Amex Business Blueprint™ Software

Company Name: Kabbage Inc.

About: Kabbage offers fast, easy loans for small businesses.

Headquarters: Atlanta, Georgia, United States.

Amex Business Blueprint Overview

What is Amex Business Blueprint?

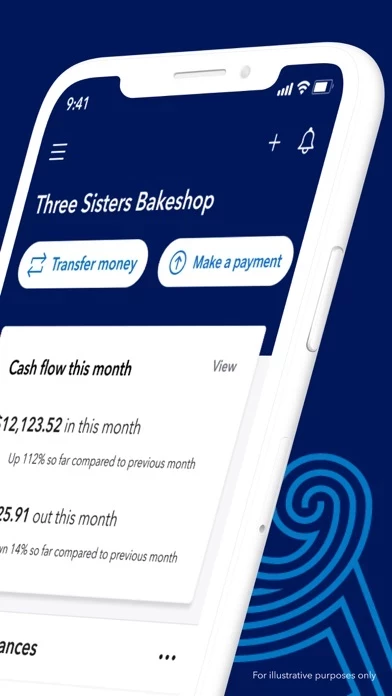

The Kabbage app is designed to help small business owners grow their businesses by providing access to selected products and services. The app offers Kabbage Funding, which allows users to apply for a business line of credit and use what they need when they need it. The app also offers Kabbage Insights, which helps users make more informed money in, money out decisions. Additionally, users can accept payments through professional invoices and custom pay links with Kabbage Payments. Kabbage Checking is also available for existing customers.

Features

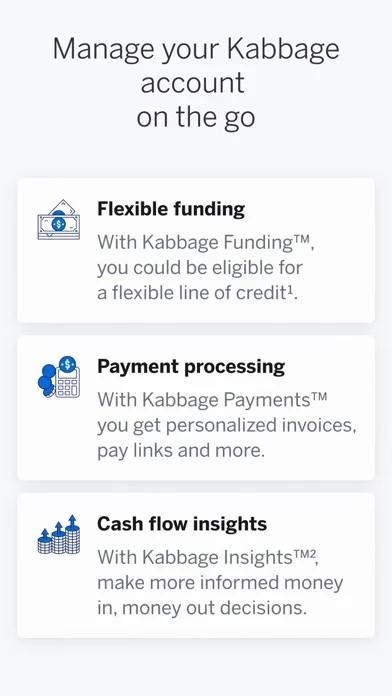

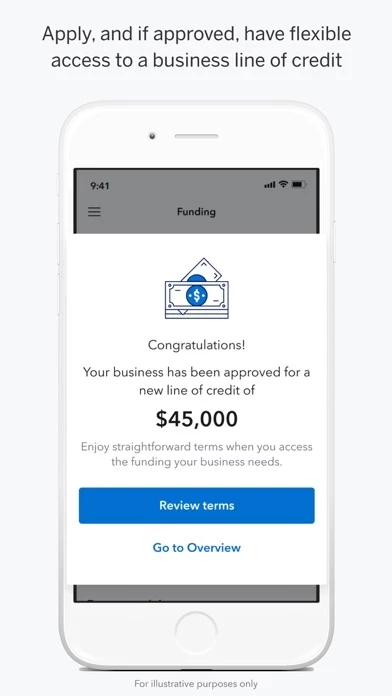

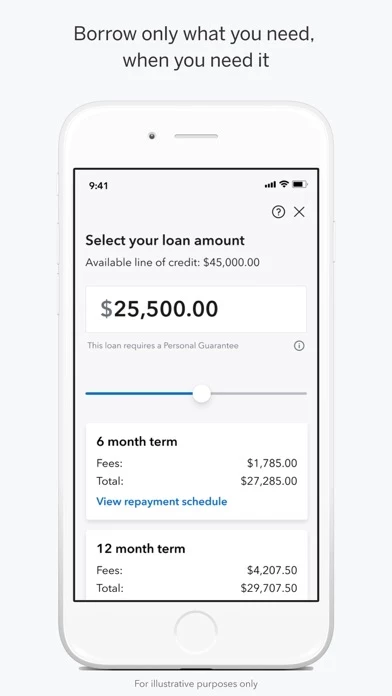

- Kabbage Funding: Apply for a business line of credit ranging from $2,000 to $250,000. Only pay loan fees on the capital you use.

- Kabbage Insights: Make more informed money in, money out decisions with data-driven insights.

- Kabbage Payments: Accept payments through professional invoices and custom pay links.

- Kabbage Checking: Existing customers can continue to access and use their accounts.

- Personalized loan terms based on creditworthiness and other factors.

- Loans are secured by business assets and require a personal guarantee.

- Total monthly fees incurred over the loan term range from 2-9% for 6-month loans, 4.5-18% for 12-month loans, 6.75-27% for 18-month loans.

- Late fees may be assessed.

- Kabbage Funding, Kabbage Payments, Kabbage Checking, and Kabbage Insights are trademarks of American Express.

- Kabbage Payments, LLC is a registered Payment Service Provider/Payment Facilitator sponsored by Fifth Third Bank, N.A., Cincinnati, OH.

- Banking services are provided by and the Kabbage Debit Mastercard is issued by Green Dot Bank, Member FDIC, pursuant to a license from MasterCard International Incorporated.

- Other Kabbage products and services are not provided by Green Dot Bank or Green Dot Corporation.

- The information provided through Kabbage Insights does not constitute legal, tax, financial or accounting advice.

- All access to and use of this app is subject to and governed by the American Express Kabbage Inc. Privacy Policy and Terms of Service.

Official Screenshots

Product Details and Description of

Use your Kabbage app to learn more about, apply for, and—with approval of your application—get access to selected products and services that can help you grow your business. KABBAGE FUNDING™[1] Apply for a business line of credit. If approved, use what you need, when you need it. Only pay loan fees on the capital you use. KABBAGE INSIGHTS™[2] Make more informed money in, money out decisions. KABBAGE PAYMENTS™ Accept payments through professional invoices and custom pay links. KABBAGE CHECKING™* At this time, Kabbage Checking is not accepting new applications. Kabbage Checking customers can continue to access and use their existing accounts. *The Kabbage Checking account is provided by Green Dot Bank. Kabbage Funding™, Kabbage Payments™, Kabbage Checking™, and Kabbage Insights™ are trademarks of American Express. Kabbage Payments, LLC is a registered Payment Service Provider/Payment Facilitator sponsored by Fifth Third Bank, N.A., Cincinnati, OH. Banking services are provided by and the Kabbage Debit Mastercard® is issued by Green Dot Bank, Member FDIC, pursuant to a license from MasterCard International Incorporated. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. Other Kabbage products and services are not provided by Green Dot Bank or Green Dot Corporation. Green Dot is a registered trademark of Green Dot Corporation. ©2022 Green Dot Corporation. All rights reserved. © 2022 American Express. All rights reserved. Terms and Conditions 1. Kabbage Funding™ offers access to a commercial line of credit ranging from $2,000 to $250,000; however, you may be eligible for a larger line of credit based on our evaluation of your business. Each draw on the line of credit will result in a separate installment loan. All loans are subject to credit approval and are secured by business assets. Every loan requires a personal guarantee. Total monthly fees incurred over the loan term range from 2-9% for 6-month loans, 4.5-18% for 12-month loans, 6.75-27% for 18-month loans, and are subject to change for future loans drawn under the available line of credit. Loans incur a loan fee for each month you have an outstanding balance. Not all customers will be eligible for the lowest fee. Not all loan term lengths are available to all customers. Eligibility is based on creditworthiness and other factors. Not all industries are eligible for Kabbage Funding. Pricing and line of credit decisions are based on the overall financial profile of you and your business, including history with American Express and other financial institutions, credit history, and other factors. Lines of credit are subject to periodic review and may change or be suspended, accompanied with or without an account closure. Late fees may be assessed. Loans are issued by American Express National Bank. 2. The information provided through Kabbage Insights does not constitute legal, tax, financial or accounting advice, and should not be considered a substitute for obtaining competent personalized advice from a licensed professional. You should seek professional advice before making any decision that could affect the financial health of your business. To log in, users must have a Kabbage user ID and password or create one in the app. All access to and use of this app is subject to and governed by the American Express Kabbage Inc. Privacy Policy and Terms of Service.

Top Reviews

By papifidel😈

Kabbage Is The Best Lender I Have Ever Experienced!

If you are looking for a lender this is it right here Kabbage has been very good to our small business! I fee like they understand real life people and situations the ups and downs of life! They are always there for you as long as you pay them back they will keep helping you! Forget the credit cards or expensive loans with outrages interest rates! Kabbage will tell you upfront how much they will charge you and how much are your payments everything without holding back makes it a very understandable for everyone! Love it!!!❤️❤️❤️💯💯

By 108158

Thankful.. 🙏🏽

Amazing. Not only is it super modern, simple and streamlined for a young entrepreneur like myself, but it also gave me a chance when no one else would. I’m just starting out and have less than ideal credit, so I was pleasantly surprised when I got the email saying that I had available funds. I love the fact that they were able to go based off of my business stats rather than just my credit alone. They’ve really played a big role in helping me jumpstart my new business.

By Jazmine & Stevhan

**Alternative Source of Funding**

This is what I call “thinking outside the box”. Owner and operator of a family owned landscaping company in Boston, Mass winters here can be brutal, being a seasonal company so we teamed up with Kabbage to give us piece of mind and its the #1 company I’ve ever worked with. Not only offering money on a daily basis but wiring the funds either same day or next day based upon what you bring into your bank account. It’s a breath of fresh air to know you have a nest egg to sit on at your convenience. Thank you.