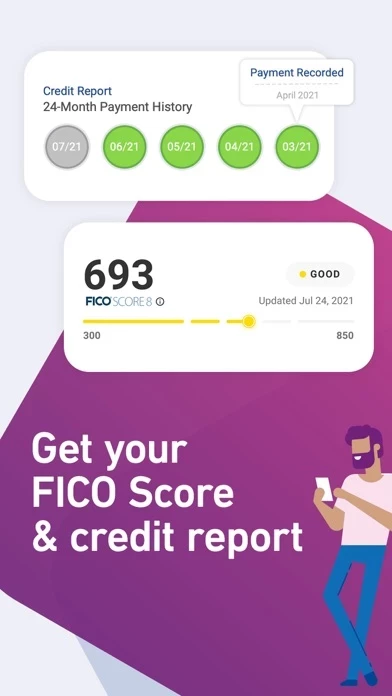

- Free Experian credit report and FICO® Score

- Check FICO Score and credit report anytime, anywhere

- No credit card required

- Automatic updates every 30 days

- See factors helping or hurting FICO Score

- Track changes to credit over time

- Learn actions to take for better credit

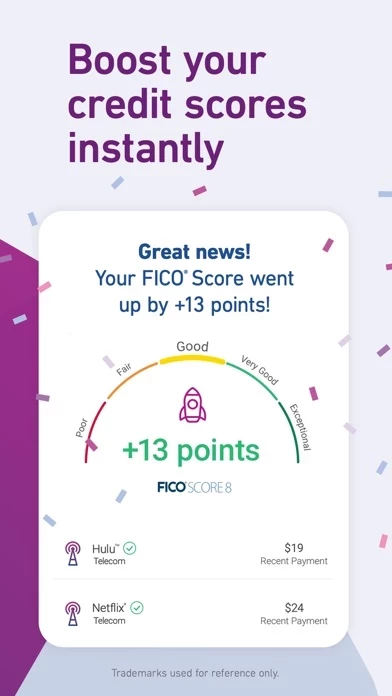

- Experian Boost to instantly increase FICO Score

- Get credit for bills already paid

- Credit monitoring and alerts

- Push notifications for FICO Score changes, new accounts, and inquiries

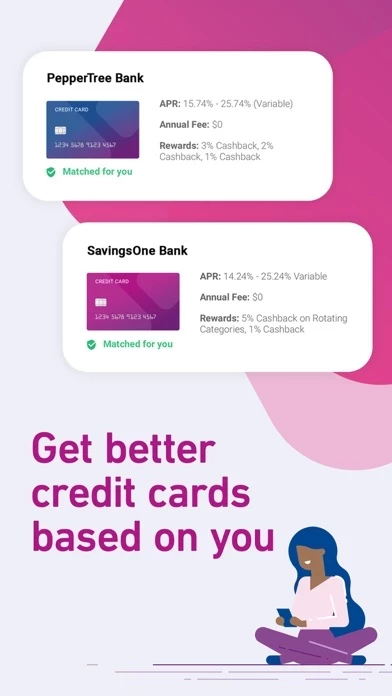

- Marketplace to compare personalized credit options

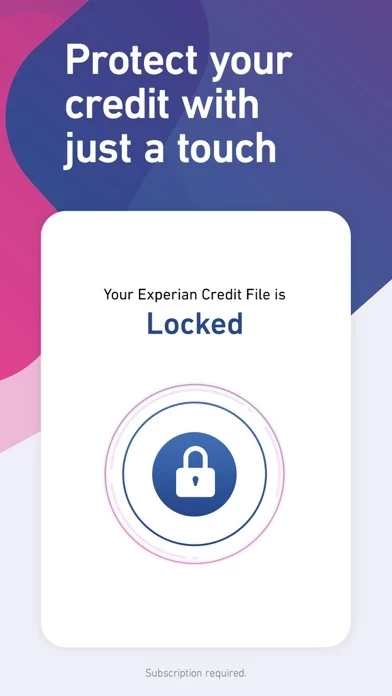

- Experian CreditLock to protect against identity theft

- Real-time alerts for credit applications in user's name

- Privacy Policy and Terms & Conditions provided

- Credit score calculated based on FICO® Score 8 model

- Lender or insurer may use a different FICO Score

- Results may vary with Experian Boost

- Not all payments are boost-eligible

- Approval not guaranteed for personalized credit options

- Experian CreditLock is a separate service from Security Freeze

- Experian and its affiliates own trademarks and copyrights mentioned in the app

- Other product and company names mentioned are property of their respective owners

- Licenses and Disclosures provided.