- Login to www.paypal.com .

- Click "Settings" » "Payments".

- Next, click on "Manage Automatic Payments" in the Automatic Payments dashboard.

- You'll see a list of merchants you've subscribed to. Click on "Mint: Budget & Expense Manager" or "Mint.com" to cancel.

How to delete Mint account:

- Reach out directly to Mint via Justuseapp. Get all Contact details →

- Send an email to [email protected] Click to email requesting that they delete your account.

Delete Mint: Budget & Expense Manager from iPhone:

- On your homescreen, Tap and hold Mint: Budget & Expense Manager until it starts shaking.

- Once it starts to shake, you'll see an X Mark at the top of the app icon.

- Click on that X to delete the Mint: Budget & Expense Manager app.

Delete Mint: Budget & Expense Manager from Android:

- Open your GooglePlay app and goto the menu.

- Click "My Apps and Games" » then "Installed".

- Choose Mint: Budget & Expense Manager, » then click "Uninstall".

Have a Problem with Mint: Budget & Expense Manager? Report Issue

Leave a comment:

What is Mint: Budget & Expense Manager?

Experience a fresh way to manage money. Reach your goals with personalized insights, custom budgets, spend tracking, and subscription monitoring—all for free. Easily see your monthly bills, set goals, and build stronger financial habits. Get the #1 personal finance and budgeting app now*. this app is the money management app that brings together all of your finances. From balances and budgets to credit health and financial goals, your money essentials are now in one place. Join the 24 million users that trust this app to help them reach their goals. ALL YOUR MONEY IN ONE APP Your spending and financial accounts all in one place. this app gives you a more complete picture of your financial health by bringing everything together: account balances, monthly expenses, spending, your free credit score, net worth, and more. Connect your cash, credit cards, loans, investments, and more. MONITOR YOUR CASH FLOW this app helps track your transactions, budgets, expenses, and subscriptions. We bring together all your numbers to show your net worth and spending trends. Get alerted when you’re close to going over budget and before you overdraft from an account. We’ll notify you when subscription prices go up and uncover old ones you don’t use. START SAVING WITH BILLSHARK BILL NEGOTIATION A new and exciting feature that could help you save on your monthly bills**. NEW PREMIUM FEATURE ENABLING SUBSCRIPTION CANCELLATION this app can now cancel subscriptions directly from our App. Get notified when subs...