Bluevine Software

Company Name: Bluevine Capital

About: BlueVine Ventures is a venture capital firm that invests in manufacturing and technology companies.

Headquarters: Menlo Park, California, United States.

Bluevine Overview

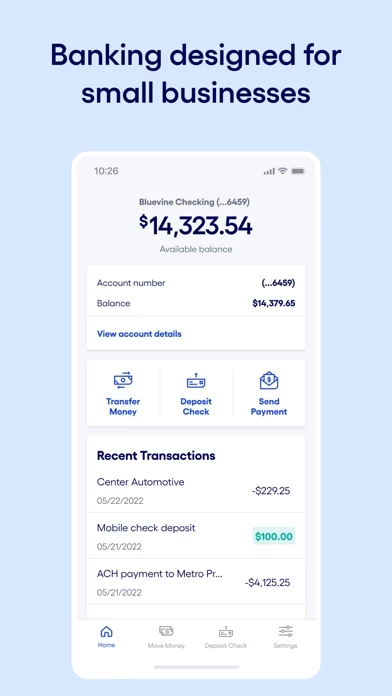

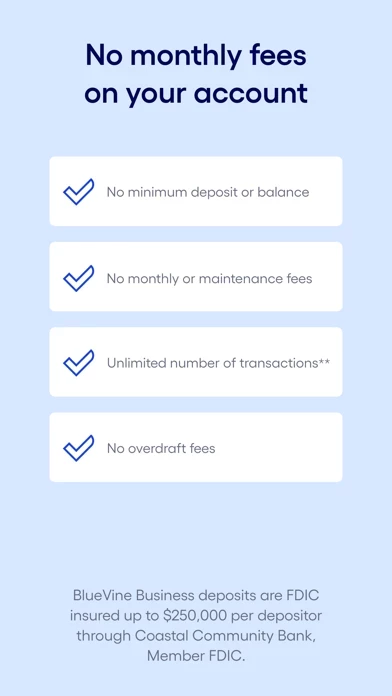

What is Bluevine? The Bluevine Business Checking app is a digital banking experience that allows users to manage cash flow, pay bills, track transactions, and deposit checks from their mobile device. The app offers a high-yield business checking account with no monthly fees, no overdraft fees, and no minimum opening deposit or balance requirements. Users can also manage up to 5 sub-accounts to budget for taxes, payroll, and more. The app provides advanced security features to protect user accounts and is FDIC insured up to $250,000 per depositor through Coastal Community Bank, Member FDIC.

Features

- High-yield business checking account with 1.5% interest on balances up to $100,000 for eligible customers

- No monthly fees, overdraft fees, or minimum opening deposit or balance requirements

- Unlimited transactions with no limit on the number of deposits or payments

- Manage up to 5 sub-accounts to budget for taxes, payroll, and more

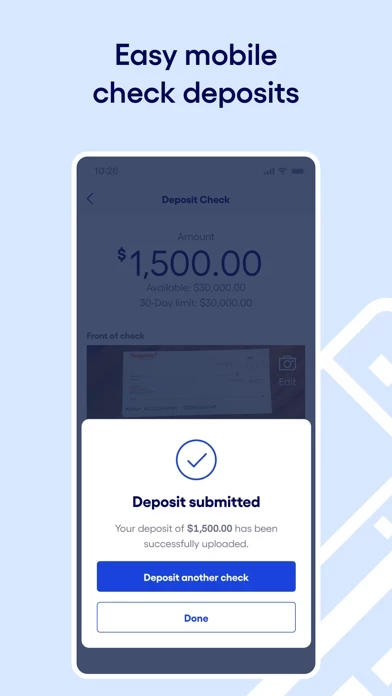

- Bank from anywhere with mobile check deposit, fund transfers, and bill payments

- Access to 37,000+ in-network MoneyPass locations nationwide for deposits and withdrawals

- Advanced security features to protect user accounts, including instant debit card locking

- FDIC insured up to $250,000 per depositor through Coastal Community Bank, Member FDIC

- Bluevine Business Debit Mastercard® issued by Coastal Community Bank, Member FDIC

- $2.50 fee for ATM transactions outside of the MoneyPass® network. Additional third-party ATM fees may vary by ATM operator.

Official Screenshots

Product Details and Description of

this app Business Checking is a premier checking account thoughtfully designed for a simple, all-in-one digital banking experience. The this app Business Checking app lets you manage cash flow, pay bills, track transactions, and deposit checks right from your phone. EARN MORE INTEREST Eligible customers can earn 1.5% interest on balances up to and including $100,000,* making this app Business Checking one of the nation’s highest-yield business checking accounts. NO MONTHLY FEES Make all the deposits or payments you need with no limit on your number of transactions.** Plus, you can save with no monthly or overdraft fees and no minimum opening deposit or balance requirements. BUDGET BETTER WITH MULTIPLE ACCOUNTS You can now manage up to 5 sub-accounts so you can easily budget for taxes, payroll, and more. Each sub-account comes with a designated account number so you have more control over your finances.*** BANK FROM ANYWHERE Deposit checks, transfer funds, and pay bills from your mobile device. You can also deposit or withdraw funds at 37,000+ in-network MoneyPass locations nationwide.**** ADVANCED SECURITY Bank with confidence and peace of mind. Your this app account is FDIC insured up to $250,000 per depositor through Coastal Community Bank, Member FDIC. We protect your this app account with industry-leading security protocols. For example, you can instantly lock your debit card if you lose or misplace it. For more information, visit https://www.this app.com/ccbx-checking-agreement/ this app in the News: “this app has demonstrated a track record of success with their multiple financing products and set themselves apart with their vision of a complete platform of innovative banking products for small businesses.” -TechCrunch “No one that we know is building or has built a bank designed and built specifically for small businesses. And that is what we’re doing.” -Banking Dive LEGAL DISCLOSURES this app is a financial technology company, not a bank. Banking services are provided by Coastal Community Bank, Member FDIC. this app accounts are FDIC insured up to $250,000 per depositor through Coastal Community Bank, Member FDIC. The this app Business Debit Mastercard® is issued by Coastal Community Bank, Member FDIC pursuant to a license from Mastercard International Incorporated and may be used everywhere Mastercard is accepted. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. this app Privacy Policy: https://www.this app.com/privacy-policy/ Coastal Community Bank Privacy Policy: https://www.coastalbank.com/privacy-notice.html *Customers will earn 1.5% interest on total balances up to and including $100,000 only if they meet the monthly debit transaction or deposit requirements described in section M of the Account Agreement. No interest earned on balances over $100,000. The national average and comparison are based on interest rates paid by U.S. depository institutions as calculated by the FDIC. **No limit on number of transactions. However, checking accounts are subject to the monthly deposit and withdrawal amount limits of the user agreement: https://www.this app.com/ccbx-checking-agreement/. ***Sub-accounts can only be opened on the desktop or mobile browser version of the this app Dashboard experience. Customers will receive a this app Business Debit Mastercard only for use with the main this app Business Checking Account. ****this app charges a $2.50 fee for ATM transactions outside of the MoneyPass® network. Additional third-party ATM fees may vary by ATM operator.

Top Reviews

By nuts&cherries

New

So far online or on our smart phone, we ran a test deposit by taking a picture of a check and it worked., was deposited into the company account., also easy transfer from PayPal to bank account. So far, so good., time will tell how this online small business Bank works out.

By Gainesway1

Business Name

Can you guys update the App so the Business Name shows up. I have several accounts with this app and when I log in there’s no quick way to see which account I’m using.

By Cgr 1988

Ok features but please update

I opened my this app business checking account and it was available instantly. The important features I need are ACH payments and deposits, and this app supports it - but we need some basic features. When a I send a payment to a vendor and request an email notification be sent to the payee, the email should minimally provide the bill number (invoice) that I supplied in the payment form. My vendors cannot reconcile my payments to their invoice - and I have to email them separately which negates the value of this app's email notification. Also, the app needs work so that it is compatible with all iOS devices. My iPhone X works fine, but even on my one year old iPad, the app struggles to render in landscape mode. PLEASE UPDATE the payment features - these are critical to small businesses.