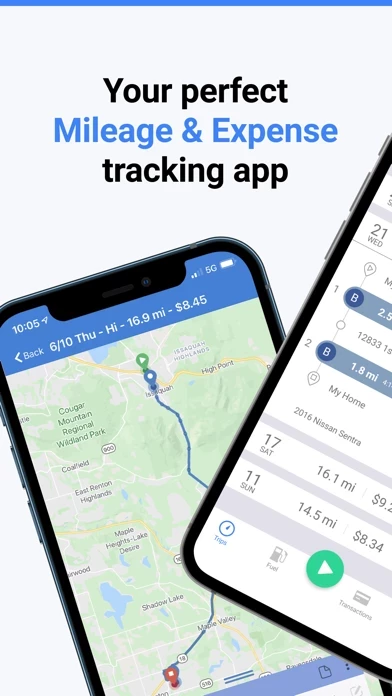

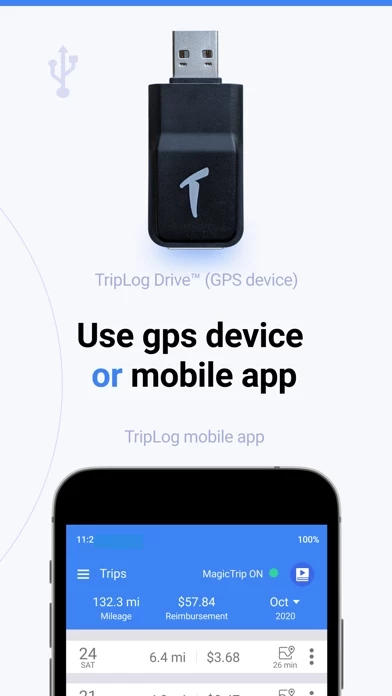

- Automatic Mileage Capture: TripLog uses accurate GPS, ensuring drivers never miss a mile. With six unique tracking options to choose from, users can find the method that works best for them.

- Expense Capture: Upload paper receipts, tolls, and fuel receipts for easy reimbursement. Scan fuel & gas receipts with OCR text recognition.

- Better Map Views: Multiple-stop route planning, daily driving overview, frequently traveled heatmap, most visited locations, longest stayed places, and real-time fleet tracking.

- Calendar Integration: Read meetings from Google Calendar, Outlook Calendar, and Salesforce and import them into TripLog.

- Tax Compliant Reports: Hassle-free tax logs.

- Enterprise Approval management, daily commute mileage, department/office, single sign-on, Google maps distance, company address book, time tracking reports, custom tags, and more.

- Track Driving Safety: Detect hard braking, rapid acceleration, phone calls, and speeding.

- Comprehensive Dashboard: Employers can manage their company's accountable plan and employee's requirements with an easy-to-use interface.

- Data Integration: ADP, Concur, Chrome River, QuickBooks, Xero, and bank and credit card integration to track revenue and expenses.

- HIPAA Compliance: TripLog encrypts protected health information (PHI) and personally identifiable information (PII) in a secure environment for your privacy.

- Real-time Location Monitoring: Helps companies and drivers stay on track throughout the day, including a map view with daily/weekly travel routes.

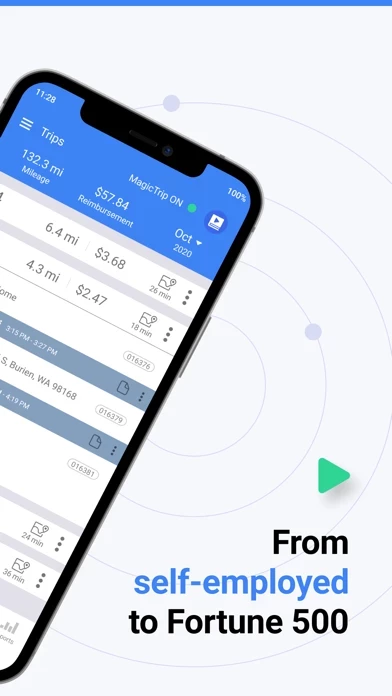

- Country Support & Mileage Rates: TripLog automatically calculates reimbursements based on the current mileage rates from your local tax authority and custom rates for you to maximize your benefits.