Ally: Banking & Investing Software

Company Name: Ally Financial Inc.

About: Ally Financial Inc. is a automotive financial services company powered by a top direct banking

franchise.

Headquarters: Detroit, Michigan, United States.

Ally Overview

What is Ally?

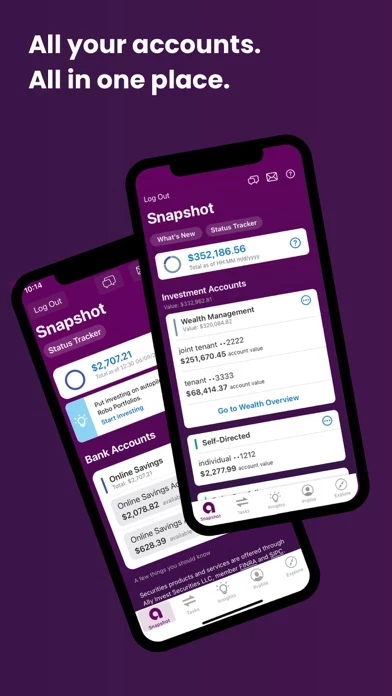

The Ally Mobile app is designed to help users manage their financial life in a simple and secure way. The app allows users to manage their bank, invest, and home loan accounts on the go, all with just one login. The app offers a range of features, including stress-free overdraft relief, mobile check deposit, bill payment, and Zelle® payments. Users can also manage their investments with robo portfolios, self-directed trading, and wealth management services. The app prioritizes user security, with encrypted transactions and an Online & Mobile Security Guarantee.

Features

- No overdraft fees and CoverDraft℠ service for temporary fee-free overdraft relief

- Ally eCheck Deposit℠ for mobile check deposit

- Transfer money, pay bills, and use Zelle® to pay anyone with a U.S. bank account

- Find nearby fee-free ATMs and cash back locations

- Card controls to manage debit card usage

- Manage CD interest disbursement and maturity options

- View and send secure messages, or chat with Ally Assist 24/7

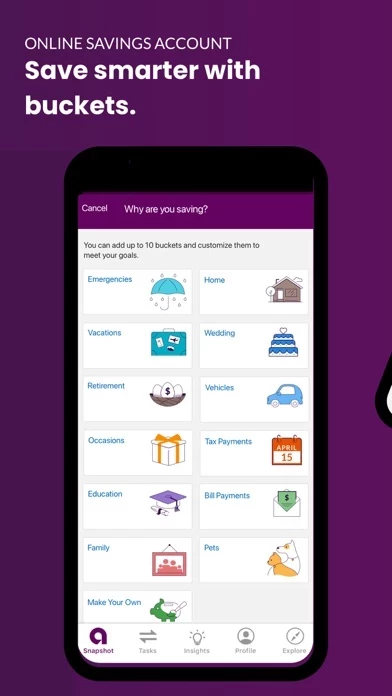

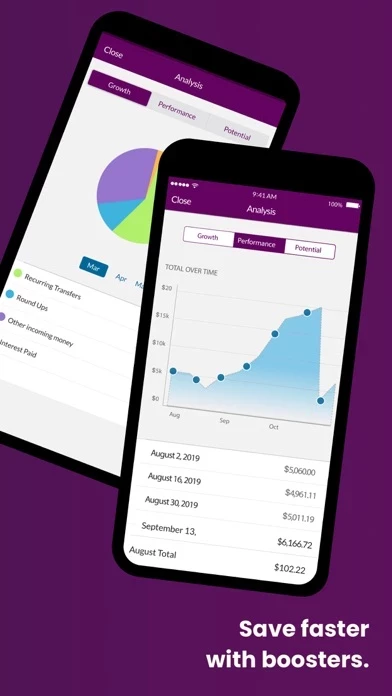

- Smart savings tools, including buckets to organize money, automatic recurring transfers, and round ups and Surprise Savings boosters

- Robo portfolios for automated investing with no advisory fees

- Self-directed trading with commission-free U.S. stock and ETF trades, ETF screener, and advanced charting tools

- Wealth management services with a dedicated advisor, tailored investment portfolio, and 360° view of finances

- Real-time updates and Autopay for home loan accounts

- Online & Mobile Security Guarantee for user protection

- Free app, compatible with iOS 14.0 or higher

- Deposit and mortgage products offered by Ally Bank, Member FDIC, Equal Housing Lender

- Securities offered through Ally Invest Securities LLC, member FINRA/SIPC

- Advisory products and services offered through Ally Invest Advisors Inc., a registered investment adviser

- Securities are NOT FDIC INSURED, NOT BANK GUARANTEED, and MAY LOSE VALUE

- CoverDraft℠ acts as a safety net and is not a line of credit or a guarantee

- Buckets and boosters are features of Ally Bank's Online Savings Account.

Official Screenshots

Product Details and Description of

Making your financial life simple and secure has always been our thing, even from the start (we were born online, after all). Easily manage your bank, invest, and home loan accounts on the go in one convenient place – all with just one login. Mobile Banking Features •Stress less when you overspend – we have no overdraft fees, plus CoverDraft℠ service, giving you temporary fee-free overdraft relief. •Deposit checks from your phone with this app eCheck Deposit℠ •Transfer money, pay bills, or use Zelle® to pay anyone with a U.S. bank account •Find nearby ATMs when you need cash on the go – choose from over 55,000 fee-free ATMs and cash back locations •Keep tabs on your debit card usage with card controls •Manage CD interest disbursement and maturity options •View and send secure messages, or chat with us 24/7 using this app Assist Save faster with our smart savings tools • Use buckets to organize your money and visualize what you’re saving for • Keep your savings on pace with automatic, recurring transfers • Grow your savings faster with round ups and Surprise Savings boosters Mobile Trading & Investing Features Robo Portfolios •Sit back while our intelligent tools do the heavy lifting to manage and monitor your investments •Invest free of advisory fees with our cash-enhanced portfolio, or invest more of your money in the market with a market-focused portfolio (available for a fee) •Automate your investing with one of our four portfolio strategies •Use Goal Tracker to monitor progress Self-Directed •Trade commission-free on eligible U.S. stocks and ETFs •Filter and find exchange-traded funds matching your goals with our ETF screener •Trade stocks and multi-leg options from your mobile device •Use advanced charting tools for technical analysis •Monitor your investments with streaming quotes Wealth Management •Receive ongoing guidance from one dedicated advisor for all your assets – even ones we don’t manage •Work toward your financial goals with a tailored investment portfolio •Link and track financial accounts outside of this app for a 360° view of your finances •View and monitor your net worth, investment exposure, and performance •Start with a $100,000 minimum in assets under care (funds with us) How we prioritize your investing security •We never store personal or account information on your phone •All your transactions are encrypted •Security codes provide an added layer of protection when you log in from a computer or device we don’t recognize •Our Online & Mobile Security Guarantee protects you against fraudulent transactions Mobile Home Loan Features •Track your progress toward paying off your home with real-time updates •View account details, upcoming statements, and past transactions •Use Autopay to set up recurring payments with no additional payment fees •Schedule additional principal-only payments at any time More details •this app Mobile is free – your mobile carrier’s message and data rates may apply •Compatible with iOS 14.0 or higher •Deposit and mortgage products are offered by this app Bank, Member FDIC, Equal Housing Lender •Securities offered through this app Invest Securities LLC, member FINRA/SIPC •Advisory products and services are offered through this app Invest Advisors Inc., a registered investment adviser •Securities are NOT FDIC INSURED, NOT BANK GUARANTEED, and MAY LOSE VALUE •You may not be approved for real-time quotes •CoverDraft℠ acts as a safety net and is not a line of credit or a guarantee •With CoverDraft℠, if your purchase isn’t covered for any reason (let’s say the transaction exceeds your CoverDraft℠ limit, for example), it’ll be declined – but we’ll never charge you an overdraft fee; you’ll have 14 days to bring your balance out of the negative, and we may restrict withdrawals from your account (if it’s not back in the black) after that •CoverDraft is only available for this app Bank Interest Checking accounts •Buckets and boosters are features of this app Bank's Online Savings Account

Top Reviews

By Jgunter2011

The Ally app has 100% full online banking features on Mobile!

Most mobile banking apps have limited services available that are limited to traditional “online banking” access that require logging in from a PC/Laptop but not this app’s Mobile App! This app has all features you would need for your banking needs such as order checks, card controls, bill pay, Zelle, Mobile check deposit, transfer money internally & externally to your linked accounts, add memos to transactions, chat real time with a banking associate and even open new accounts! I love this app for their customer service, user friendly services and their great products! Also I can not forget to add that their app is reliable, dependable and consistent- it never goes down or has glitches like other banking apps I’ve used in the past.

By C. M. Bollinger

Works Well — Functional and Easy

I don’t see why people make complaints — I’ve used the bank for years (and frankly, this isn’t the place to be reviewing the bank itself; these reviews are supposed to be for the app) and it’s been nothing but good experiences all around. For those who are complaining that it’s not a good trading app, that’s your problem... it’s a banking app and isn’t touted solely as a trading app. As far as a bank app goes, it’s functional, easy to access statements and information regarding your account, and the features a normal banking customer would utilize are perfectly fine. I’ve never had an issue and I’ve been using the app for basically as long as it’s been around. I also use other banking apps that are much less functional and useful and frankly frustrating — such as Fidelity, which IS meant to allow trading, and falls short of what it is apparently intended to do — and various others whose features are faulty at times, request you to phone the institution for certain functions, etc. Thus far, this app’s functionality and accessibility far outrank any other financial institution’s app that I have used to date.

By Sancy777

GREAT BANK

I understand this is a review area for the App...which I think is almost flawless. My only comment on the app is that I wish I could download my checking account activity for the last year in csv format. I love the check deposit interface, I love how sharp the images come out, especially when you want to look them up months later...they’re perfect! MY review is mainly for the bank itself because the App (& website) basically ARE the bank! I use the check and savings accounts and they are better than any ‘physical’ bank that I have used thus far!!! They promptly notify you when it comes to any ‘Suspicious Activity'. They once caught a scam directed at my accounts that was just under $2!! I wouldn’t have caught it without them. this app told me they had seen that ‘scammer’ before, they would see if a small amount would go through and if that was successful they would take much, much more!! THANKS to this app!! I love the added bonus of using ANY ATM I choose confident in the fact the reimbursement fee will show back up into my account within a day or two...ALWAYS! Team this app! Keep up the good work!!!👍🏼