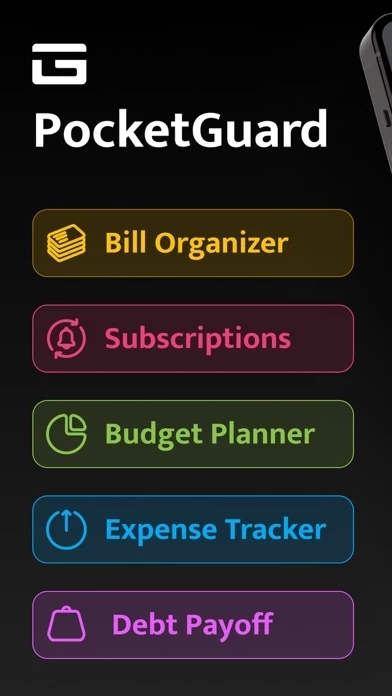

I’ve used mint and every dollar. Every dollar is very clean looking, PocketGuard takes some getting used to. BUT, I’ve got to tell you, after taking a few days or so to get my feet wet to truly understand PocketGuardMoneyBillTracker and learn how to navigate my way through it, I love it! My favorite features:

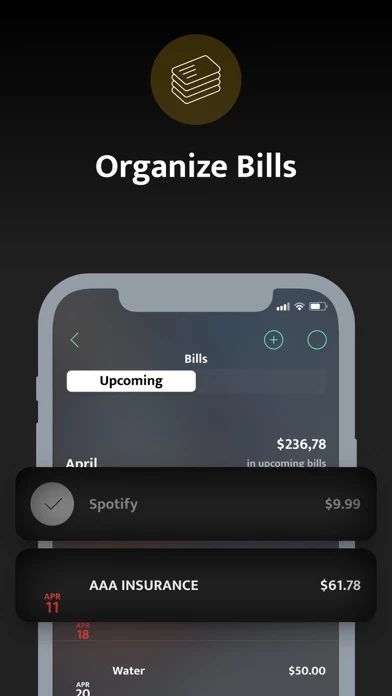

– upcoming bills. It’s a feature that I have sorely been missing,Knowing what bills are coming up and when is key for making sure I’ve got enough money in the bank to avoid overdraft payments. Super easy the way I have it set up, on the overview page I have a section that includes all my fixed costs for the month, easy to see and easy to categorize. Makes it super easy to budget what I have left over.

- hashtags.I love the hashtags, never been easier to see how much I spent on back to school stuff , on my recent vacation, etc.

-Love the easy comparison from one month to the next to see if I spent more than less than the previous month in a particular category.

There’s more, but suffice it to say that I found PocketGuardMoneyBillTracker that works for me.

My only qualm is that I wish you could customize the color scheme. I’d like a lighter color scheme.