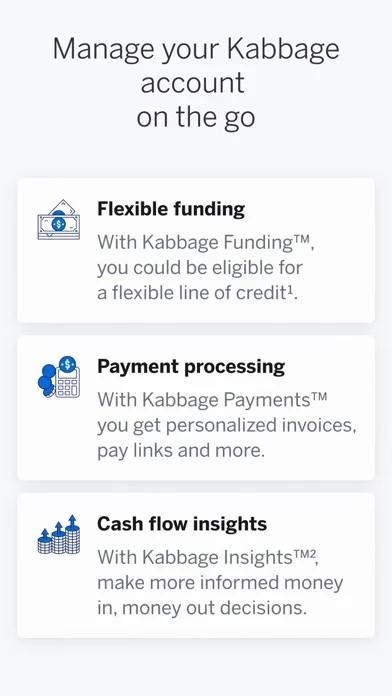

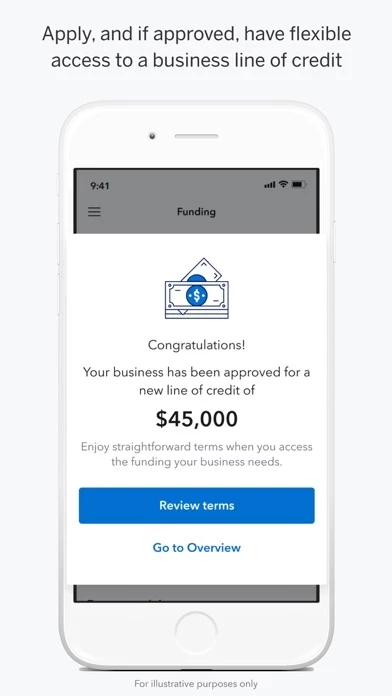

- Kabbage Funding: Apply for a business line of credit ranging from $2,000 to $250,000. Only pay loan fees on the capital you use.

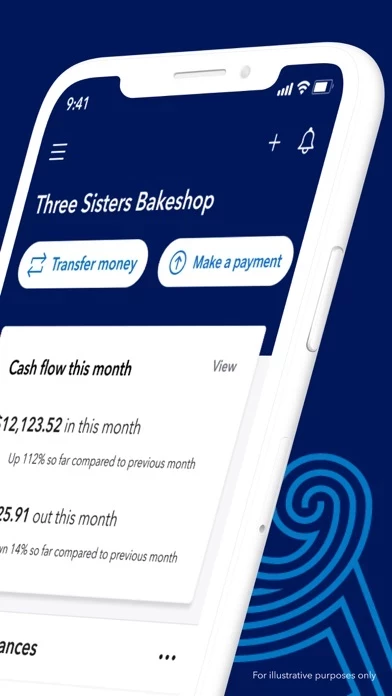

- Kabbage Insights: Make more informed money in, money out decisions with data-driven insights.

- Kabbage Payments: Accept payments through professional invoices and custom pay links.

- Kabbage Checking: Existing customers can continue to access and use their accounts.

- Personalized loan terms based on creditworthiness and other factors.

- Loans are secured by business assets and require a personal guarantee.

- Total monthly fees incurred over the loan term range from 2-9% for 6-month loans, 4.5-18% for 12-month loans, 6.75-27% for 18-month loans.

- Late fees may be assessed.

- Kabbage Funding, Kabbage Payments, Kabbage Checking, and Kabbage Insights are trademarks of American Express.

- Kabbage Payments, LLC is a registered Payment Service Provider/Payment Facilitator sponsored by Fifth Third Bank, N.A., Cincinnati, OH.

- Banking services are provided by and the Kabbage Debit Mastercard is issued by Green Dot Bank, Member FDIC, pursuant to a license from MasterCard International Incorporated.

- Other Kabbage products and services are not provided by Green Dot Bank or Green Dot Corporation.

- The information provided through Kabbage Insights does not constitute legal, tax, financial or accounting advice.

- All access to and use of this app is subject to and governed by the American Express Kabbage Inc. Privacy Policy and Terms of Service.