Quicken Simplifi Reviews

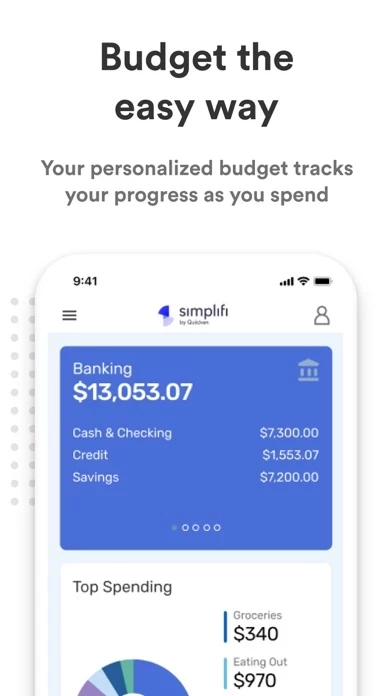

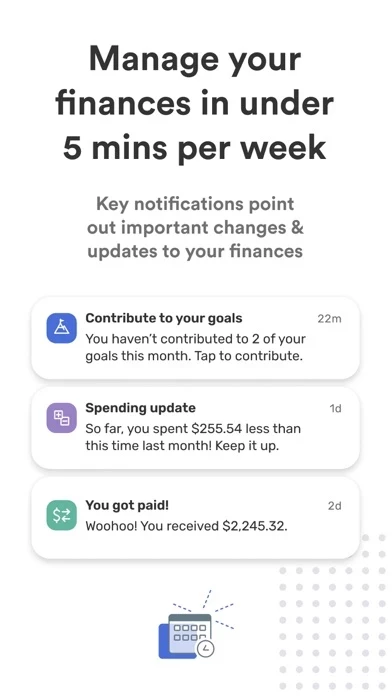

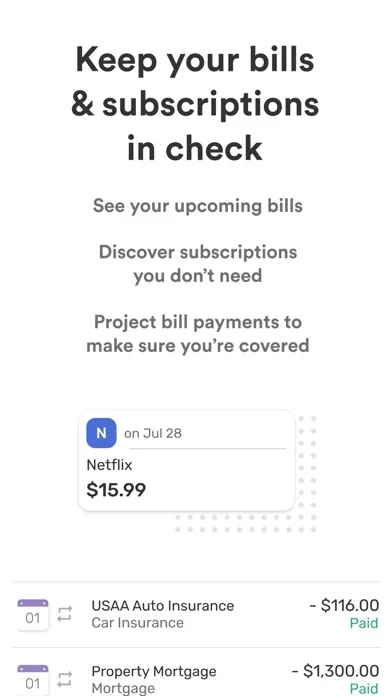

Published by Quicken Inc. on 2025-05-14🏷️ About: Simplifi by Quicken is a budgeting app that helps users manage their finances and track their spending. It allows users to see their monthly bills, set goals, and grow their savings in less than 5 minutes a week. The app lets users customize and track their budget based on their specific needs and provides personalized alerts and insights.