Lenme Overview

What is Lenme? Lenme is a peer-to-peer lending platform that allows users to borrow and lend money digitally. It offers a unique feature of using cryptocurrency as collateral for cash loans. The app provides borrowers with immediate offers from over 7,000 lenders and lending businesses, competitive interest rates, and automated payment services. Investors can diversify their portfolio in a market with low volatility, select investments based on their risk level, and withdraw their earnings at no cost. Lenme also provides credit scores, borrower's history, and banking data to support the lending process.

Features

- Use cryptocurrency as collateral for cash loans

- Borrow up to $10,000 with immediate offers from over 7,000 lenders and lending businesses

- Competitive interest rates and automated payment services

- Diversify investment portfolio in a market with low volatility

- Select investments based on risk level and withdraw earnings at no cost

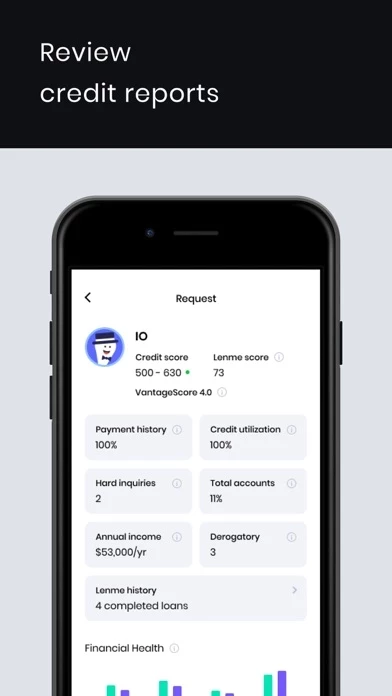

- Provides credit scores, borrower's history, and banking data to support the lending process

- Offers a monthly/annual subscription through Apple Pay

- LenmePredict, a machine learning algorithm, is offered for lenders through Apple Pay for purchase either per-use or monthly/annual subscription

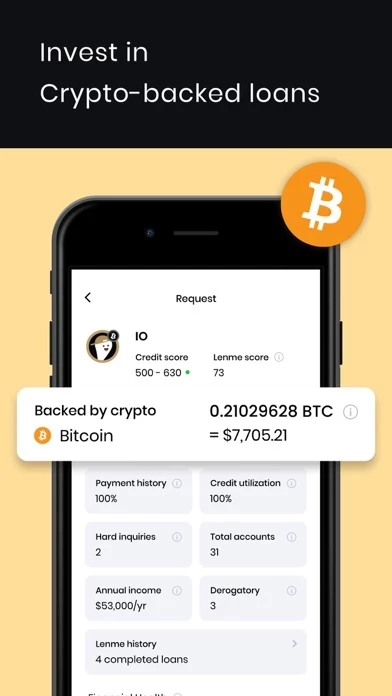

- Offers crypto-backed loans where investors can fund cash loans backed by cryptocurrency owned by the borrower

- Lending decision is based on multiple factors including credit, income, and cash flow analysis

- Offers a representative example of the total cost of the loan, including all applicable fees

- Provides Terms of Use and Privacy Policy for more information.

Official Screenshots

Product Details and Description of

Why sell your crypto when you can use it to back your cash loan? Use your crypto as collateral for a cash loan to make purchases, start a small business, or invest in more crypto. In minutes you can pursue your financial goals without the need to sell your assets. Connect your crypto account now. Discover the best peer-to-peer lending platform. Lend and borrow digitally in minutes. There is no need to go to a bank. With this app, you can borrow in minutes with no hidden fees. Are you someone that is looking to make some money? this app connects you directly with borrowers, we manage the lending and make it simple for you. Want to be equipped with the same tools and data professional lenders have at their disposal? this app provides you with the credit score, borrower’s history, banking data and supports the process of lending all via the app. As an investor, you can: - Diversify your portfolio in a market with low volatility. - Easily select investments that suit the level of risk you’re comfortable with. - Enjoy withdrawing your earnings at no cost. - Get all the data you need. - Use the latest machine learning algorithm. - Invest in crypto-backed loans. As a borrower, for as low as $1.99 a month you can get access to: - Loans up to $10,000. - Immediate offers from over 7,000 lenders and lending businesses. - Funds directly transferred to your bank account the next day. - Competitive interest rate. - Automated Payment service. - Hassle-Free borrowing. this app is a lending platform that connects people looking to borrow money with financial institutions, lending businesses, and individual investors looking to invest in the loan market. Users remain completely anonymous throughout the entire borrowing/lending process. For transparency and to encourage a fair and competitive market, the “feed” tab within the app allows users to see which loans are being funded and at what interest rate. this app offers a monthly/annual subscription through Apple Pay. Subscriptions will automatically renew unless canceled within 24-hours before the end of the subscription period. You can cancel anytime via your iTunes account. LenmePredict, our machine learning algorithm, is a standalone product offered for lenders through Apple Pay for purchase either per-use or monthly/annual subscription. Subscriptions will automatically renew unless canceled within 24-hours before the end of the subscription period. You can cancel anytime via your iTunes account. Crypto-backed loans, our new product allows investors to fund cash loans backed by cryptocurrency owned by the borrower. Cryptocurrencies are used as collateral and maybe liquidated in case of default or sudden price drop of the held currency. Since our app is not directly involved in the lending decision, we cannot guarantee the interest rate borrowers will be offered. All borrowers have the option to request a loan on our platform for up to a 12 month repayment period, paid in installments. Lenders can offer loans for a minimum of 3% APR based on the credit score and their own criteria. The lending decision is based on multiple factors viewable on our app, including credit, income, and cash flow analysis. A representative example of the total cost of the loan, including all applicable fees: If you borrow $1,000 over a term of 1 year with an APR of 12% and an origination fee of 1%, you will pay $89.75 per month. The total amount payable will be $1,076.96, with a total interest and fees of $76.96. For more information, see our Terms of Use and Privacy Policy. https://this app.com/privacy-policy/ https://this app.com/term-of-use/

Top Reviews

By merk240

Actually works

I downloaded this app because I was considering taking out a loan for financial reasons. I first requested a loan then asked myself if this is actually legit so I went on the apps page and come to find majority of the reviews 1 star, most of them stating how it took too long, or how the customer service was bad. That wasn’t the case with my loan! 6 days ago I requested a loan and yesterday I got a notification stating my loan was fully deposited, as I check my bank account I noticed nothing was different... okay.. so I then write an email to the Lenmo team and they responded within 3 hours! Stating my lenders transaction was successfully initiated and it will only take 1-2 more days. And come today! It came in. I see at first when this app launched, yes it had problems but it’s apparent with the service I’ve received that they may have fixed a lot of those problems. Highly recommend.. was better and easier than applying for a loan at a branch.

By CassieEckert012

⭐️MIRACLE WHEN I NEEDED IT THE MOST!⭐️

I found this app literally at the time I needed it the most. I wasn’t sure about if it actually worked or if there was a catch, but it DOES WORK and THERE IS NO CATCH! I needed diapers and formula desperately. I made a request for $50, chose how much I wanted to tip the person who would loan me the money and then chose the date that I could pay it back. Within an hour, I got a notification saying someone loaned me the money! It’s literally a MIRACLE APP! I paid the money back a few days earlier than my chosen date and now my request amount is $100. As long as you pay the people back within the time frame that you give (it’s all on your terms), your amount that you can borrow goes up by $50! I am SO grateful for this app and the people who are kind enough to loan their own money to people like me who really need it. 100% HANDS DOWN RECOMMEND GETTING THIS APP! Trust me, you will NOT regret it!

By jpark1

I made a 20% ROI in my first month!!!

I was looking for a p2p investing platform that allowed be more control and did not require $1000 initial investment. Lenmo seemed to offer this, but maybe the high ROI was too goo to be true. With this in mind I deposited $110 to try it out. To my surprise both investment were successful and deposited to my chase account 1 month and 8 days after the investment. Since that successful 20.1% ROI I received in a little over a month I have since deposited $450 and am hoping to utilize Lenmo money making potential. The only negative that I have is there is some gaps in knowledge after you make a loan offer, accepted, and then completed. If there was a feature or tacking system that would give more information beyond an email would make the process more personal and would give me more comfort. I hope the ROI continues but as this app becomes more popular it will cause more money to come into the app pushing rates down. Until then I plan on using the app regards of any positive changes for the time being.